Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center.

TL/DR (Too Long/Didn’t Read) Summary: Pretty quiet week across all financial markets-precious metals did the best.

Stocks/Equities: Ended basically unchanged this week-all indices still around all time highs.

Gold/Silver: Up significantly this week. Gold (~$3,600), Silver (~$41.20).

Cryptocurrency: Basically unchanged. Quiet week.

Bonds/US Dollar: Bond yields down, USD level.

Special Topic: Government Bond Update

Stocks: The main US news this week was the most recent unemployment data released by the Bureau of Labor Statistics yesterday (Friday):

August jobs report reveals employers added just 22,000 jobs

The fact the report contains the number “22” is interesting. But aside from that, the numbers were considered to be “disappointing”, and US unemployment is now the highest it’s been in four years-increasing the already high likelihood of the Federal Reserve announcing a cut in interest rates later this month. Markets initially fell following this news, although on the week, all the major indices are unchanged:

nasdaq composite – Google Search

Gold/Silver:

Very good week for gold and silver, continuing the upward trajectory they’ve both been on since the beginning of this year. Although remember, this is more an indication that the currencies they’re priced in (mainly US Dollars) are losing value, rather than gold and silver gaining value.

Gold currently at $3,599, up $136 or ~4% since last Friday. I remain bullish on gold in the medium-long term. Gold’s FINALLY reclaimed the $3,500 it briefly hit on May 6th, and has now closed on another all time high.

Silver currently at $41.19, up $1.31 or ~3% since last Friday. Closing decisively above $40 is great news for silver, and very promising for its short term price action. Of course, that’s only a nominal value; due to inflation, silver would have to be significantly higher to match the price of $40, which it last reached fourteen years ago.

Gold/Silver Ratio: Remained below 90. It’s now 87.4 (was 86.7 last Friday).

Cryptos:

A fairly quiet week (for once) in the Crypto markets. Possibly the “calm before the storm”, which I’m expecting to see in October and November.

Bitcoin was fairly range bound between $108k and $113k. Ethereum similarly range bound between $4,300 and $4,500.

For now, at least-there seems to be a floor under Bitcoin’s price at the $108,000 mark (or thereabouts). It’s fallen to it multiple times since reaching that all time high, and always bounced back. So far…

Prices on the week:

Bitcoin’s up $3k at around $111k.

Ethereum level at ~$4,300.

BTC/ETH ratio: Up to 25.8 (was 24.9 last Friday). I think we remain in an overall downward trend here-which is bullish for the entire asset class. We’re at the end of the now established 4-year Crypto cycle when this ratio falls to the 12-15 range-which, assuming it does the same thing this time around, will NOT be reached in a straight line.

Ripple (XRP) level at around $2.80.

Solana’s level at around $201.

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

Bonds/US Dollar:

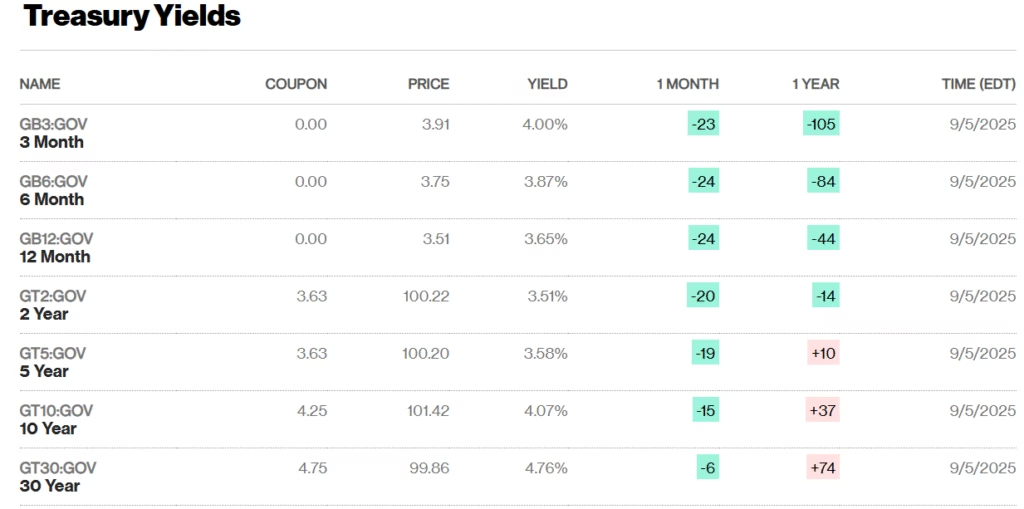

The US Treasury 10-year bond yield is now at 4.07% (was 4.23% last week, so significantly lower). The 30-year bond yield decreased by 17 basis points (was 4.93%, now 4.76%), so also significantly lower on the week. Lower yields mean higher bond prices, as they have an inverse relationship:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar remained the same this week against the Swiss Franc-like last week, it still costs $1.25 to buy 1CHF.

Special Topic: Government Bond Update

One thing I’ve found since writing this newsletter is that the bond market moves pretty slowly-much more slowly than stocks and cryptos. Hence why I normally have less to say about bonds each week than the other asset classes. I suppose that’s partly because the bond market is so huge, and that the most “liquid” (i.e., most actively traded) bonds seem to be issued by various sovereign governments-who are large, developed economies, have been around for a long time, and are generally trusted to keep their financial obligations to their creditors.

