Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center.

TL/DR (Too Long/Didn’t Read) Summary:

Stocks/Equities: Up very slightly this week (1-2%).

Gold/Silver: Down very slightly this week. Gold ($3,350), Silver ($38.16).

Crypto: Up, then down. Bitcoin reached another new all time high, just shy of $125k, while Ethereum also almost did so, before crashing on Thursday.

Bonds/US Dollar: Both relatively unchanged this week.

Special Topic: The only interest rate we need to worry about is the one the President sets, right?

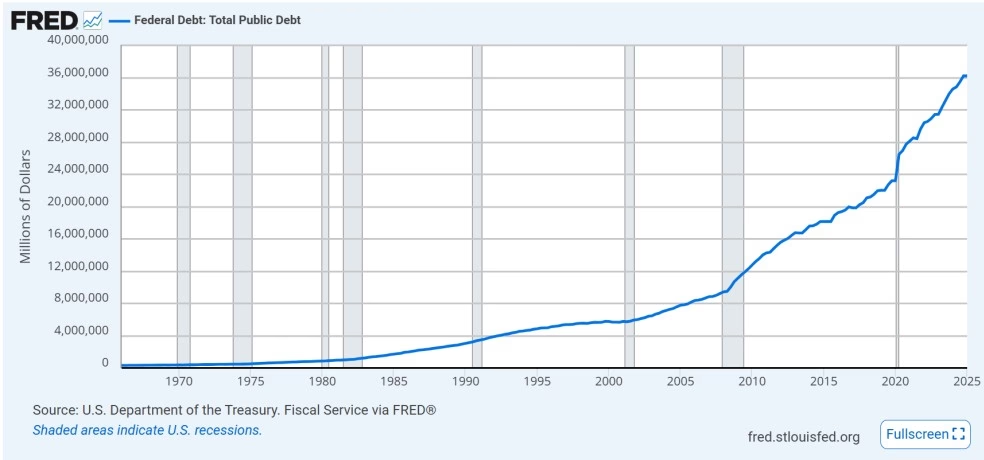

Today marks the anniversary of a rather inauspicious day in monetary history. On August 15th 1971, US President Richard Nixon announced the end of the post war, Bretton Woods system, by “temporarily suspending the dollar’s convertibility to gold”. This suspension was to “defend the dollar against the speculators”, apparently. As I’ve now come to expect from the political class, the stated reasons for a policy decision are never the real reasons-and fifty-four years later, that “temporary” suspension remains in place. Since when, the total US debt has skyrocketed from a somewhat manageable (and almost quaint sounding) $397.3bn, to its current level of almost $37trn:

Federal Debt: Total Public Debt (GFDEBTN) | FRED | St. Louis Fed

This is one of my (least) favorite graphs, and has been featured on Curranomics before. America now owes 91x more money than it did when it left the gold standard. That may not sound like much, but the difference between owing someone $100 and $9,100 is very significant, is it not? Wages certainly haven’t increased 91-fold in the past five decades.

In more contemporary news, presidents Trump and Putin are meeting in Alaska this weekend-notably no representatives from the UK, EU, or the comedy actor currently masquerading as president of Ukraine, Volodymyr Zelensky, are invited. The location is certainly significant; Alaska is America’s 49th State, which joined the Union following America’s purchase of it, from Russia, in the 1850s.

Finally, next week sees the annual symposium held by the Kansas City branch of the US Federal Reserve system, which takes place at the resort of Jackson Hole, Wyoming (apparently it’s stunning-I’ve never been to Wyoming). This is a gathering of central banksters from all over the world, discussing the direction of monetary policy over the next twelve months. Which sounds incredibly dull and dry (as it’s supposed to), but the reality is that many important decisions will be discussed here, for implementation elsewhere later. For example, it was at the 2019 edition of this symposium that the “going direct reset” was discussed (actually, it was a presentation given by Blackrock, Inc., entitled “Preparing for the Next Downturn”). This was in advance of the unprecedented money printing which took place only a few months later, allegedly in response to the Covid pandemic, which they evidently all knew was coming. One of the delegates to that year’s conference was none other than Mark Carney, now prime minister of Canada, who was governor of the Bank of England at the time. Carney pointed out that the world’s financial system in its current form was already dead (“this center cannot hold”, he is alleged to have remarked). Carney’s one of the most obvious examples of the previously discussed revolving door between Government, Central Banks, Wall Street, and Academia.

