Welcome to the first regular edition of Curranomics® of 2026 from the Crystal Beach Investor Center.

Since a few people have asked me about it, I was going to add a special topic this week addressing the recent goings on in Venezuela, but I simply don’t have time to do it justice. If it hasn’t been all but forgotten about in a week’s time (as the never-ending news cycle tends to do these days), I may include something about it in next week’s market update. I will briefly mention that as discussed here previously at Curranomics®, it does appear as though Greenland is next on the list for annexation within the “Americas” region of the upcoming multipolar world (please see the 4/25/25 market update for more details).

TL/DR (Too Long/Didn’t Read) Summary: Three main pieces of news; Venezuela, the December jobs report released on Friday by the US Bureau of Labor Statistics (BLS) and America’s Supreme Court (SCOTUS) ruling on the legality of President Trump’s tariffs (on no; not tariffs again). All of which seemed to combine to provide a decent week for most asset classes.

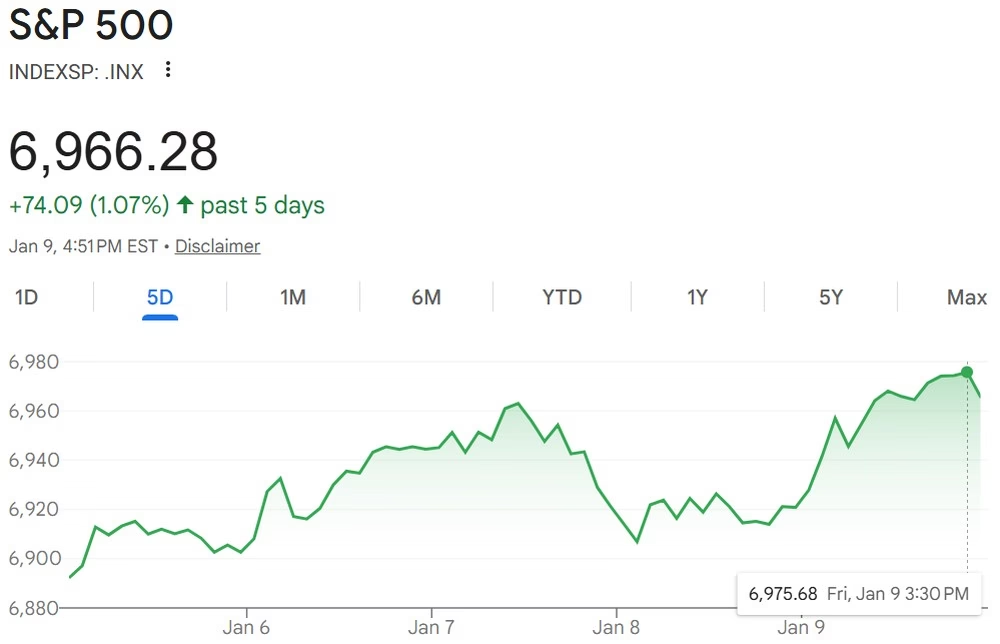

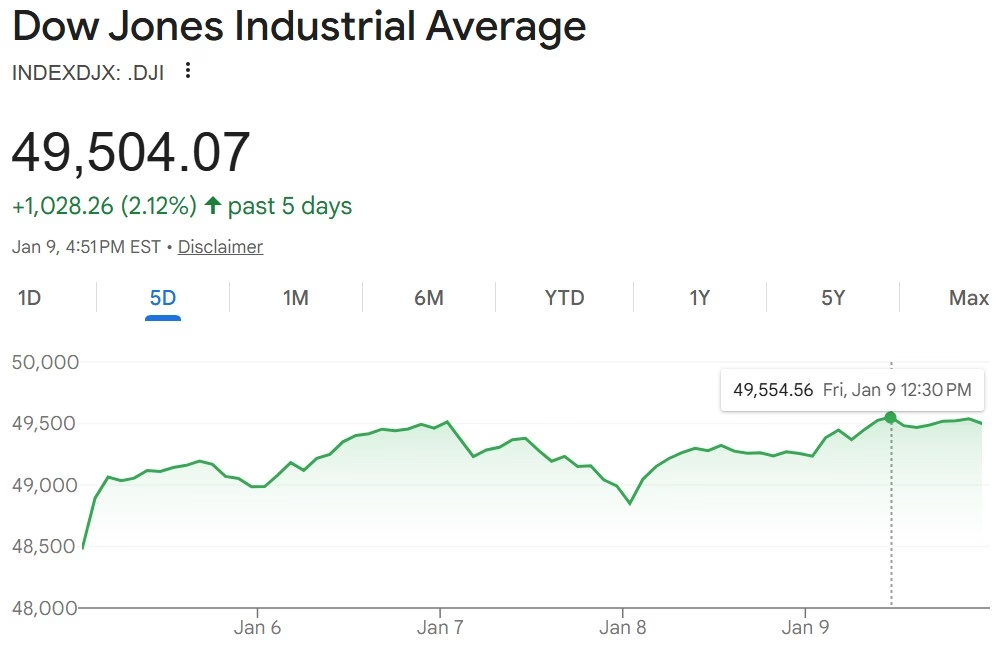

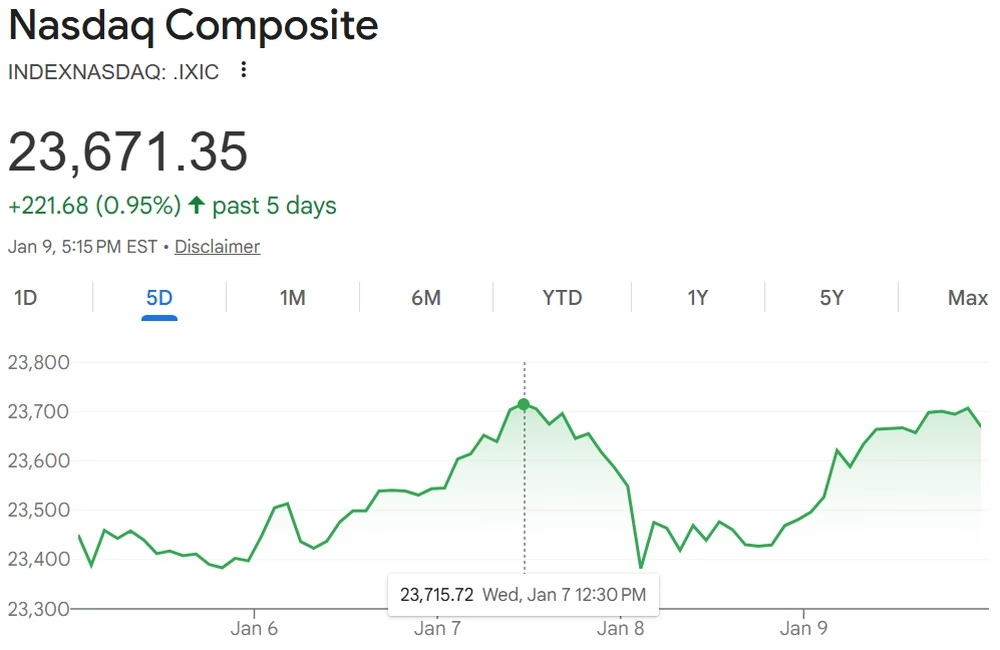

Stocks/Equities: All three major indices up slightly-those all time highs keep coming.

Gold/Silver: Gold and silver both up strongly this week. Gold closed above $4,500/oz, silver above $80/oz-both of which are important support levels.

Cryptocurrency: Mostly sideways. Still impossible to say which way the market’s going to go in the short term.

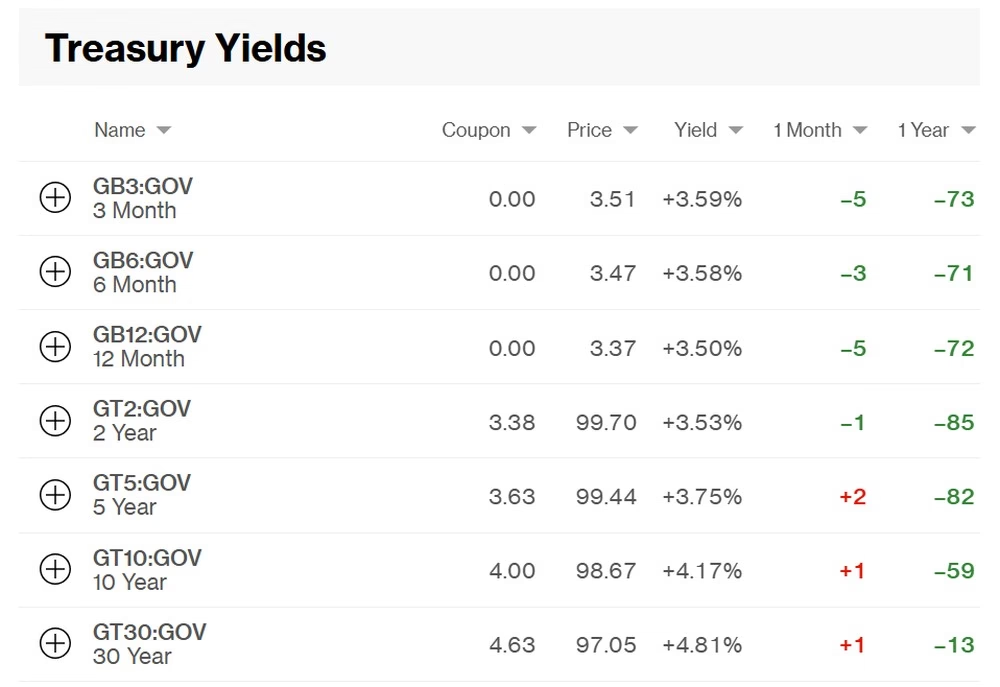

Bonds/US Dollar: Bond yields slightly up again for the second successive week. USD unchanged against the Swiss Franc.

Stocks:

Performed well this week, which is interesting, because per the BLS’s non farm payrolls report released on Friday, fewer than expected jobs were added in December:

This indicates that when the Federal Reserve convenes for their first FOMC (Fed Open Markets Committee) meeting of the year at the end of January, they’ll probably keep their funds (interest) rate where it is:

You would expect stocks to react badly to this news, preferring lower interest rates, but as is increasingly the case, financial markets simply don’t perform as expected. Instead, both the S&P and Dow Jones made new all time highs on Friday. Here are all three indices on the week:

nasdaq composite – Google Search

Gold/Silver:

Both up significantly this week, although the precious metals market is becoming increasingly volatile-something which is new to me. Towards the end of last year, gold peaked around $4,550/oz, and silver at $84/oz. Silver, however, has been as low as ~$73/oz since making that high. Closing above $4,500 and $80 last week SHOULD help both metals maintain their upward momentum, but who knows. I guess as prices rise, we’ll continue to see more extreme price swings.

Gold closed the week up $188 (~3%) at $4,521 (was $4,333 at the previous Friday’s close). It again remained above the key $4,200/oz support level.

Silver closed the week up at $80.63, up $7.77 or ~11% since the previous Friday’s close.

Gold/Silver Ratio: Fell to 56.1 (was 59.5 the previous Friday)-due to silver climbing more than gold this week. This is the lowest it’s been in a while-overall, good news for both gold and silver, in my opinion. First time it’s been in the 50s since August 2013. If/when it falls into the low 30s as it last did in 2011, I’ll consider swapping some of my gold for silver.

Cryptos:

Since its last major decline in the middle of November, when it finally fell through the $100k barrier, Bitcoin has oscillated between ~$85k-$95k, without making a decisive move either way. So for almost two months, there’s been very little significant price movement. In my experience, it’s times like these that the Crypto market is trying to bore us all to death; either encouraging us to sell before it spikes, or buy before it collapses. I keep reminding myself that patience is required in the short tern.

As discussed last year, I’ve decided that all the speculation in the world isn’t productive, as none of us have a clue which way it’s going to go. I’m not selling at the moment, and that’s that.

Prices on the week:

Bitcoin’s up $2,400 at around $90,700.

Ethereum’s up $100 at around $3,100.

BTC/ETH ratio: Down to 29.2 (was 29.4 last Friday).

Ripple (XRP) up $0.10 at around $2.10.

Solana’s up $6 at around $137.

Bonds/US Dollar:

The US Treasury 10-year bond yield is very slightly up this week-now at 4.17% (was 4.16% as of a month ago).

The 30-year bond yield increased by 1 basis point (was 4.80%, now 4.81%), so also fractionally higher. This means the bonds’ prices have fallen again (very slightly), since bond prices and yields are inversely correlated.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar stayed the same against the Swiss Franc. Last week, it cost $1.25 to buy 1CHF. This week, it’s the same at $1.25. The exchange rate remains fairly range bound at the moment; one Swiss has cost between $1.22-$1.27 since June 2025.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know. And keep warm out there.

Good luck and happy investing,

Tom Curran