Bonds are fixed interest debt instruments. They’re IOUs, issued by various entities (national governments, local governments, municipalities, school districts, corporations, etc.), which are issued for a particular duration (1-30 years is a common timeframe), and bear a pre-agreed amount of interest (the coupon), which is also payable at various intervals. A bond’s yield is similar to its coupon, but takes into account the fluctuating price of the bond, rather than only its “face” value. Yields rise when bond prices fall, and vice versa.

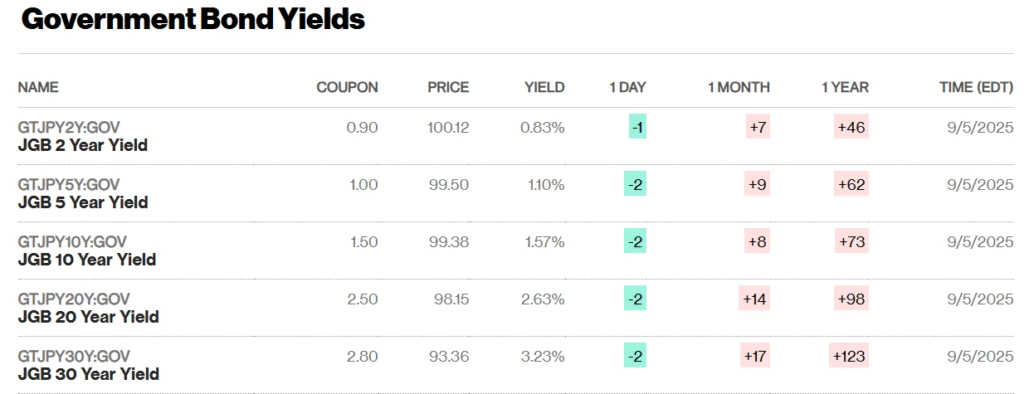

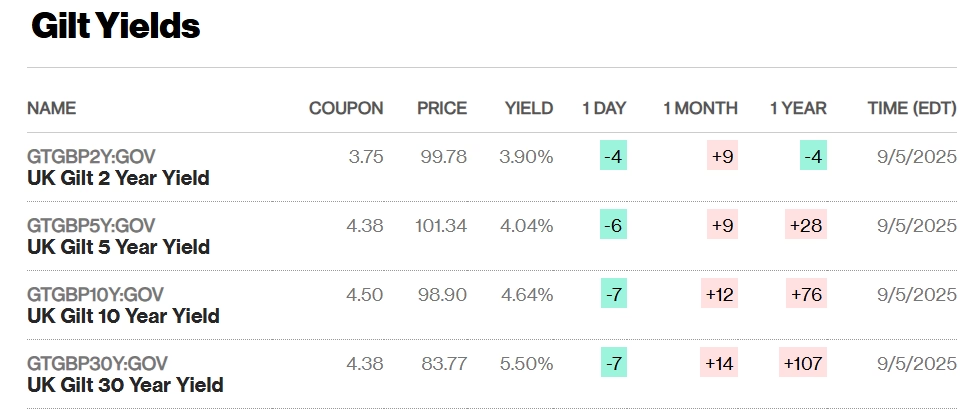

I reported in July 25th’s Market Update that I would occasionally return to the subject of overseas government bond performance-the two most significant being the UK and Japan. Neither of which have been performing especially well of late-meaning that their yields have been rising. This appears to be because investors are more concerned about both Britain and Japan’s ability to meet their long term financial obligations, and as such are demanding more compensation (i.e., a higher yield) for assuming (what they perceive to be) more risk.

Here’s Japanese Government Bond (JGB) performance:

Japanese Rates & Bonds – Bloomberg

You don’t have to be a bond expert to see that in the “1 year” (yield) column, everything’s red (not good-this means governments are required to spend more and more of their citizens’ money on interest payments). Similarly with the UK:

United Kingdom Rates & Bonds – Bloomberg

Interestingly, the UK 30 year gilt yield is now at 5.5%. Significantly higher than the 5.1% it spiked at in September 2022, when former Prime Minister Liz Truss was forced out by Britain’s central bank, the Bank of England (yes, I know that sounds far fetched, but that’s what I believe the evidence surrounding that affair tells us). Truss is Britain’s shortest serving Prime Minister-lasting only seven weeks before being hounded from office. She was the last Prime Minister to be asked to form a government by Queen Elizabeth-only a day or two before she passed away.

UK hit by fresh sell-off in government bond markets as pound weakens | Gilts | The Guardian

So-what’s my conclusion here? I’m not a bond expert, but the markets do seem to be in a pretty precarious state-and as such I’ll be paying close attention to them going forward. Our governments having to tax us more, or borrow more, to service their debt, isn’t good for the citizenry. My suggestion to anyone exposed to government bonds (which is probably all of us in some way), is simply be careful. They’re no longer the rock solid, predictable, investment they were between roughly 1980-2020, and with the way inflation’s going-if you lend a government $5,000 for say, 5 years (or longer)-remember, when you get that $5,000 back, what are you going to be able to buy with it? A lot less than you did when you lent them the money. After all, the purchasing power of your money is more important than its absolute quantity.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran