Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center. (Aug 22, 2025)

TL/DR (Too Long/Didn’t Read) Summary: I’d already written my overview stating that the markets were mostly down this week-however, that was prior to one of the biggest single day pumps across all asset classes I’ve ever seen-which occurred today, following comments made by Federal Reserve chairman Jerome Powell. These will be discussed in more detail below. In the end, what was looking like a bad week ended up being largely unchanged from this time last Friday:

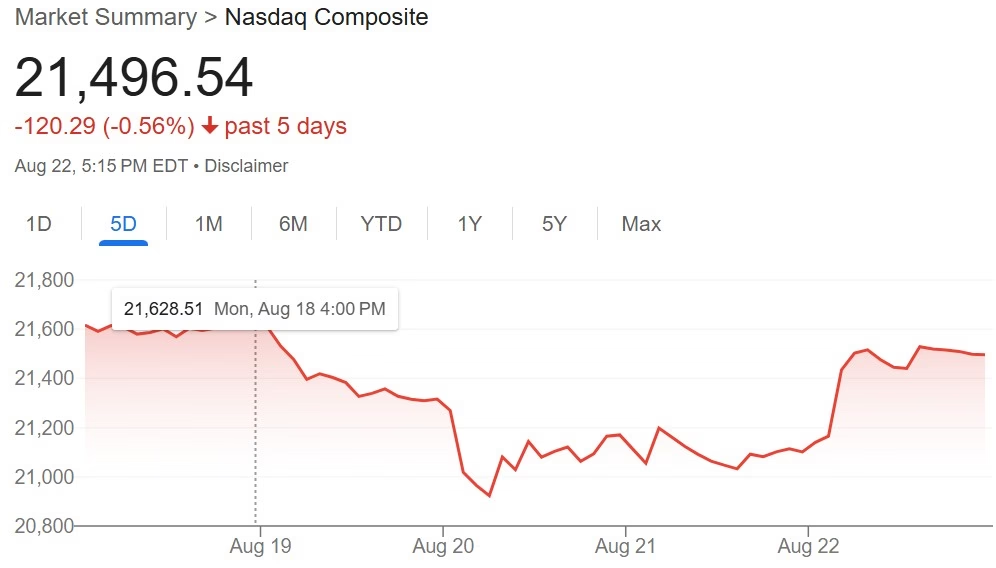

Stocks/Equities: Ended basically unchanged this week-S&P and Dow Jones slightly up, Nasdaq slightly down.

Gold/Silver: Up slightly this week. Gold ($3,385), Silver (~$39).

Crypto: Down, then up today. As of writing, Bitcoin’s unchanged from last week at $117k. As of a few minutes ago, Ethereum hit $4,866, just $26 short of its all time high ($4,892), which it hit almost four years ago. I’ll go out on a limb and say ETH will finally reach a new all time high some time later this weekend.

Bonds/US Dollar: Both relatively unchanged this week.

Special Topic: Price inflation (again).

Stocks: We were heading for the worst week in a long time-not terrible-just slightly down on the week, rather than hitting all time highs. That was until Chairman Powell delivered his remarks from the Kansas City Fed’s annual symposium in Jackson Hole, Wyoming. The full transcript of Powell’s speech, from the Fed’s website, is below:

Speech by Chair Powell on the economic outlook and framework review – Federal Reserve Board

In typical central bankster speak, Powell says a lot whilst saying very little. But the key paragraph is this one:

Putting the pieces together, what are the implications for monetary policy? In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

Monetary policy essentially consists of two things; deciding the quantity of currency in circulation, and setting interest rates. As discussed in previous Market Updates, President Trump and US Treasury Secretary Scott Bessent have been very publicly lobbying the Fed for a cut in interest rates-something the Fed has been reluctant to do since Trump was elected (citing high inflation caused by the tariffs as the main reason). So when Powell talks about “changes to/adjusting our (monetary) policy stance”, the market has interpreted this as a probable rate cut being announced the next time the Fed Open Markets Committee meets, which is in mid-September.

Despite the consistent all time highs we’ve seen in stocks in recent months, for me, there’s simply too much focus on the activities of the Federal Reserve. It’s a privately owned corporation, which, as far as I’m concerned, has no business dictating the monetary policy of a sovereign nation anyway, but that’s a separate discussion.

