Welcome to this week’s edition of Curranomics® from Crystal Beach Investor Center.

Well, quite the bloodbath this week-across the board. Metals (which had been doing rather well for the past year) down sharply. Crypto (which had been doing badly since October 10th last year anyway), also down sharply. Stocks were mixed. Metals and stocks I think will bounce back this year-I predicted in the annual report that with it being a big year for America, I thought those markets would end 2026 higher than they started it, and I stand by that prediction.

Crypto’s an entirely different story-assuming the four-year-cycle is intact (and I have no reason to believe otherwise at this stage), Ethereum topped out in August 2025 at just under $5,000, Bitcoin in October 2025 at $126,000, with an ETH/BTC ratio low of 24 (it’s now 34). In prior cycles, the low was around one year after the cycle top, and 70% off the high (although with the non-event that was the top, maybe we’ll be closer to 60% off the high, which would put Bitcoin at around $50,000). So-we’ll probably continue to trend down overall until the end of the year-no doubt with the occasional move upwards along the way. At this point, I’ll consider buying some more (update; I ended up buying a little more on Friday-with the bitcoin fear and greed index at 5 (out of 100-the lowest I’ve ever seen it, and indicating “extreme fear”, I couldn’t help it)).

Crypto Fear and Greed Index | CoinMarketCap

This also means that we probably won’t peak again until Q4 2029! That’s a long time to wait, but if I’ve learned anything recently, it’s that you HAVE to be patient, and take small profits on the way up. I’ve spent too long waiting for the biggest possible payday, which may never come. However, it was pleasing to see Bitcoin rebound strongly from a price of $60,000, closing Friday at just over $70,000, or 17% up on the day. $60k looks like a level of support-for now. Although since all the other bear markets have lasted 12 months, there’s a long time between now and October in which we can fall into the $50k price range (or lower).

I will make a point generally-more than ever, the financial markets do appear to be totally rigged, with the insiders becoming even more brazen, and less bothered about maintaining even the veneer that all market participants obey the law, and that everyone has the same opportunity for profit. The financial markets have likely always been rigged by criminal insiders, but in a bygone era in which (for example), university was largely a good investment, houses were affordable, secure jobs with decent retirements were widely available, and most young people could afford to start a family, the public was willing to overlook this. This is no longer the case.

TL/DR (Too Long/Didn’t Read) Summary: A mixed week.

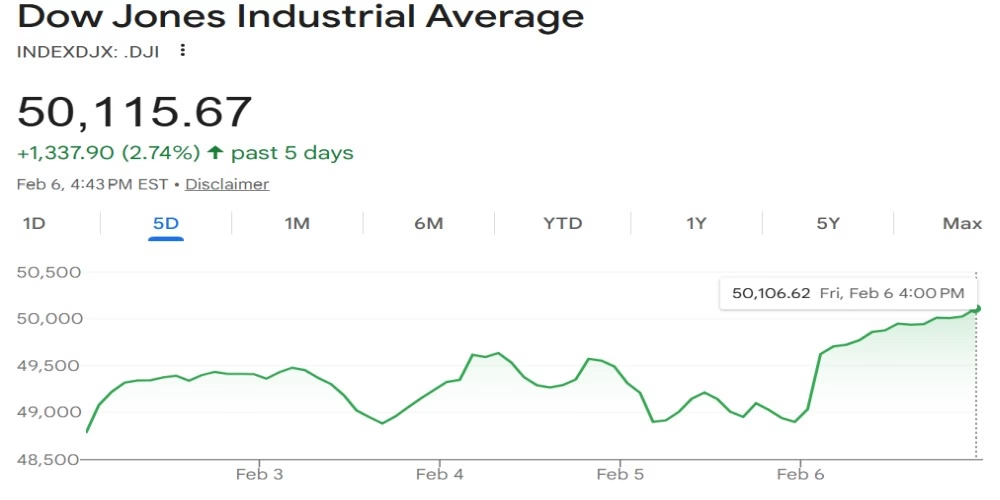

Stocks/Equities: Dow Jones hit 50,000 points for the first time ever, but the Nasdaq finished the week slightly down.

Gold/Silver: Gold up, silver down.

Cryptocurrency: Terrible. That’s all there is to say!

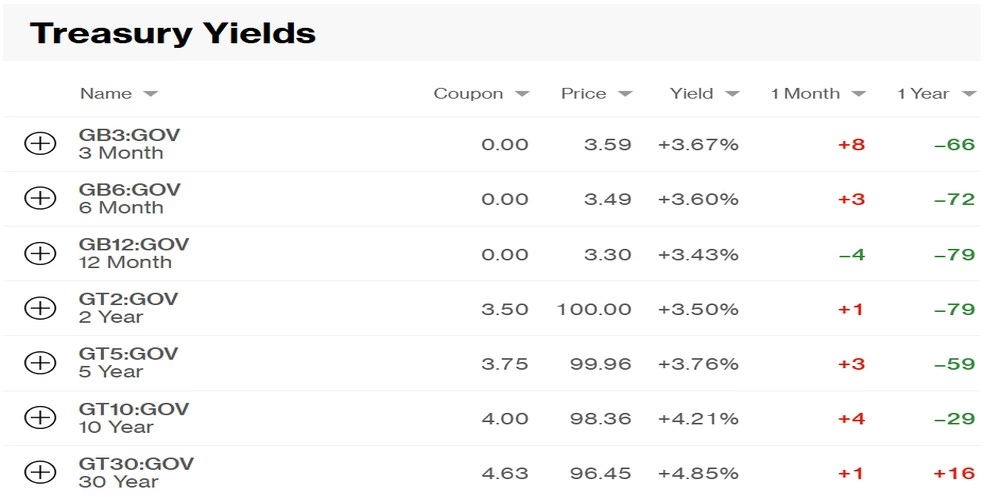

Bonds/US Dollar: Yields down slightly. US Dollar unchanged against the Swiss Franc.

Stocks:

Equities were having a pretty awful week until a strong rally on Friday. I did say last week that Fridays can be days in which markets fall due to sell offs (like October 10th 2025), but maybe this is primarily a phenomenon associated with the last Friday of the month (like the prior Friday, January 30th 2026). Who knows; all financial markets are pretty crazy right now.

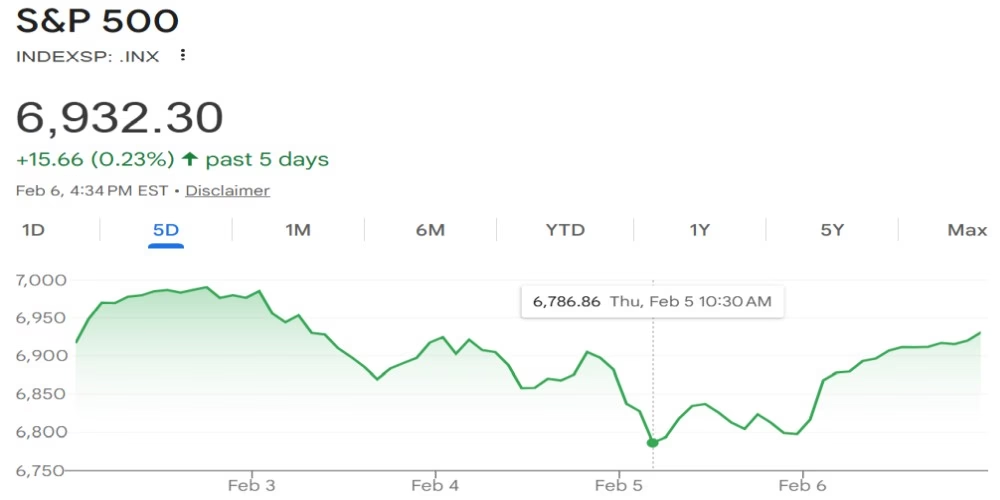

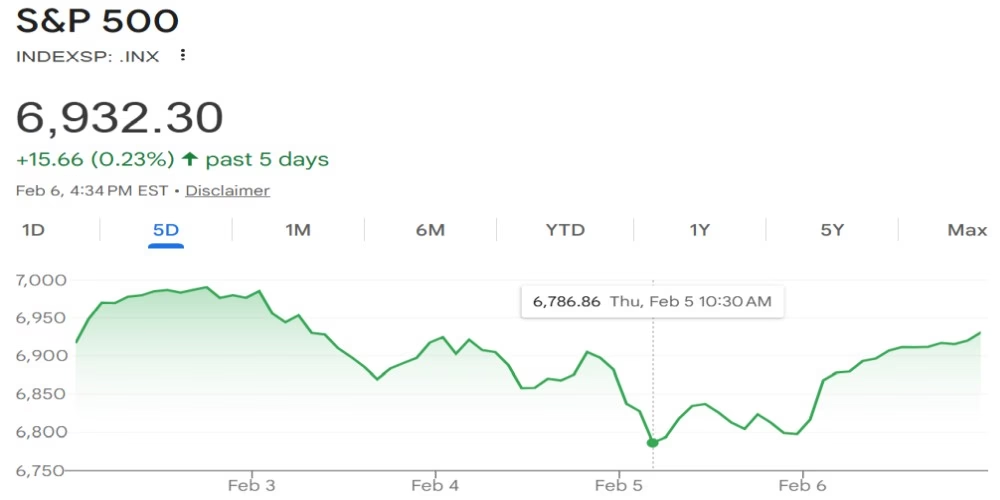

Which brings us to charts. Even though the weekly charts are mixed, this is skewed by the Nasdaq containing so many technology stocks, which are having a rough time at the moment. The Dow Jones on the other hand, hit 50,000 points for the first time ever on Friday-quite the achievement. The S&P remains just below its 7,000 threshold, also. Here are all three indices on the week:

nasdaq composite – Google Search

Gold/Silver:

Prices are still doing very well on the year so far, but still yet to regain the late January highs. I hope those levels are matched and exceeded by later this year (it is only early February, after all).

Gold closed the week up $79 (~2%) at $4,979 (was $4,900 at the previous Friday’s close).

Silver closed the week at $78.52, down ~$7 or ~9% since the previous Friday’s close.

Gold/Silver Ratio: Shot up to 63.4 (was 57.1 the previous Friday)-due to silver falling much more than gold this week (which actually rose).

Cryptos:

See the introduction for a broader discussion on the Crypto market. I will say that the one day collapse on Thursday was one of the most crushing reverses I’ve experienced in over eight years of crypto investing. The current prices speak for themselves, but my long term confidence in Cryptos hasn’t changed. 2026 is a buying opportunity, I think.

Prices on the week:

Bitcoin’s down $6,500 at around $71,000.

Ethereum’s down $300 at around $2,100.

BTC/ETH ratio: Up to 33.8 (was 32.3 last Sunday).

Ripple (XRP) down $0.16 at around $1.44.

Solana’s down $15 at around $87.

Bonds/US Dollar:

The US Treasury 10-year bond yield is very slightly down this week-now at 4.21% (was 4.24% as of last week).

The 30-year bond yield decreased by 2 basis points (was 4.87%, now 4.85%).

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

The market for long term US government debt peaked in March 2020 (interestingly, the same month the WHO declared coronavirus to be a “pandemic”), after which time, it’s been mostly downhill. Yes, yields have risen during that time, but since bonds return a “fixed” income, if you bought a ten-year dated bond in say, 2020, and are still holding it (presumably to maturity), you’ll be receiving exactly the same interest (known as the “coupon”) now as you were then-i.e., a low rate-whilst the value of the bond has fallen.

Meanwhile, the US Dollar remained the same against the Swiss Franc, costing $1.29.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran