Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center. With me being busy preparing for Christmas this past weekend, today’s report is going to be slightly shorter than usual.

TL/DR (Too Long/Didn’t Read) Summary: Main news was the much previously discussed Federal Reserve rate cut, which, as expected, was announced on Wednesday afternoon. After an initial rally, most markets fell on Friday.

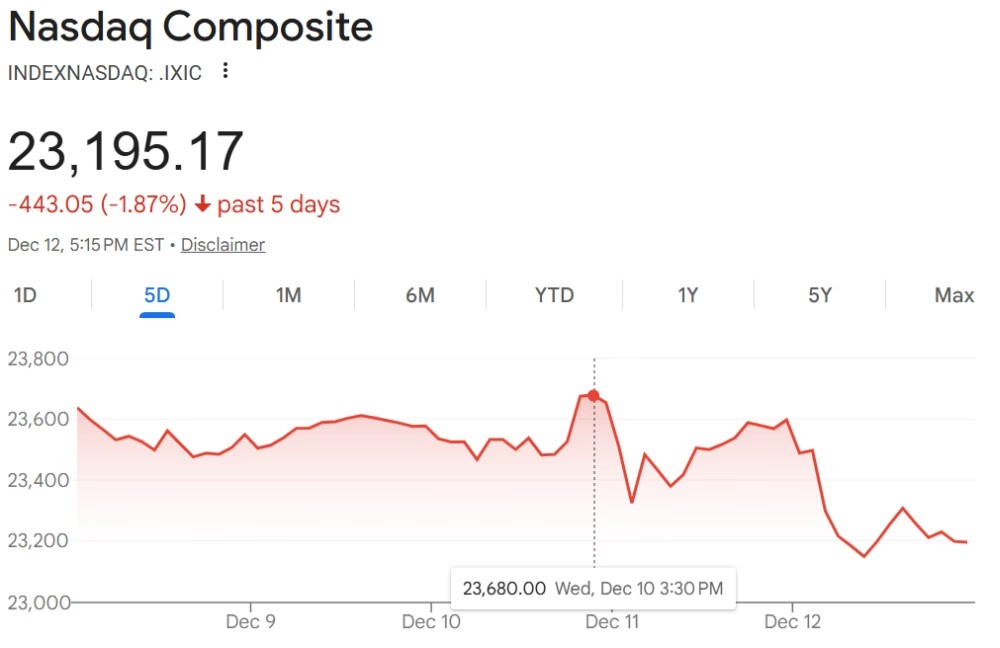

Stocks/Equities: A mixed week. S&P and Nasdaq finished down, Dow Jones up.

Gold/Silver: Gold and silver both up strongly this week. Silver keeps making new (non inflation adjusted) all time highs, closing above $60/oz for the first time ever.

Cryptocurrency: A choppy week. Still impossible to say which way the market’s going to go in the short term.

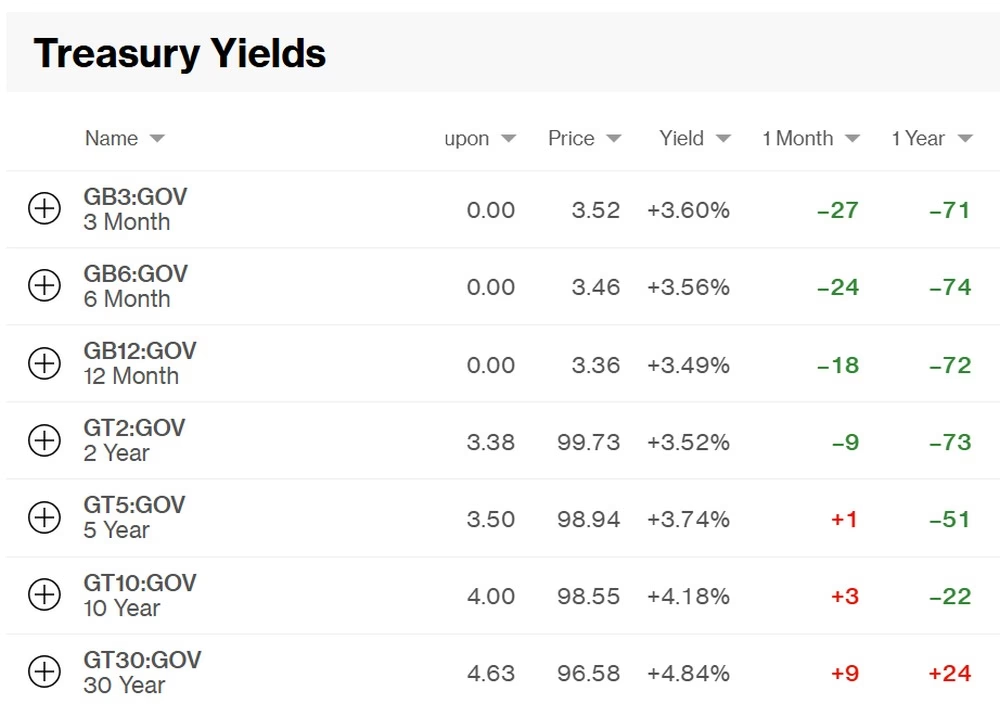

Bonds/US Dollar: Bond yields up again for the second successive week. USD weaker.

Stocks:

A mixed week. Incidentally, if anyone’s wondering abut the difference between each of the three indices we track each week, I found this very handy cheat sheet at www.bankrate.com:

The Dow Vs. Nasdaq Vs. S&P 500 | Bankrate?

Interestingly, the Dow Jones made an all time high on Friday morning at 10am, reaching 48,841. The Nasdaq on the other hand, had a rough week. Two of its major constituents, Broadcom and Oracle, experienced significant declines in value. Both of these are classified as technology companies, indicating further jitters around the “AI bubble” possibly bursting. We’ll have to see.

Here are all three indices on the week:

nasdaq composite – Google Search

Gold/Silver:

Both up significantly this week. More silver all time highs (although not adjusted for inflation).

Gold closed the week up $121 (~3%) at $4,330 (was $4,209 last Friday). It again remained above the key $4,000/oz support level (moving forward, I may increase gold’s key support level to $4,200/oz).

Silver closed the week up at $62.08, up $3.58 or ~6% since last Friday. As predicted last week, it reached $60, although that was hardly one of my more outlandish forecasts.

Gold/Silver Ratio: Fell to 69.7 (was 71.9 last Friday)-due to silver climbing more than gold this week. This is the lowest it’s been in a while-overall, good news for both gold and silver, in my opinion. First time it’s been in the 60s since July 2021 (incidentally, gold was around $1,800 and silver $26 at the time-would have been great buying opportunities for both).

Cryptos:

Yet another choppy week in Cryptoworld. On Thursday, following the Fed’s rate cut, Bitcoin reached $94,500, but is now trading below $89,000. I’ve decided that all the speculation in the world isn’t productive, as none of us have a clue which way it’s going to go. I’m not selling at the moment, and that’s that.

Prices on the week:

Bitcoin’s down $3,200 at around $88,300.

Ethereum’s down $150 at around $3,000.

BTC/ETH ratio: Up to 29.4 (was 29.0 last Friday).

Ripple (XRP) down $0.10 at around $2.00.

Solana’s down $6 at around $130.

Bonds/US Dollar:

The US Treasury 10-year bond yield is up again this week-now at 4.18% (was 4.14% as of last week).

The 30-year bond yield increased by 5 basis points (was 4.79%, now 4.84%), so also higher. This means the bonds’ prices have fallen again this week, since bond prices and yields are inversely correlated.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar weakened against the Swiss Franc-unsurprising following the Fed’s rate cut. Last week, it cost $1.24 to buy 1CHF. This week, it’s more expensive at $1.26. The exchange rate remains fairly range bound at the moment; one Swiss has cost between $1.22-$1.27 since June.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know. And keep warm out there.

Good luck and happy investing,

Tom Curran