If all the attention that’s been placed on whether or not they’ll cut interest rates were channeled into something productive, then maybe we’d have more than four listed companies (Nvidia, Microsoft, Facebook and Netflix) carrying the entire equities market. It isn’t exactly a sign that everything’s healthy when a word from the Fed Chairman suggesting a quarter of one percent interest rate cut (or not) can send the market skyrocketing or plummeting. Additionally; if the economy WERE in good shape, there’d be no need to cut interest rates in the first place, would there?

Still, who knows what’s going to happen with stocks. They are ridiculously overvalued-but various commentators have been saying the same thing for years, and we still haven’t had a lasting correction since 2008. And if the Fed does end up consistently cutting rates, they’re probably going even higher. Then there’s the midterm elections in America to think about next year-which will essentially be a referendum on President Trump’s perceived handling of the economy, before (probably) setting up JD Vance for a run at the White House in 2028.

In summary-thanks to today’s comments from the Fed chairman, the three main indices finished mixed on the week (note the boost today exhibited by all):

nasdaq composite – Google Search

Gold/Silver:

Like stocks, were about to have a pretty “meh” week, until this morning. I still don’t quite know why they jumped higher following Powell’s comments from Wyoming, but they did.

Gold currently at $3,385, up $34 or ~1% since last Friday. I remain bullish on gold in the medium-long term. It still hasn’t rebounded from the $3,500 it briefly hit on May 6th (although it didn’t “close” that high-its highest closing price was $3,453-which it hit on Friday June 13th).

Silver currently at $39.08, up $0.92 or ~2% since last Friday.

Gold/Silver Ratio: Remained below 90. It’s now 86.6 (was 87.8 last Friday).

Cryptos:

Another very volatile (i.e., perfectly normal) week in Crypto world. There does seem to be a floor under Bitcoin’s price at the moment, around the $112k mark, which it’s fallen to twice in the past month (including today), before rebounding and heading significantly higher. Ethereum had an amazing today, up around 15%, and like Bitcoin, seems to have had a floor placed under its price, around the $4k mark. However, Crypto world moves SO quickly, this is probably only temporary. As mentioned every week, I remain bullish on this asset class in the short term. If Ethereum reaches $5k soon, 2025’s altcoin season is FINALLY upon us.

Prices on the week:

Bitcoin’s level at around $117k (currently rising).

Ethereum up $460 (~10%) to ~$4,860.

BTC/ETH ratio: Down to 24.0 (was 26.6 last Friday). I think we remain in a downward trend here-which is bullish for the entire asset class. We’re at the end of the now established 4-year Crypto cycle when this ratio falls to the 12-15 range-which, assuming it does the same thing this time around, will NOT be reached in a straight line.

Ripple (XRP) up to $3.09 (was as low as $3.03 last Friday).

Solana’s up to $201 (was as low as $186 last Friday).

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

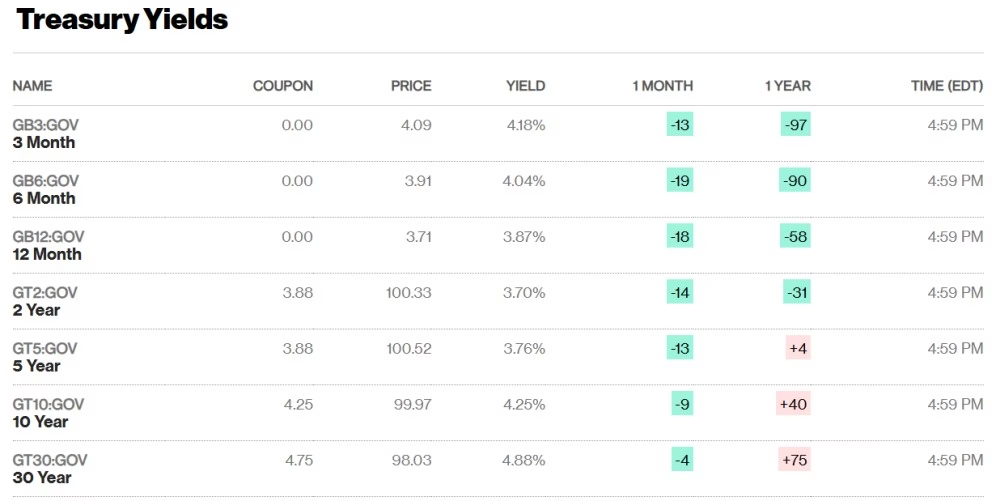

Bonds/US Dollar:

The US Treasury 10-year bond yield is now at 4.25% (was 4.32% last week, so hasn’t moved much). The 30-year bond yield decreased by 4 basis points (was 4.92%, now 4.88%), so still uncomfortably close to that totemic 5% threshold for long term US Treasuries. Lower yields mean higher bond prices, as they have an inverse relationship:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

The dollar weakened slightly against the Swiss Franc; it now costs $1.25 to buy 1CHF (it was $1.24 until this morning. Following Powell’s aforementioned remarks from Jackson Hole, the US Dollar fell in value, relative to other currencies).

Special Topic: Price inflation (again)

One of our favorite topics here at Curranomics is price inflation. Actually, the term has become confused, no doubt deliberately obfuscated by the economics industry. Inflation correctly refers to an increase in the amount of currency in circulation (one of the aforementioned monetary policy tools of the Federal Reserve, and other central banks). Rising prices of goods and services, referred to as “inflation” nowadays, is only a symptom of inflation. Rising prices are not inflation in and of themselves.

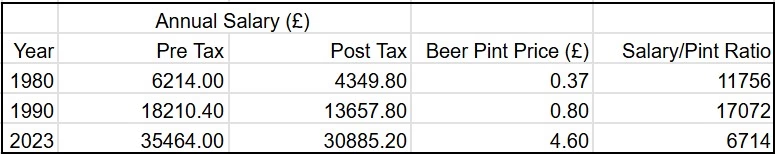

Related to the concept of rising prices is some quick analysis I conducted this week. It’s based partly on data provided by the UK government (in my opinion, data provided by ANY government is unreliable, but since that’s what’s been officially announced, we’ll go with it), and some anecdotal evidence also (probably more reliable than official figures).

When I once asked my late father how much a pint of beer used to cost (which is a surprisingly typical conversation between Irish/British fathers and sons!), I remember him telling me that he paid “about 37p in 1980”. For anyone unfamiliar with British currency, there are one hundred pence (abbreviated as p.), in a pound (whose symbol is £). Someone else, who was a barman in 1990, told me he can remember the furor created at the pub he worked for when “the price of a pint went above the 80p barrier”. When I bought a pint in a very similar pub during a visit to Manchester in 2023, I paid £4.60.

Incidentally, the chain of pubs in question is this one-Joseph Holt. Well worth a visit if you happen to find yourself in England’s Greater Manchester area:

Anyway, I decided to find out what the median British salary was for the three years in question (1980, 1990, and 2023), which I did by consulting the UK’s Office of National Statistics (which provided the average gross weekly wage (documents are attached)-I merely multiplied this number by 52)-and calculate how many pints of Holt’s beer can be purchased with each. My guess is that you’ll be able to buy far fewer pints nowadays than in the past. Here’s my spreadsheet of the results:

Employee earnings in the UK – Office for National Statistics

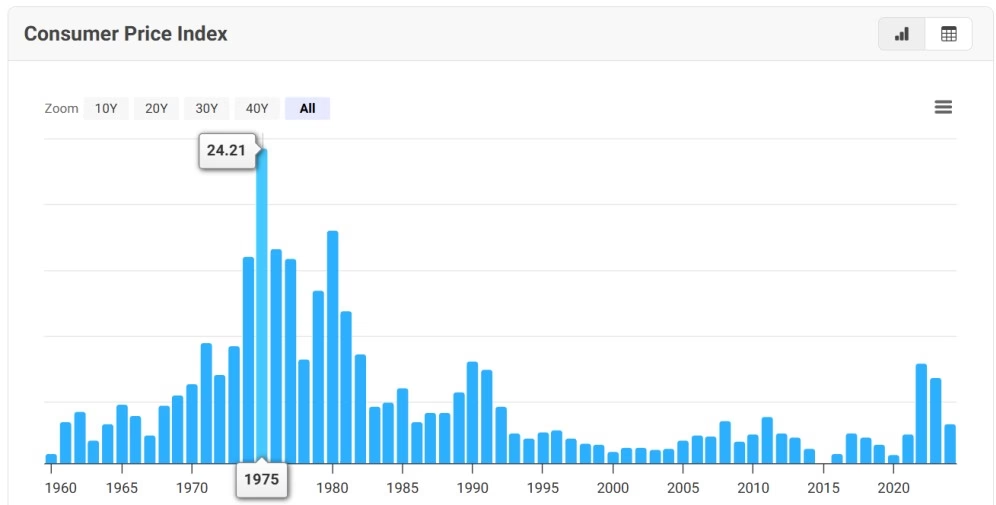

Couple of interesting things to note-first, yes-as expected, far fewer pints can be purchased with 2023’s average earnings compared to the two previous years (although the data doesn’t progress linearly-i.e., 1990 represented better value for money than 1980. I’m not entirely sure why; I do know that inflation rose at a higher rate in the 1970s compared to the 1980s (per the chart below), and that the brewery in question, Joseph Holt’s, were known for their reluctance to raise their prices at that time).

U.K. Inflation Rate (1960-2024)

Second-throughout the 80s, the average salary rose at a higher rate than the price of a pint-in other words, earnings stayed AHEAD of the rate of inflation.

Third-the average annual pre-tax salary almost tripled during the 80s. However, in the 33 years between 1990 and 2023, it hasn’t quite doubled. The price of a pint, however, has increased almost six-fold. Initially I wasn’t going to take income tax rates into account, but eventually I did-albeit approximate ones:

UK income tax rates 1980 to present – Google Search

Maybe I should apply for the vacant commissioner’s job at the US Bureau of Labor Statistics (as reported two weeks ago, Trump fired this person due to the massive inaccuracy of their published data).

So what does the price of a pint of beer in 1980s England have to do with today’s overvalued stock market? The point I’m making is that at least some of the seemingly inevitable increase in prices, whether it be pints of beer, or shares of Microsoft, is because the purchasing power of our currency is falling. And the reason it’s falling is because so much of it is now being produced. It has to go somewhere-and it tends to go into the prices of goods and assets at a higher rate than it does the average person’s wage.

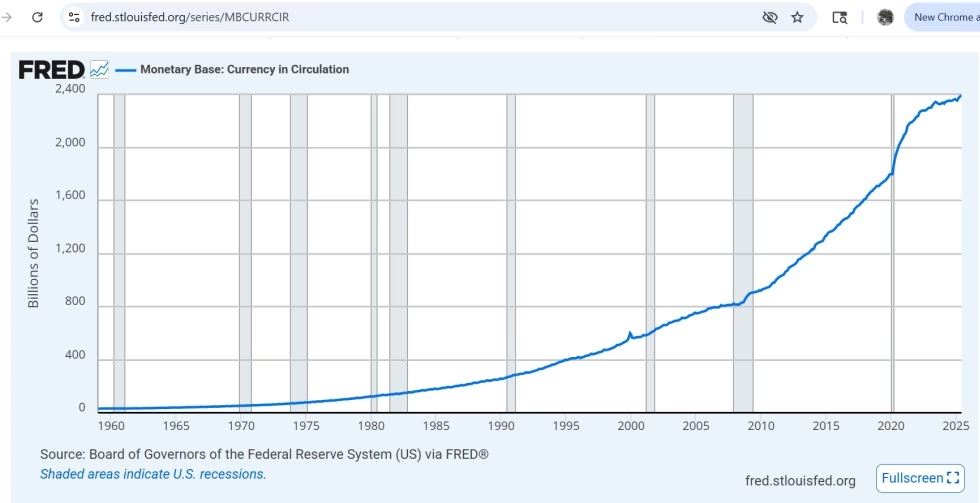

https://fred.stlouisfed.org/series/MBCURRCIR

I’ve shared the above graph before, but it can’t be shared often or widely enough. It’s directly from the Federal Reserve itself, and shows the increase in dollars in circulation from 1959 until now (other western currencies will show a similar trend, but the Fed has the most accessible data). There’s almost 77x as much currency available now as there was in February 1959 (note where the blue line goes almost vertical in 2020, when trillions of dollars were needlessly printed-as a response to the Covid pandemic, for some reason). Even though it may feel good, there’s little point in your salary being twice what it was a year ago, if your cost of living has increased three-fold. This is a trend which is only likely to continue-for now.

Alright-on that joyous note, that’s all for this week. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran