Welcome to this week’s edition of Curranomics® from a chilly and windy Crystal Beach Investor Center.

Yet another crazy week in the world. The main story this week is precious metals-which were doing unbelievably well until yesterday (Friday), when they suddenly collapsed in the space of a few hours. It’s quite incredible that we went from utter euphoria only twenty-four hours ago, to an outpouring of despair! More on that in the relevant section below. It’s interesting that Fridays, in particular the last Friday trading day of the month (as was the case yesterday), often seem to be the days in which we see the biggest collapses. I’ve noted this for next month-sell on Thursdays.

In general, I need to be better about cutting my positions when I’m sat on a decent profit-especially with how volatile the financial markets are nowadays. It’s escalator up, elevator down; so make sure to step off the escalator before it reaches the top. I’d love to hear ideas on this, so if anyone wants to discuss strategies, please get in touch. We’re probably all guilty of admiring how much of a gain we’ve made in a particular asset on paper, only for a significant amount of it to evaporate before we try and sell. Then waiting for it to return to the same level can take months, years, or even decades.

Aside from likely incurring a taxable event, this does then introduce an additional problem-which is, when do you buy back in? Let’s remember Liberation Day, April 2nd last year. Following the announcement of the tariff policy that day, stocks fell sharply, but then rebounded upwards again within a month, and have been sitting around record highs ever since. How were we supposed to play that?

TL/DR (Too Long/Didn’t Read) Summary: A pretty bad week across the board in the end.

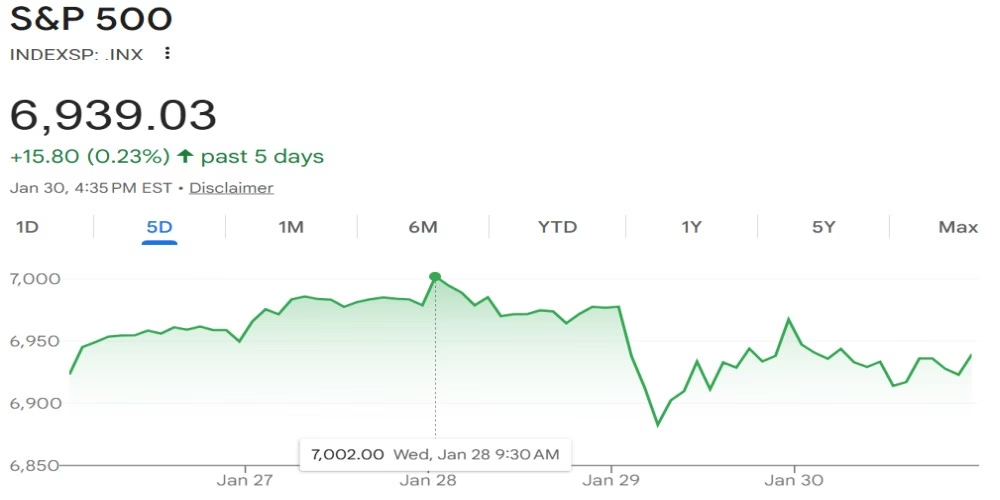

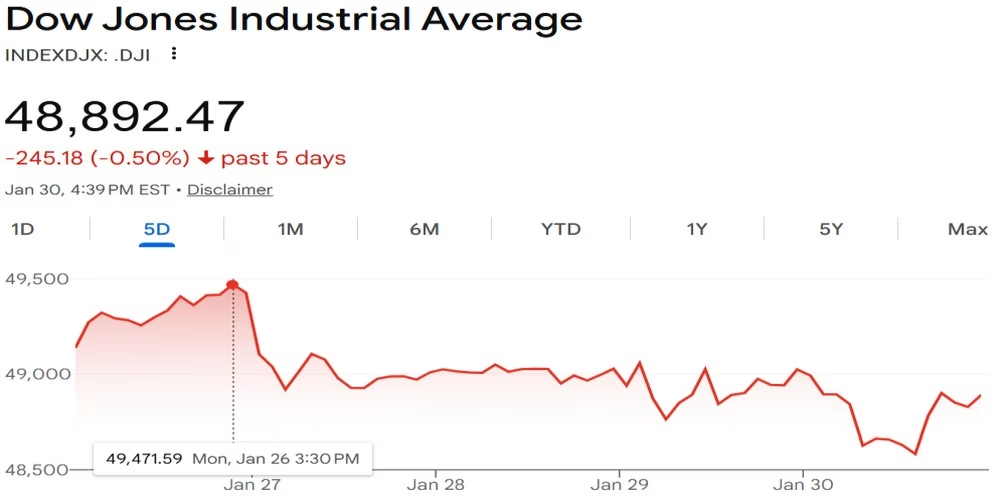

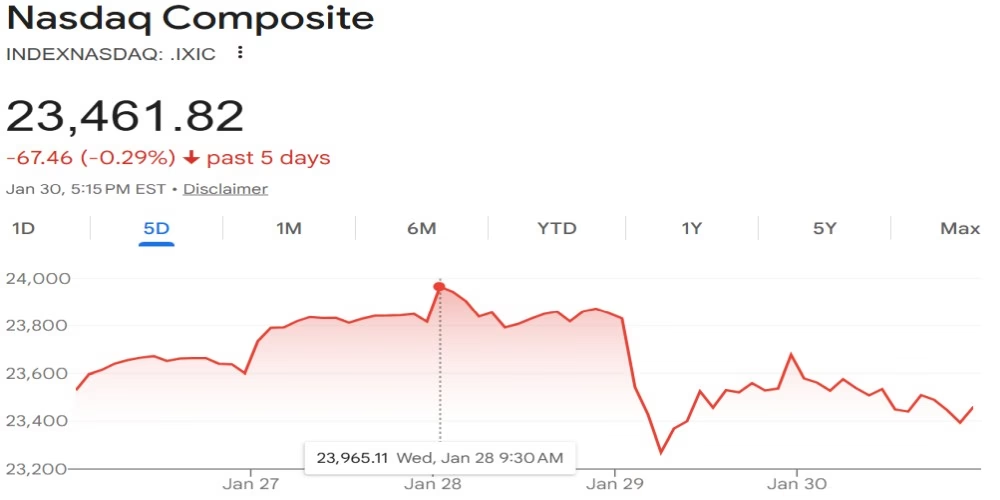

Stocks/Equities: Despite some movement, all three major indices essentially where they were a week ago, still hovering around all time highs.

Gold/Silver: Gold and silver both up strongly through Friday morning, then down VERY strongly.

Cryptocurrency: Another terrible week! Although still impossible to say which way the market’s going to go in the short term (probably further down).

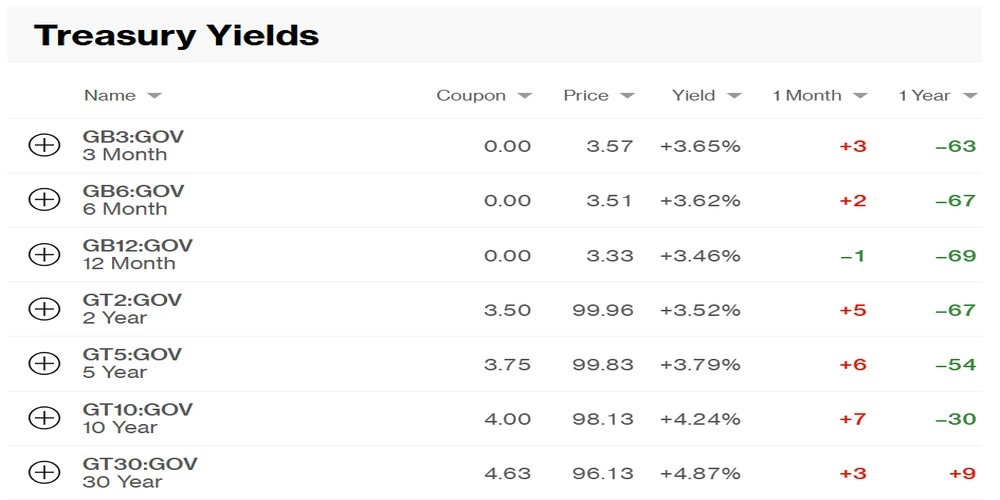

Bonds/US Dollar: A mixed week, although in general, bond yields keep creeping up, especially at the long end of the yield curve.

Stocks:

A few important items to mention this week:

1) As expected, America’s central bank, the Federal Reserve, kept interest rates unchanged following its first Open Markets Committee (FOMC) meeting of the year on Wednesday:

Federal Reserve Board – Federal Reserve issues FOMC statement

The next such meeting is March 18th.

2) Staying with the Fed, President Trump finally announced his nomination for Jerome Powell’s replacement as Chairman:

Wide Acclaim for President Trump’s Nomination of Kevin Warsh as Fed Chair – The White House

There’s been much speculation about this, and I think it’s fair to say there was some surprise expressed by the media. At various times, Rick Rieder and Kevin Hassett had both been more heavily tipped for the job than Warsh. Anyway, Warsh’s appointment now has to be confirmed by the Senate-probably a formality, although he’ll likely receive some supposedly difficult questions when he testifies, to give the veneer of some sort of due process (of which there is none). Warsh will do whatever the bankster class wants-which at the moment, appears to be to continue weakening the purchasing power of the US Dollar.

3) One of Mag. 7 stocks, Microsoft, had a bad week, with its price down 11%:

Microsoft Q2 earnings beat, but stock plummets as investors fret on AI spend, cloud growth

4) Mass layoffs were announced by numerous American corporations, including Dow Chemicals, UPS, Amazon, Nike, Home Depot (the equivalent of B&Q for my British readers) and Mastercard:

Corporate America continues job cuts in 2026 in efficiency push | Reuters

So the disconnect between the real world and the overblown stock market grows ever wider.

Which brings us to charts. Even though the weekly charts are mixed, the reality is they’ve hardly moved this week (again). I think it’s important to remember that the major US indices remain right around their all time highs; in fact, the S&P crossed the 7,000 threshold I’d predicted, albeit only very briefly. Here are all three indices on the week:

nasdaq composite – Google Search

Gold/Silver:

A lesson learned for me-as discussed previously (in particular following the great crypto market rinse of October 10th 2025), is TAKE PROFITS ON THE WAY UP. At the very least, I should have sold some of my shares of the silver miners ETF (exchange traded fund), SILJ. Still, as it’s completely pointless complaining about it now, and none of us are allowed to be “back traders”, that’s the last time I’ll mention what I “should” have done.

Selling physical silver is an entirely different animal, as it’s far more difficult than clicking a button on a mobile phone. Its physical nature is part of its strength and weakness as an asset. I did call a coin shop in Houston on Tuesday this week to enquire about swapping some of my silver for gold, as the gold/silver ratio is now far more favorable than it was when I bought it. I was told they’d buy silver at $12/oz under the spot price (which at the time I made the phone call was $108), and sell gold at $150/oz over the spot price, which at the time was $5,100. 5,250/96 ~55, significantly higher than the roughly 47 it actually was. I’ll be honest; I came away from that interaction not thinking that it was brilliant value for money. And even then, the market top was some way off! Silver peaked around $121 on Thursday evening, before collapsing to $78 ($43 or 35%) by Friday afternoon-it’s now around $86. That’s utterly absurd. Gold didn’t do as badly, but then it is a larger market, so I guess easier to find buyers on the way down. God peaked on $5,615, before falling to a low of $4,767 ($848 or 15%). It’s now around $4,900.

Both metals are still way up compared to where they were a year ago (silver in the $20s, gold in the $2,000s), and even a month ago-but yesterday came as a real shock. I think fiat currencies, especially the US Dollar, are only going to continue to fall in terms of their purchasing power, so I suspect the bull market remains intact. But who knows where we’ll go in the short term. And I still don’t know what triggered yesterday’s selloff. Trying to get to the bottom of exactly what happened is impossible. You could spend thousands of hours researching it and still not come up with the correct answer-after all, I’m not an insider.

Gold closed the week down $97 (~2%) at $4,900 (was $4,997 at the previous Friday’s close).

Silver closed the week at $85.81, down ~$18 or ~17% since the previous Friday’s close.

Gold/Silver Ratio: Shot up to 57.1 (was 48.1 the previous Friday)-due to silver falling much more than gold this week.

Cryptos:

The crypto market is just depressing me at the moment, so I’ll keep it short. The current prices speak for themselves.

Prices on the week:

Bitcoin’s down $9,000 at around $77,500.

Ethereum’s down $400 at around $2,400.

BTC/ETH ratio: Up to 32.3 (was 30.9 last Sunday).

Ripple (XRP) down $0.25 at around $1.60.

Solana’s down $16 at around $102.

Bonds/US Dollar:

The US Treasury 10-year bond yield is very slightly up this week-now at 4.24% (was 4.23% as of last week).

The 30-year bond yield increased by 4 basis points (was 4.83%, now 4.87%).

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

The long term bear market in government debt (from 2020 onwards) continues. In fact, I’d advise anyone who’s held US government debt in any part of their investment portfolio (often it’s part of a retirement account) for at least five years or so to call their custodian, and ask how well it’s performed during that time. Below, you’ll see a snippet from a graph of the TLT, an exchange traded fund (ETF) which tracks the performance of long term US Treasury bonds. It’s currently trading at the same price it was in August 2014, so eleven-and-a-half years ago. Except that due to inflation, the purchasing power of your currency is now far lower than it was then.

The market for long term US government debt peaked in March 2020 (interestingly, the same month the WHO declared coronavirus to be a “pandemic”), after which time, it’s been mostly downhill. Yes, yields have risen during that time, but since bonds return a “fixed” income, if you bought a ten-year dated bond in say, 2020, and are still holding it (presumably to maturity), you’ll be receiving exactly the same interest (known as the “coupon”) now as you were then-i.e., a low rate-whilst the value of the bond has fallen.

Seriously-if anyone has such a conversation with their bondholding custodian, please let me know what they say.

iShares 20+ Year Treasury Bond ETF | TLT

Meanwhile, the US Dollar remained the same against the Swiss Franc, costing $1.29. In fact, 1CHF cost as much as $1.31 on Tuesday, presumably falling somewhat as the dollar also strengthened against gold yesterday.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know. And keep warm out there.

Good luck and happy investing,

Tom Curran