Greetings Fellow Wealth Creators, Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center. Overall, it was a disappointing week for all the major asset classes covered here (Crypto’s continuing to fall as I write this), which will be discussed in more detail below. There were several major events, most of which were interpreted negatively by the financial markets, except US treasury bonds, which we’ll get to later.

1) The first item concerns one of my (least) favorite institutions on the planet-that’s right, the Federal Reserve, the privately owned American central bank. The Fed’s Open Markets Committee (FOMC) met this week to discuss what to do about the cost of borrowing money-and as expected, the Fed left interest rates unchanged at 4.25-4.5%, despite public pressure from President Trump who wants lower rates (although this is mostly theater to keep us distracted, of course, since both Trump and Fed Chairman Jerome Powell answer to the same hidden people).

Additionally, it sounded to me as though the public is being prepared for rates to remain unchanged at the next such FOMC meeting, which is at the end of September, but a lot can happen in between now and then, so who knows.

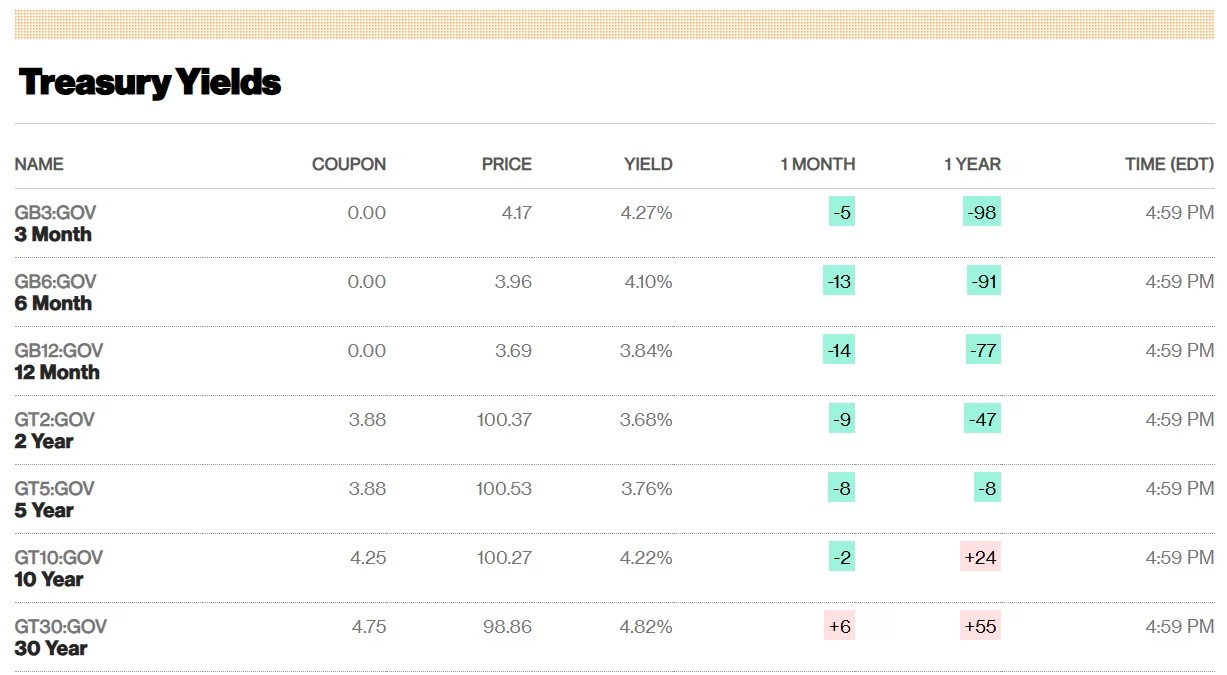

Either way, a cut in interest rates would have been a boost for riskier assets such as stocks and cryptos, since the public is less likely to invest in them when interest rates are higher, because they can enjoy equally good returns, but on an almost “risk free” basis, from FDIC protected money market accounts, CDs, savings accounts, etc. Trump seems to value stock market performance very highly; probably because he’s exposed to it. Ditto crypto assets. The other reason Trump wants lower interest rates is because America has a LOT of debt which needs to be refinanced this year, and lower interest rates would make it less expensive to do so, at least for its short term bonds (which are called notes). I’m no expert, but I believe the longer dated the bond, the less impact the Fed’s funds rate has on its yield.

I don’t know the entire make up of the FOMC (this is something I haven’t researched), but two Governors on it publicly dissented from Powell’s announced decision, stating they would have cut rates by 0.25% (or 25 “basis points”). This is unusual, and hasn’t happened since 1993, apparently:

Fed holds rates steady despite Trump’s pressure, with two governors dissenting

Furthermore, another Fed governor (not one of the two who dissented) and member of the FOMC board, announced her resignation today. Apparently, “she will be returning to Georgetown University as a professor in the fall”. Mmm. Remember that revolving door of economists that I mentioned last week?

Fed Governor Kugler is resigning, giving Trump a nominee on committee that sets interest rates

The Fed is an incredibly opaque institution, a feature which is no doubt deliberate. It’s actually a “system” of twelve regional banks (the nearest location to us is in Dallas), by far the most powerful of which is its branch in New York City (aka the New York Fed). Each of the regional banks reports into the board of governors, which is headed by the chairman (currently Jerome Powell), based in Washington, DC. The President appoints the chairman, but can’t fire them-(except “for cause”, although I don’t think this has ever happened). The Fed is therefore independent of the executive branch of the US government, but not the legislative branch (i.e., Congress), which originally created it under very murky circumstances in 1913. Prior to the Federal Reserve Act, America hadn’t had a central bank for 77 years.

Confused? I know I am.

This brings me on to some more Fed theater, which actually occurred the week before last, but last week’s update was already too long for me to mention it. The Fed is currently renovating its headquarters, which has incurred some significant budget overruns. Trump recently visited the building site (link to the relevant YouTube video clip is below).

First, it’s never been clear to me why the taxpayer is footing the bill for the Fed building’s allegedly necessary renovations. The Fed is a privately owned corporation, run for private profit, by its owners-its member banks. Why aren’t they paying for it?

I wonder if the entire story hasn’t been fabricated for the purposes of producing the cringefest which was the aforementioned photo op of Trump and Powell visiting a building site, sporting hard hats, with Trump bossing Powell around while they publicly disagreed over the cost of the repairs (as if they wouldn’t have aligned on a figure beforehand). It looked like a humiliation ritual for Powell, which I guess was the point. I’m no architect obviously, but the building they were in looked extremely rudimentary to me-like a bog standard block of apartments found in any major city. Not something the overpaid suits at the Fed would be satisfied with. And as yet, I haven’t found any footage from that day of Trump actually entering the Fed building. My guess is that it was probably filmed (using multiple takes) in a TV studio.

Trump and Fed chair Powell clash on camera over Federal Reserve renovation cost

2) In other news, the monthly “non farm” payroll data was released by the US Bureau of Labor Statistics (BLS) this morning. This is a key report, which is released on the first Friday of every month. Today, it didn’t look very good:

Jobs report July 2025: U.S. added just 73,000 jobs, prior months revised much lower

In fact, it was so bad, especially the downward revisions on previously reported numbers, that the commissioner of the BLS has since been fired:

Trump fires commissioner of labor statistics after weaker-than-expected jobs figures slam markets

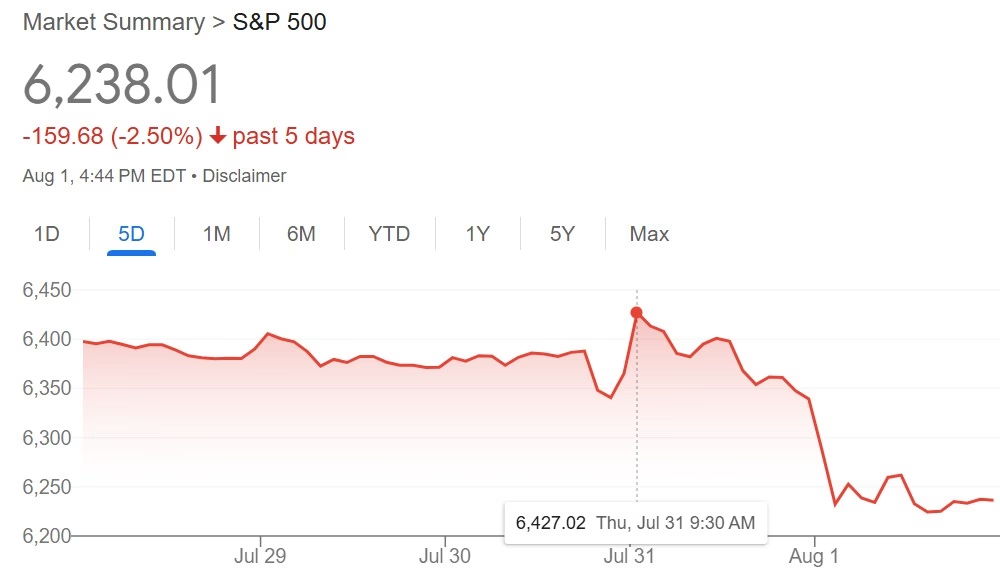

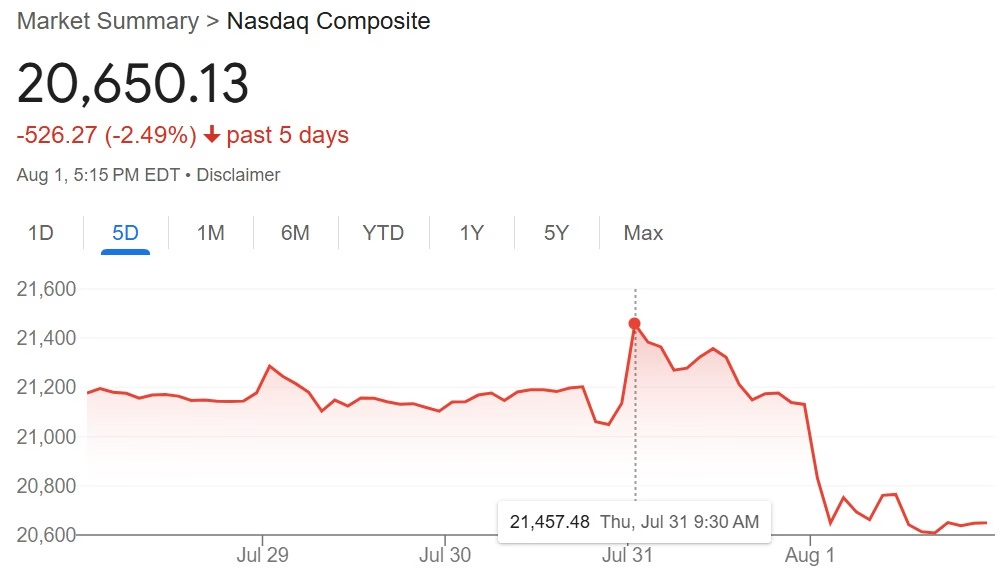

Anyway, the markets did NOT react well to this buffoonery, as we’re about to see. First, stocks:

s&p 500 – Google Search

s&p 500 – Google Search

nasdaq composite – Google Search

nasdaq composite – Google Search

However, two of the three main indices, the S&P 500 and the Nasdaq, hit new all time highs only yesterday, so other than the concerns I’ve already raised about stocks, they’re still performing extremely well.

Gold/Silver:

It was another disappointing week in metals-that’s now two in a row. As such, we may be in a period of price consolidation. Both gold and silver had good days today, (up about 2% and 1% respectively), probably in light of the disastrous jobs report data, but they’re down on the week.

Gold closed on $3,376, down $39 or 1.2% since last Friday. I remain bullish on gold in the medium-long term. It still hasn’t rebounded from the $3,500 it briefly hit on May 6th (although didn’t “close” that high-its highest closing price was $3,453-which it hit on Friday June 13th). I expected gold to carry on rising when it hit this milestone, which it hasn’t done-a lesson for me is to not get carried away when assets are performing better then expected-you never know what’s around the corner.

Silver closed on $37.21, down $1 or 3% since last Friday.

Gold/Silver Ratio: Starting to creep up again. It’s now 91, it was on a downward trend to the mid 80s only a couple of weeks ago.

Cryptos:

Another very volatile (i.e., perfectly normal) week in Crypto world. On Sunday, Bitcoin hit $120,300 (still shy of its July all time high of just over $123k), before falling to $113,000, which is where it currently sits. Ethereum was similarly wild-hitting $3,930 (also on Sunday), before correcting to its current $3,500.

Prices on the week:

Bitcoin’s down $4,000 to around $113k.

Ethereum down $230 (3.6%) to ~$3,500.

BTC/ETH ratio: Up to 32.6 (was 31.2 last Friday)-although overall, I think we remain in a downward trend here. We’re typically at the end of the now established 4-year Crypto cycle when this ratio falls to the 12-15 range-which, assuming it does the same thing this time around, will NOT be reached in a straight line.

Ripple (XRP) down to $2.94 (was as high as $3.15 last Friday).

Solana’s down to $162 (was as high as $180 last Friday).

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

Bonds/US Dollar:

The US Treasury 10-year T-Bill is now at 4.22% (was 4.39% last week, so has improved significantly). The 30-year bond fell from from 4.93% to 4.82%, so still uncomfortably close to that totemic 5% threshold for long term US Treasuries-however, the uncertainty in the rest of the market today meant that investors were piling into the “safety trade” of US Treasuries once again. Lower yields mean higher bond prices, as they have an inverse relationship.

Meanwhile, the US Dollar strengthened this week against the Swiss Franc-it now only costs $1.23 to buy 1CHF (it was $1.26 last week).

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran

E: thomasjxcurran@gmail.com

J. Lee Austin

August 5, 2025 at 9:41 amThanks Thomas … so refreshing to see someone calling out the Clown World, Powell/Trump Nonsense Theatre for what it really is, a mere distraction. But distraction from what? To paraphrase Ron Paul, the Creature from Jekyll Island should be euthanized and buried deep …. End the Fed!

~~ j ~~