Hey y’all, I’m Bayside Bruce — your full-time, independent local lender living and working right here on the Bolivar Peninsula. At Gulf Coast Home Loans, I shop 250+ lending partners for virtually any loan type, making sure my neighbors get the best options available. Whether it’s your forever home, a vacation spot, or an investment property, I’m here to help you navigate the market tides with confidence.

Bolivar Peninsula Housing Market Snapshot (July 2025)

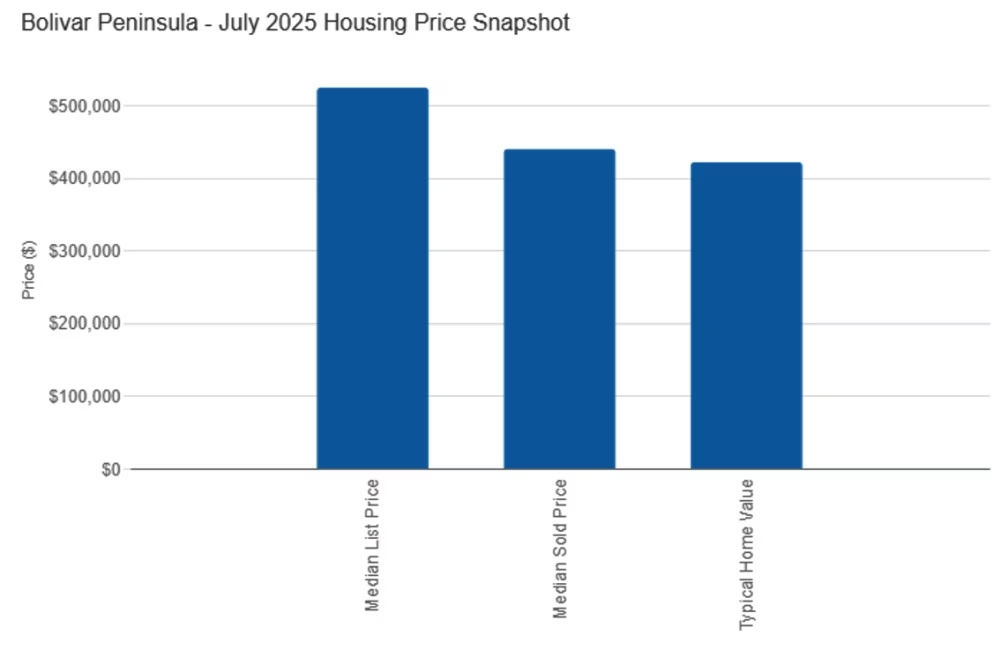

If you’ve been keeping an eye on the Bolivar Peninsula real estate scene, you’ve probably noticed things have shifted since last summer. According to Zillow, the typical home value here is about $421,902 as of July 31, 2025—down roughly 8.6% year-over-year (source: https://www.zillow.com/home-values/44814/crystal-beach-port-bolivar-tx/). That drop may sound dramatic, but in reality, it’s more of a soft landing than a crash.

On the flip side, Realtor.com shows the median list price holding firm at $525,000 (source: https://www.realtor.com/realestateandhomes-search/Bolivar-Peninsula_TX/overview). In other words, sellers aren’t slashing prices left and right—at least, not yet. Buyers, however, have some breathing room. Rocket Homes reports a median sold price of $440,000 (source: https://www.rockethomes.com/tx/bolivar-peninsula), which means there’s a little wiggle room between list and sale.

Inventory has also crept up, with 438 active listings on Zillow (source: https://www.zillow.com/home-values/44814/crystal-beach-port-bolivar-tx/). That’s good news if you like having options, whether you’re searching for a beachfront getaway or your forever home. But patience is the name of the game right now—homes are spending an average of 106 days on the market (source: https://www.realtor.com/realestateandhomes-search/Bolivar-Peninsula_TX/overview), which is longer than we’ve seen in a while.

Pro Tip: If you’re a seller feeling the itch to drop your asking price, consider a different tactic: a seller-paid temporary buydown. This can lower a buyer’s interest rate by 2–3% for the first 2–3 years, making your property more attractive without shaving thousands off the price tag. Ask me how this works—it’s getting more attention from buyers than another price cut ever could.

What’s Behind the Trends

We’re seeing a perfect storm of higher inventory, patient buyers, and a market dominated by second homes and investment properties. Vacation rentals and short-term rental income potential keep our area attractive, but with investor loan rates running higher than primary residence loans, offers are more calculated and less frenzied.

What it Means for You

The current Bolivar market is a bit unpredictable — kind of like the ferry line to Galveston. Sometimes you breeze right on, sometimes you wait, and sometimes it feels like the schedule changed without telling you. But here’s the thing—if you understand the patterns and get advice from a local expert, your trip (or your real estate deal) will be smoother, faster, and far less stressful.

Bill Pacheco

August 19, 2025 at 10:05 amVery informative article.