Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center.

TL/DR (Too Long/Didn’t Read) Summary: A good week for metals and cryptos; stocks and bonds didn’t move much.

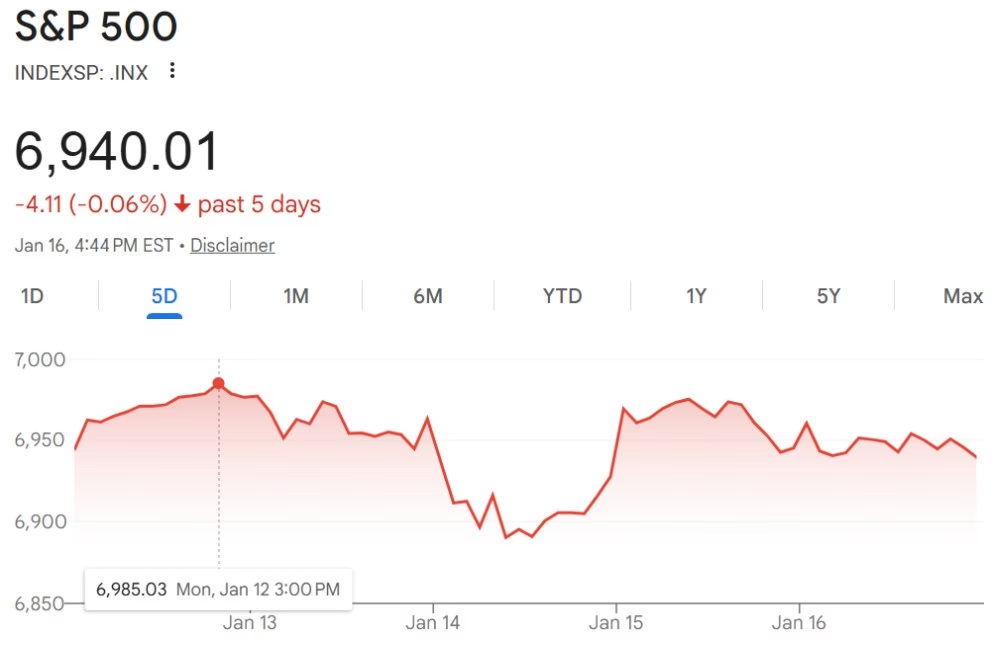

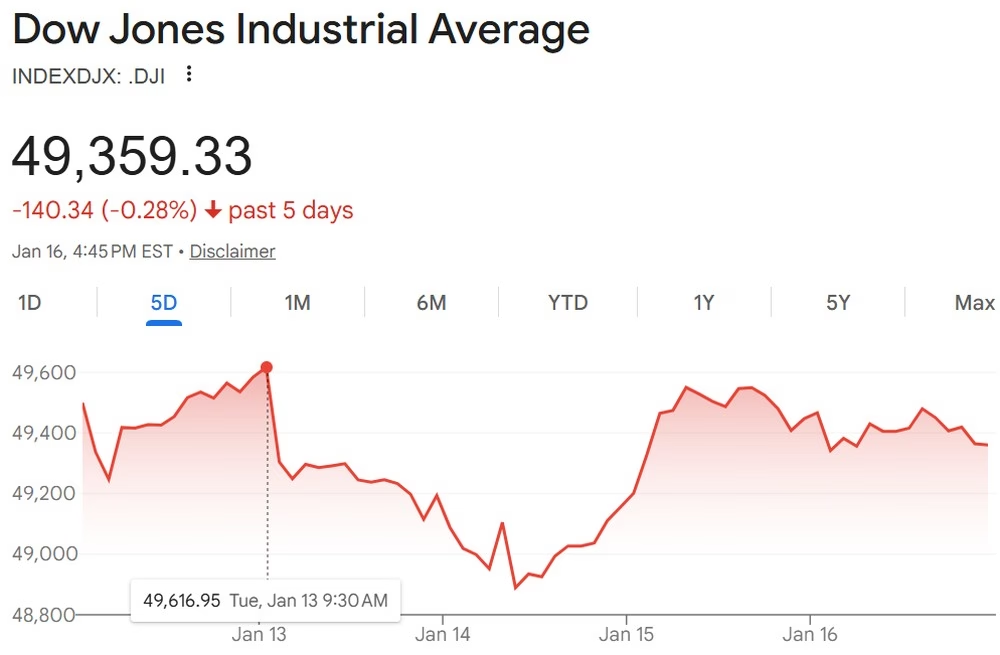

Stocks/Equities: All three major indices essentially where they were a week ago, still hovering around all time highs.

Gold/Silver: Gold and silver both up strongly this week (again). More new nominal all time highs. Gold closed above $4,600/oz, silver above $90/oz-both of which are important (new) support levels.

Cryptocurrency: A good week this week; for a change. Still impossible to say which way the market’s going to go in the short term.

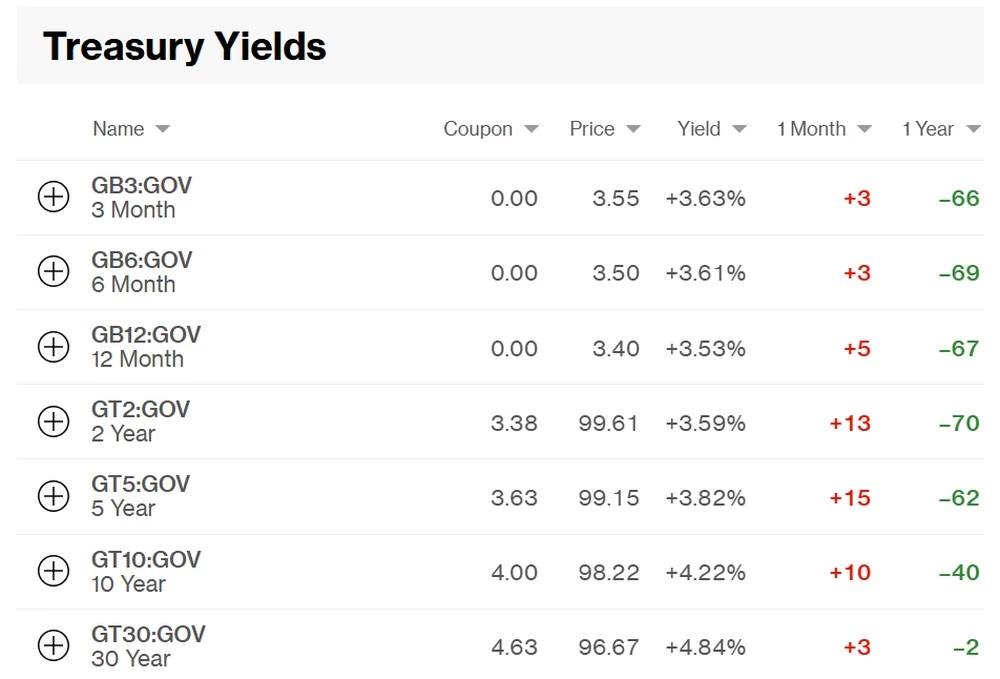

Bonds/US Dollar: Bond yields slightly up again for the third successive week. USD marginally stronger against the Swiss Franc.

Special Topic: Venezuela/Greenland/NATO

Stocks:

Even though the weekly charts are red, the reality is they’ve hardly moved this week. I think it’s important to remember that the major US indices remain right around their all time highs; so we’re probably about to see some major thresholds crossed-which are:

S&P 500: 7,000

Dow Jones: 50,000

Nasdaq 24,000

Here are all three indices on the week:

nasdaq composite – Google Search

Gold/Silver:

Both up significantly this week, and closed on new (nominal) all time highs-although the precious metals market is becoming increasingly volatile. Towards the end of last year, gold peaked around $4,550/oz, and silver at $84/oz. Silver, however, has been as low as ~$73/oz since making that high. Closing above $4,600 and $90 last week SHOULD help both metals maintain their upward momentum, but who knows-and as prices rise, we’ll continue to see more extreme price swings. I mentioned in the annual review that gold at $5,000 and silver at $100 were likely imminent-we’ll see. Silver did touch $93.54 this week-so it’s already very close to three figures.

Gold closed the week up $87 (~2%) at $4,608 (was $4,521 at the previous Friday’s close). It again remained above the key $4,200/oz support level.

Silver closed the week at $90.86, up ~$10 or ~13% since the previous Friday’s close.

Gold/Silver Ratio: Fell much lower to 50.7 (was 56.1 the previous Friday)-due to silver climbing more than gold this week. This is the lowest it’s been in a while-overall, good news for both gold and silver, in my opinion. If/when it falls into the low 30s as it last did in 2011, I’ll consider swapping some of my gold for silver.

Cryptos:

Finally had a decent week. Looks as though Bitcoin’s consolidating within a $95-$98k range (for now). I won’t start celebrating again until we have multiple weekly closes above $100k-however long that takes-as there are probably mountains of automated sell orders right below $100k which will make this key level extremely difficult to retake.

In my experience, it’s times like these that the Crypto market is trying to bore us all to death; either encouraging us to sell before it spikes, or buy before it collapses. I keep reminding myself that patience is required in the short tern.

As discussed last year, I’ve decided that all the speculation in the world isn’t productive, as none of us have a clue which way it’s going to go. I’m not selling at the moment, and that’s that.

Prices on the week:

Bitcoin’s up $4,500 at around $95,200.

Ethereum’s up $200 at around $3,300.

BTC/ETH ratio: Down to 28.5 (was 29.2 last Sunday).

Ripple (XRP) down $0.05 at around $2.05.

Solana’s up $5 at around $142.

Bonds/US Dollar:

The US Treasury 10-year bond yield is up this week-now at 4.22% (was 4.17% as of last week).

The 30-year bond yield increased by 3 basis points (was 4.81%, now 4.84%), so also slightly higher. This means the bonds’ prices have fallen again (very slightly), since bond prices and yields are inversely correlated. The long term bear market in government debt continues.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar strengthened slightly against the Swiss Franc. Last week, it cost $1.25 to buy 1CHF. This week, it’s less expensive at $1.24. The exchange rate remains fairly range bound at the moment; one Swiss has cost between $1.22-$1.27 since June 2025.

Special Topic: Venezuela/Greenland/NATO

“All warfare is based on deception”

Sun Tzu, The Art of War

A few readers have asked me about Venezuela, so I guess I have to address it. As most of you know, other than doing the research required to write this weekly update, I try to avoid the news as much as possible nowadays, as I find it depressing, divisive, and full of lies. However, as recent geopolitical events do pertain to the financial markets, I’ll briefly mention what I think is really going on here. If anyone has an alternate opinion, I’d love to hear it.

I think the first thing to do is separate the takeover of Venezuela’s oil industry from the “kidnapping” of President Maduro and his wife. I suspect the “kidnapping” is theater, in which Maduro and his wife are willing participants. I have no evidence to support this, but equally, I haven’t seen or heard any evidence that they were kidnapped. I wasn’t at the presidential palace in Caracas that night, nor am I one of Maduro’s bodyguards (in fact, where was the Maduros’ security detail? Had they all simultaneously gone outside for a cigarette, leaving their machine guns unattended?). Anyway. The burden of proof is on the media, is it not? I.e., it’s the media’s job to present facts and information to the public to support the assertions they make. In this case they have failed to do so. If anyone has any real evidence of the Maduros’ kidnap and trial, please send it to me.

The Trump administration is apparently holding talks with major oil companies about investing in Venezuela’s oil infrastructure:

Trump urges US oil giants to repair Venezuela’s ‘rotting’ energy industry | Reuters

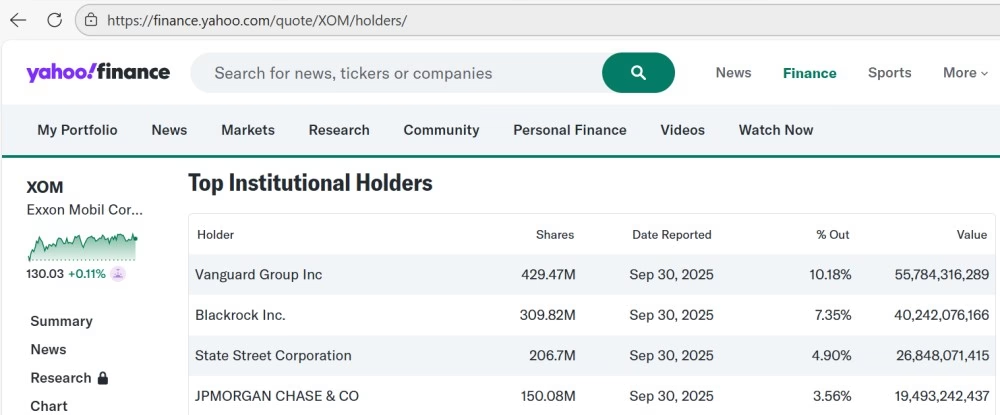

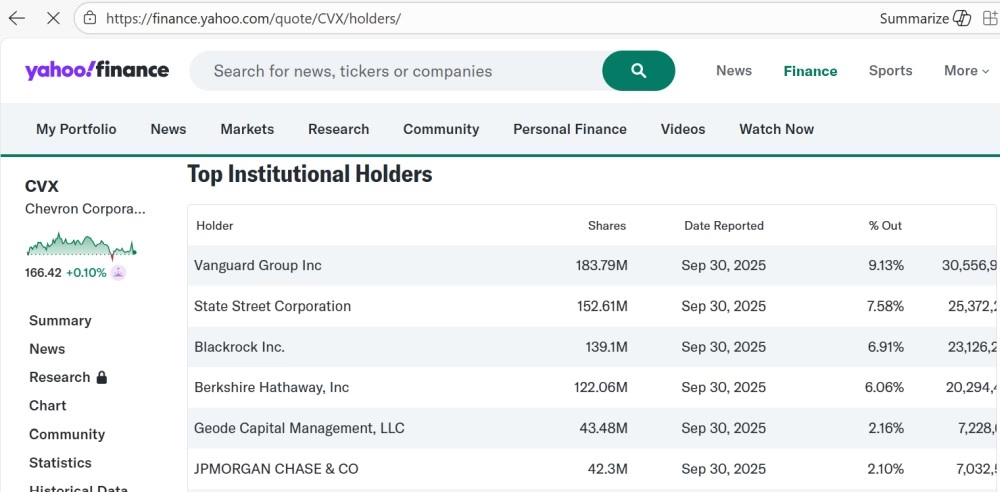

The two largest American companies involved are the publicly traded ExxonMobil and Chevron corporations. Take a look below at the list of the biggest stockholders of each. Notice anything?

Exxon Mobil Corporation (XOM) Stock Major Holders – Yahoo Finance

Chevron Corporation (CVX) Stock Major Holders – Yahoo Finance

That’s right; both companies are owned by the same institutions-in fact Vanguard is also Blackrock Inc.’s largest shareholder, owning almost 9% of it.

Tracking Vanguard/Blackrock Corporate Ownership

So whatever happens with Venezuela’s oil will probably be decided by the owners of Vanguard and Blackrock-not by any of the political leadership currently pontificating about it.

After Venezuela came renewed talk of American occupation of Greenland, a gigantic, freezing mass in the north American region, currently under the control of Denmark-a fellow founding member of the NATO military alliance (we’ll return to NATO later).

European military personnel arrive in Greenland as Trump says US needs island

Mmm, OK. Let’s take a step back here. NATO was formed on April 4th 1949, and was supposedly necessary as an opposing force to the Soviet Union. Yes, the same Soviet Union which collapsed in 1990. NATO’s still around, though-for some reason. Remember, Russia was on the Allied side during World War Two, but rapidly became our enemy afterwards, again-the reasons behind this are obscure. However, our WW2 opponents, Italy and Germany, are now NATO members (Italy was a founder member; West Germany joined the alliance in 1955):

NATO member countries | NATO Topic

So we can already see that military alliances are very fluid. Some dictators are our allies (e.g., Stalin), others are our enemies (e.g., Saddam Hussein). Meanwhile, France, another founding NATO member, left the Alliance’s strategic command structure in 1966-not rejoining it until 2009:

When France Pulled the Plug on a Crucial Part of NATO | HISTORY

My point is that NATO has experienced its ups and downs in the past. America remains by far the single most dominant force in the Alliance (boasting military bases all over western Europe, exerting her influence far and wide), so she will get her way. If America wants Greenland, (then Cuba, Canada, or anywhere else in the Western hemisphere) en route to becoming the leading regional player in the Americas pole of the upcoming multipolar world, then she’ll acquire them. Likewise, if the disintegration of NATO is a necessary stepping stone, this will also occur.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know. And keep warm out there.

Good luck and happy investing,

Tom Curran