Anyway. This time much of the focus seems to be around whether or not the Federal Reserve will cut rates next month-and if so, by how much. As things stand-although of course, this is simply speculation-the market’s expecting a 0.25% rate cut (US Treasury Secretary Scott Bessent called for a 0.5% rate cut earlier this week). Chairman Powell typically doesn’t like to surprise Wall Street, so if a rate cut isn’t expected, he should make comments to this effect. We shall see-there’s more on interest rates in this week’s special topic.

What Treasury Secretary Bessent’s Call for a 50bps Cut in September Could Mean for Crypto

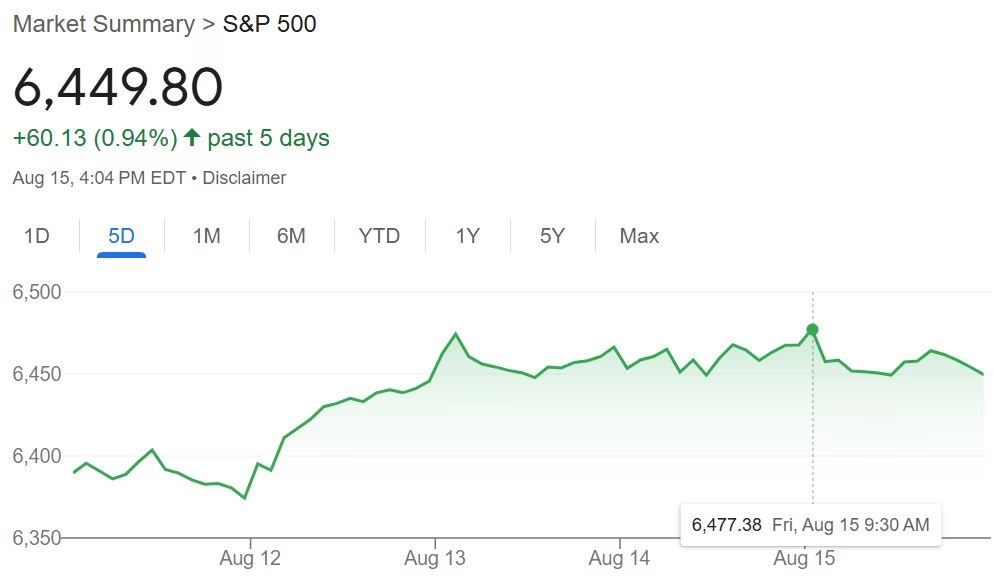

Stocks: Covered in detail last week-the situation has changed very little. More all time highs, but the majority of growth is being generated by only a handful of corporations (Microsoft, Nvidia, Meta (Facebook), and Netflix), therefore many stocks aren’t actually doing very well at all (notably Tesla). The dollar’s declining purchasing power is also making stocks (and other assets, such as real estate) rise. Bad news, which in the past, would have adversely affected most stock prices, seems to make zero difference any longer. Expect additional short term growth, assuming the Fed interest rate cut occurs next month. Thus, all three major US stock indices are up again this week:

nasdaq composite – Google Search

Gold/Silver:

Hilariously-last week, after I mentioned gold prices had spiked on Friday, following the news of high US tariffs on Swiss products (including gold), it was revealed on Saturday that there was more clarification expected from the White House regarding this matter:

Swiss gold exports might not face US tariffs after all – SWI swissinfo.ch

Then, on Monday, it was confirmed gold will NOT face tariffs, after all:

Gold Imports Will Not Face Tariffs, Trump Says

I did say in last week’s Curranomics “we’ll see how long it (i.e., the tariff on imported gold) lasts”. I didn’t expect it be discarded so soon, but as I keep saying, the tariff shenanigans is impossible for one person to keep track of.

Gold currently at $3,351, down $61 or ~2% since last Friday. I remain bullish on gold in the medium-long term. It still hasn’t rebounded from the $3,500 it briefly hit on May 6th (although it didn’t “close” that high-its highest closing price was $3,453-which it hit on Friday June 13th).

Silver currently at $38.16, down $0.37 or ~1% since last Friday.

Gold/Silver Ratio: Remained below 90. It’s now 87.8 (was 88.6 last Friday).

Cryptos:

Another very volatile (i.e., perfectly normal) week in Crypto world. On Wednesday, Bitcoin hit yet another new all time high of $124,500, before sinking to $117,000, which is where it currently sits (level with last week’s market update). Ethereum was similarly wild-it almost hit a new all time high on Wednesday (in fact it stopped just short of $4,800) and currently sits at $4,400. Hopefully the bull market will continue, although significant declines (such as the one we saw this week) will no doubt continue to occur along the way. I have no problem with these pullbacks, I think they’re preparing us for higher highs later this year. In fact, if we go down much further, I’ll probably buy some more.

Prices on the week:

Bitcoin’s level at around $117k (currently falling).

Ethereum up $240 (6%) to ~$4,400.

BTC/ETH ratio: Down to 26.6 (was 28.1 last Friday). I think we remain in a downward trend here. We’re typically at the end of the now established 4-year Crypto cycle when this ratio falls to the 12-15 range-which, assuming it does the same thing this time around, will NOT be reached in a straight line.

Ripple (XRP) down to $3.03 (was as high as $3.27 last Friday).

Solana’s up to $186 (was as low as $180 last Friday).

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

Bonds/US Dollar:

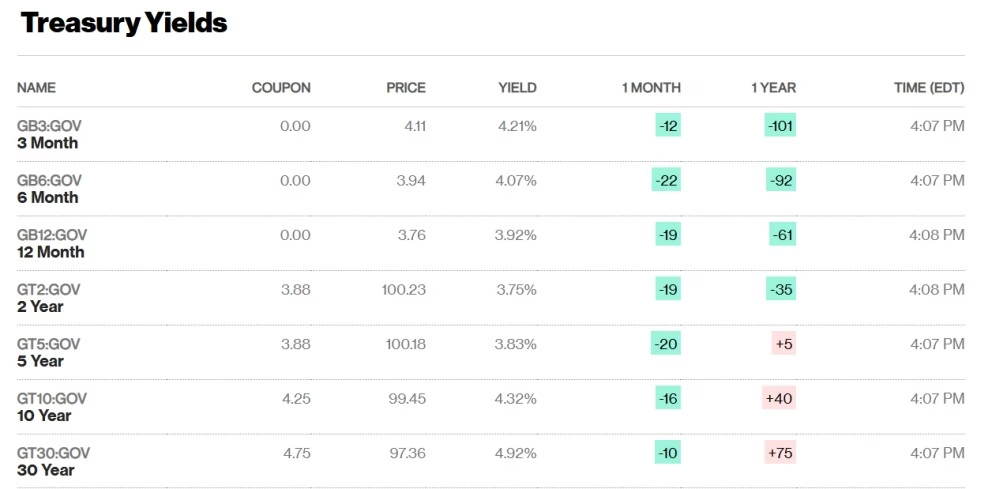

The US Treasury 10-year T-Bill yield is now at 4.32% (was 4.28% last week, so hasn’t moved much). The 30-year bond yield increased by 7 basis points (was 4.85%, now 4.92%), so still uncomfortably close to that totemic 5% threshold for long term US Treasuries. Lower yields mean higher bond prices, as they have an inverse relationship.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

As with the last two weeks, it still costs $1.24 to buy a Swiss Franc.

Special Topic: The only interest rate we need to worry about is the one the President sets, right?

As you can tell from the title, this week I’ll be attempting to dispel some widely held myths around interest rates. A real estate agent friend of mine and I were discussing this subject a few days ago-after which, I came up with the following list of points:

1) There’s been much commentary in the media recently regarding “interest rate cuts”-especially President Trump putting pressure on Federal Reserve chairman Jerome Powell (whom he referred to as a “numbskull”,) to cut rates.

2) The rate they’re referring to is the so-called “Fed funds rate” (the Fed being the Federal Reserve-America’s central bank). This rate is the interest rate banks charge each other for overnight borrowing in their own circuit of money (called the “reserve” circuit)-that the public has neither access to, nor visibility of.

3) The key word here is “overnight”. I.e., it’s very short term lending. Contrast this with a mortgage, which is typically paid over 20-30 years.

4) The reasons President Trump is pushing so hard for a rate reduction has nothing to do with mortgages. He wants a weaker dollar, a higher stock market, and lower short term US Treasury yields-all of which can be facilitated by a lower Fed funds rate.

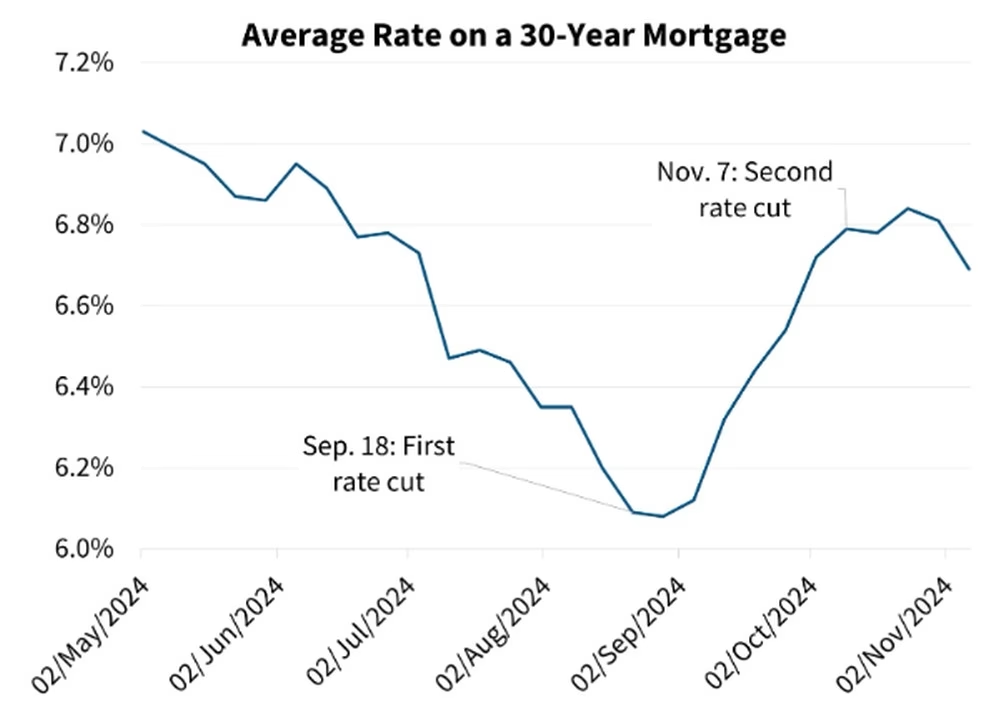

5) According to Nathaniel Drake, senior associate at Fannie Mae (Fannie Mae is formerly the Federal National Mortgage Association, a US government sponsored enterprise, which facilitates mortgage financing, and pioneered the adoption of the now popular 30-year, fixed rate, mortgage loan), the last time the Fed cut its rate (not even a year ago), mortgage rates went up, not down:

What Determines the Rate on a 30-Year Mortgage? | Fannie Mae

6) Even though Wall Street is now expecting rate cuts later this year, especially in light of Wednesday’s lower than expected CPI (which stands for the Consumer Prices Index, and is the US government’s preferred measure of inflation) number, we’re still not 100% sure they’ll happen. I don’t know about you, but I’m not a member of the Fed board of governors. One additional point worth noting here, which I think is quite deceptive-is that any positive rate of inflation means that prices are STILL rising. All a lower number means is that they’re increasing at a slower rate than they were previously. The way in which “lower” inflation is hailed as a good thing by the media is extremely misleading, in my opinion-since the purchasing power of our currency is still continuously being eroded.

https://www.cnbc.com/2025/08/12/cpi-inflation-report-july-2025.html

7) Even if mortgage rates do fall (and as discussed, there’s no guarantee they will-at least not as a result of a small reduction in the Fed funds rate), a quarter of one percentage point reduction in the interest rate will have a negligible impact on a monthly repayment.

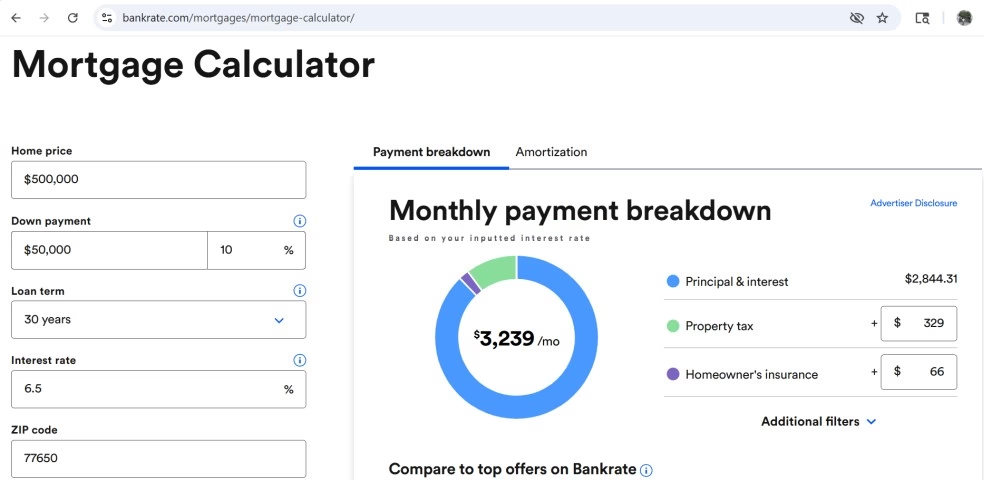

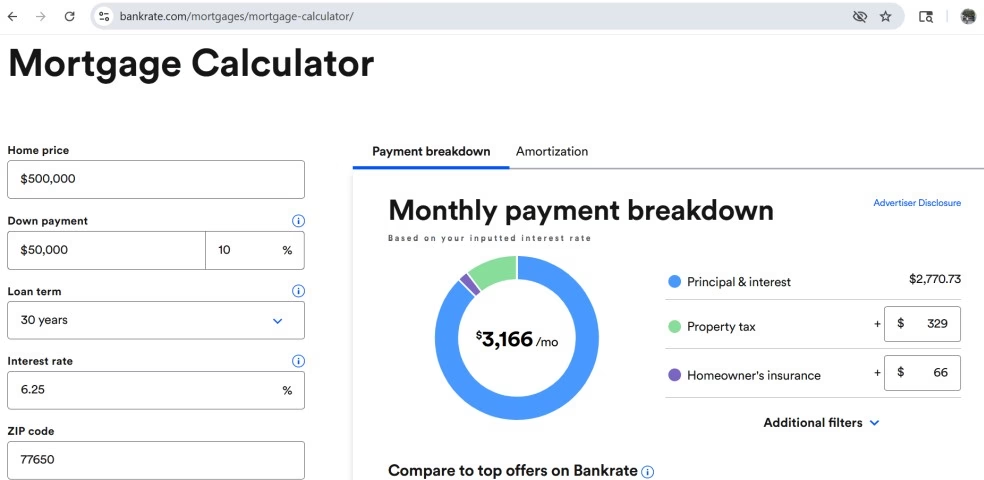

Example; a $500k (£370k) home, with 10% down, and a 30-year mortgage with a 6.5% interest rate, will produce a monthly note of $2,844.31 (£2,104.79):

A 6.25% rate applied to an otherwise identical scenario, produces a monthly note of $2,770.73 (£2,050.34). Only $73.58 (£54.45) lower:

Mortgage Calculator | Bankrate

8) I would personally always caution against counting on Government/Central Bank intervention. Shall we ask the people who are still waiting for student loan forgiveness, as promised by former President Biden prior to the 2022 midterm elections?

Supreme Court strikes down Biden’s student loan forgiveness plan

Biden admin withdraws student loan forgiveness plans. What borrowers should know.

9) When President Trump and his Treasury Secretary Scott Bessent mentioned “lowering interest rates by 3%”:

They neglected to mention a few things. In particular:

a) The Federal Reserve is responsible for lowering interest rates, not the President, or the Treasury.

b) Despite its name, the Federal Reserve is NOT part of the Federal Government, and is actually answerable (supposedly) to Congress, not the Executive branch.

c) The MOST the Fed has ever lowered its funds rate at one time is 1%, and it’s only done this twice; during two moments of significant economic turmoil-in 2008, during the subprime crisis, and 2020, during Covid.

d) The average American homebuyer wouldn’t want a 3% reduction in rates at once. Typically rates are cut when the economy is struggling and requires a boost-therefore such a move would essentially tell the entire world that the American economy is collapsing! Terrible news for both Americans, and all the foreign countries which hold our debt (which is essentially all foreign countries). The damage to the dollar would likely be irreparable.

10) There may be some potential homebuyers who have already delayed purchasing a home by up to a year or so, in anticipation of lower mortgage interest rates-lower rates which still haven’t happened. During which time, the value of your dollars has fallen by at least 11%.

Conclusion: Those delaying purchasing a home simply because they’re hoping interest rates will drop significantly any time soon are likely to be disappointed.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran