Greetings Fellow Wealth Creators,

Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center. Since I have rather a lengthy special topic this week, I’ll keep the introduction brief. Or at least as brief am I’m capable of being.

I do want to say a big thank you to everyone at the wonderful website CrystalBeach.com – Your Local Information and News Destination, who are now publishing Curranomics on their website (here’s a link to last week’s update):

This week’s edition of Curranomics® – Crystal Beach

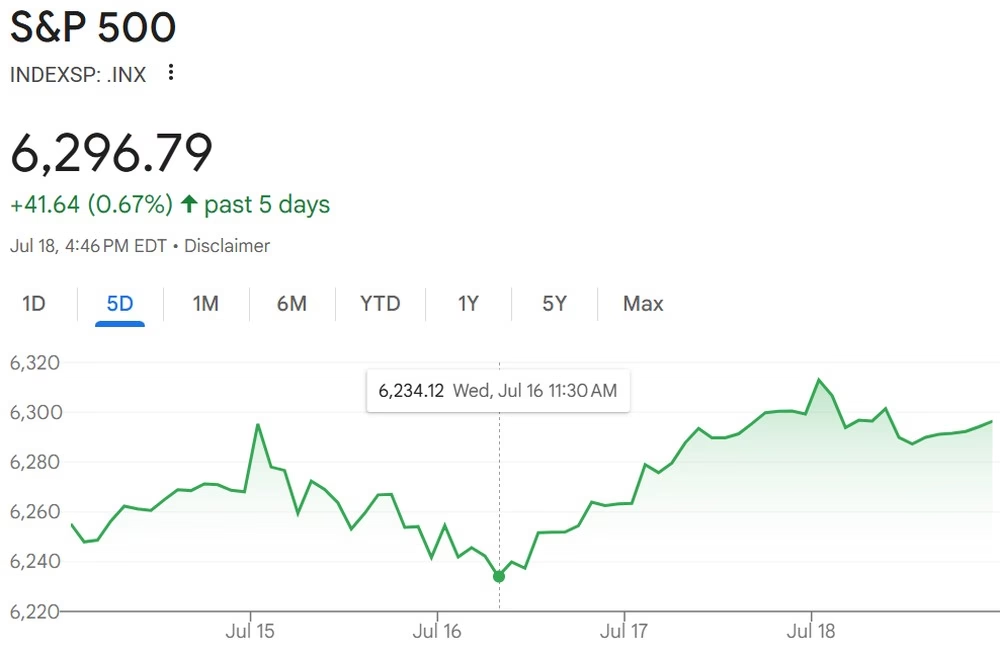

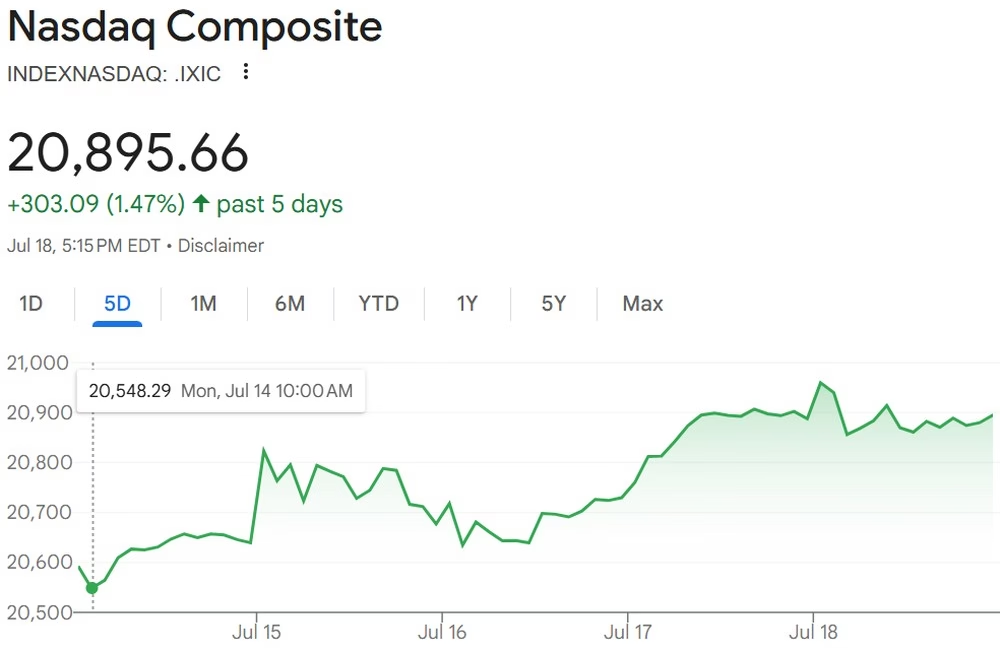

Alright; as usual we’ll start with stocks. Very little aggregate movement again this week, although all three major US indices remain right around their record highs.

The reason the Nasdaq outperformed the other exchanges is largely because chipmaker Nvidia (NVDA) is traded on it. Nvidia is up over 4% this week alone-a LOT for a large cap stock. Nvidia is also one of the so called “magnificent seven” or “mag seven” stocks, belonging to the small group of corporations which have enjoyed a disproportionately high concentration of the recent growth in equities (although I believe this is a fluid list, the others are currently Apple, Amazon, Google, Facebook (Meta), Microsoft and Tesla). We had a similar collection a few years ago-FAANG (Facebook, Amazon, Apple, Netflix, and Google)-I’m not sure why Netflix is now excluded-it’s enjoyed unbelievable growth in recent years.

In my opinion, it isn’t an especially healthy sign that of all the hundreds of publicly traded companies, a small handful are so dominant. Especially when that handful are the ones doing most of the harvesting of our private data.

Gold/Silver:

Didn’t move this week, however silver maintained above $38, which is promising.

Gold: Level at $3,370. I remain bullish on gold in the medium-long term. It still hasn’t rebounded from the $3,500 it briefly hit on May 6th (although didn’t “close” that high-its highest closing price was $3,453-which it hit on Friday June 13th).

Silver: Down to $38.50. Closed last week on $38.66.

Gold/Silver Ratio: Fell slightly from 88.1 to 87.5. Still remains very high compared to the historic range of 50-80.

Remember, a high ratio indicates silver is better value for money than gold. A falling ratio is likely bullish for both gold AND silver prices.

Cryptos:

Another very exciting week in Crypto world. On Monday, Bitcoin hit yet another new all time high just over $123K before pulling back to its current $118K or so. However, most of the action this week was in the Altcoin market (altcoin being the collective term for every cryptocurrency other than Bitcoin). A superb week for Ethereum (ETH) and Ripple (XRP). Likely buoyed by all the Cryptocurrency activity in Washington DC, in which three pieces of legislation were passed by the US House of Representatives, and are now awaiting signature into law by President Trump:

House Passes ‘Crypto Week’ Bills, Sending GENIUS Act to Trump’s Desk

Now-how long this rally lasts is anyone’s guess. Crypto’s so volatile that all its recent gains can be very easily wiped out within 24 hours. As I keep saying, I hope Bitcoin continues to appreciate rapidly for the remainder of this year, and that the BTC/ETH ratio continues to fall.

Prices on the week:

Bitcoin’s essentially level at $118K.

Ethereum up $600 (20%) to ~$3,600.

BTC/ETH ratio: Down a LOT to 32.8 (was 39.3 last Friday and around 42 the week prior to that). We’re typically at the end of the 4-year Crypto cycle when this ratio falls to the 12-15 range-which, assuming it does the same thing this time around, will NOT be reached in a straight line.

Ripple (XRP) Up to $3.50 (was as low as $2.80 last Friday). That’s a 25% week on week increase; DEFINITELY this week’s winning asset.

Solana’s Up to $180 (was as low as $165 last Friday).

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

Bonds/US Dollar:

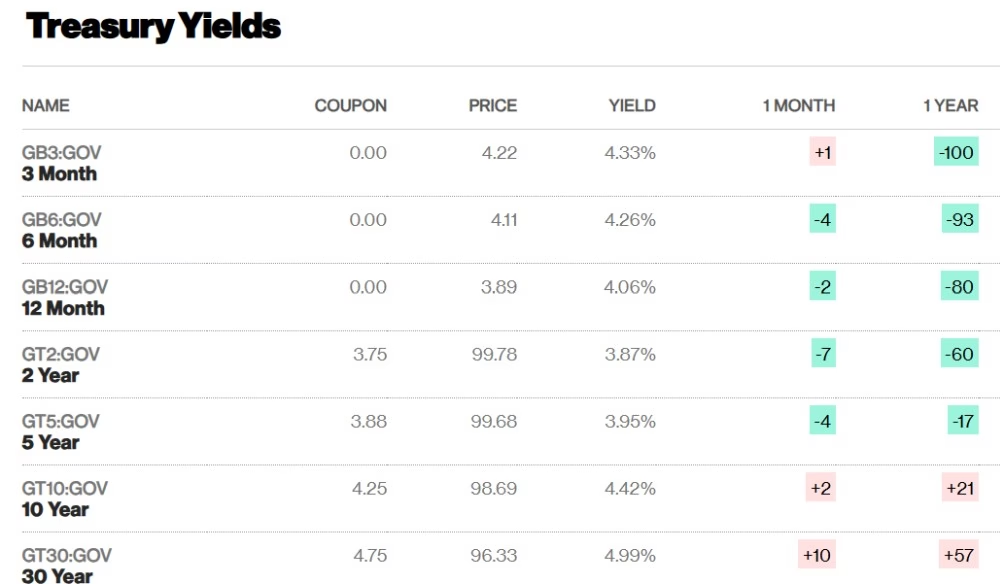

The 10-year remained at 4.42%. The 30-year increased from 4.95% to 4.99%, edging ever closer to that totemic 5% threshold for long term US Treasuries. Higher yields mean lower bond prices, as they have an inverse relationship.

United States Rates & Bonds – Bloomberg

The Federal Reserve’s (the central bank of the US) next decision on interest rates will be after their meeting at the end of July. They’re unlikely to raise rates, but it isn’t yet known if they’ll maintain or lower them. We’ll have to wait and see.

Meanwhile, the US Dollar remained the same against the Swiss Franc compared to last week-it still costs $1.25 to buy 1CHF.

Special Topic: Multi-Polar World (Part 2)

Please note that part 1 was written in an earlier edition of Curranomics, which can be provided on request.

This week, I’m including a link to a YouTube video from 2022, narrated by well known multi-billionaire investor, Ray Dalio. It’s called Principles for Dealing with the Changing World Order:

Principles for Dealing with the Changing World Order by Ray Dalio

Regular readers of this column will know that I have very little time for the celebrity billionaire class, but I think the video is very well done, and in the space of forty minutes, helps to explain how we’ve ended up at this particular moment in human history.

He also mentions concepts which I’ve discussed here before, such as the Bretton Woods agreement, world reserve currencies, central banks, money printing, gold standards, the success of the British empire being underpinned by its Naval superiority, and so on, but probably does a better job than me of explaining their relevance to now.

Spoiler alert-Dalio concludes that the era of the American empire is coming to an end, and will be replaced by a Chinese empire. Some readers may be shocked to hear that America has an empire; well, I would say she does. 750 openly acknowledged military bases in 80+ countries worldwide, all acting in concert to ensure the US Dollar remains the world reserve currency IS an empire-it’s simply better from a PR perspective for those running the show to not refer to it as such.

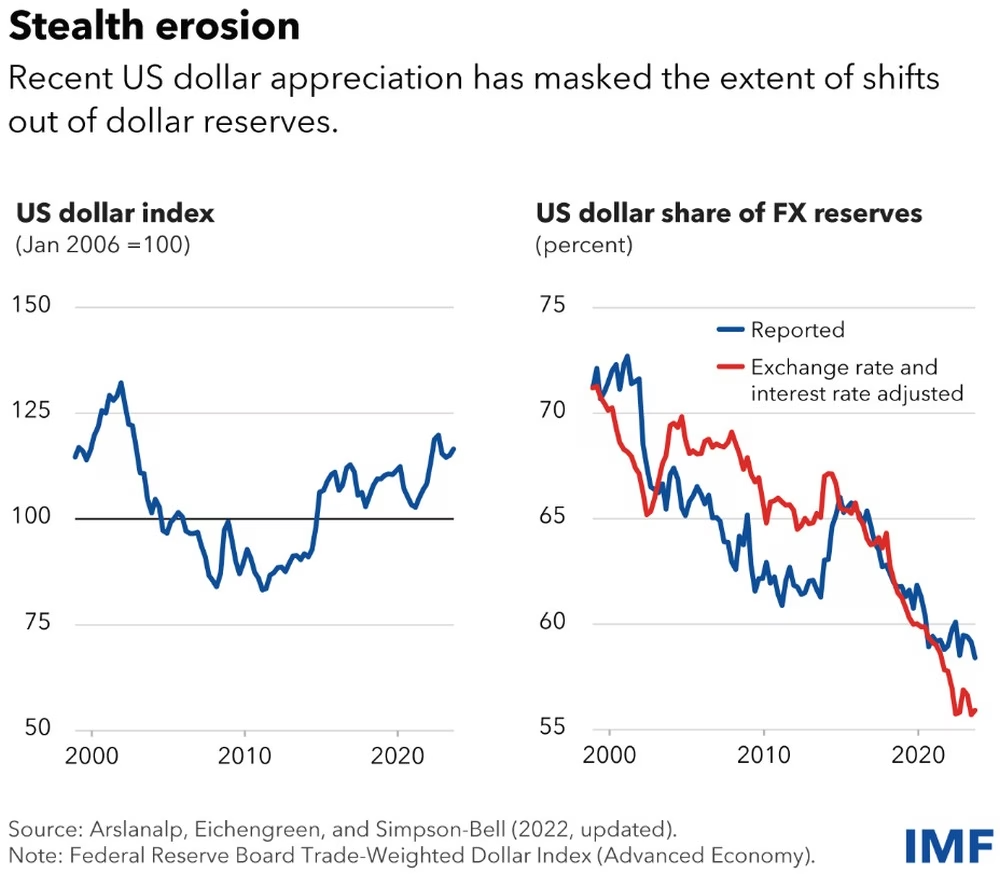

I will make a couple of points-firstly, yes, it does appear that the sun is setting on the era in which America is planet Earth’s undisputed superpower. Our high rates of chronic illness, debased currency, artificially inflated stock market, universities which charge more than ever yet don’t provide our young people with the education required to be competitive on the world stage, massive and clearly unpayable $37trn+ in national debt, are all signs of a decaying empire. However, it won’t unravel overnight-and the US military is still by far the world’s biggest and best. It will happen slowly at first, before happening quickly (seemingly the phase we’re in). Foreign countries have been moving away from the US Dollar for some time, as this chart courtesy of the International Monetary Fund (IMF) shows. The dollar was around 72% of foreign exchange reserves in 2000, falling to 58% last year:

Dollar Dominance in the International Reserve System: An Update

Dollar Dominance in the International Reserve System: An Update

However, I disagree with the second part of his conclusion (hang on…which one of us is the multibillionaire again?)-that China is set to replace America as world hegemon. I’m no expert on China, and have never been there, so am open to debate on this point. However, I have a gut feeling that China doesn’t WANT to be the world superpower and issue the reserve currency. This would involve opening themselves up to a level of scrutiny that the Chinese State probably wouldn’t be comfortable with. Nor do I think the rest of the world will accept China in such a role-and besides, China doesn’t currently have the military capability to enforce it.

I appreciate that it’s a very crude method of comparison, but America still boasts eleven aircraft carriers to China’s three:

Aircraft Carriers by Country 2025

Furthermore, mainland America is protected by two giant oceans east and west, and two subservient neighbors north and south. China, on the other hand, has border disputes with no fewer than seventeen countries:

All the countries in which China claims territory | The Week

China’s also facing significant issues with its aging population and plummeting birthrates:

How Severe Are China’s Demographic Challenges? | ChinaPower Project

So if China isn’t going to replace the US, then who is? It’s impossible to know for sure, but at the moment, my guess, as I mentioned in the April 28th edition of this newsletter, is that we won’t have a single dominant country (i.e., the current “unipolar” model), but more likely we’ll transition to a “multipolar” world, with North America (including at least the US, Canada, and Greenland) as one pole, China being another, and possibly others (not Europe).

I do often wonder if one of the features of Trump’s second term will be the replacement of the US Dollar as world reserve currency. I think we are in the final phase of this paradigm, with none of us having known anything else, but who knows how long this final phase will last-I’m sure people were saying the same thing when President Nixon abandoned the gold standard in 1971.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom

July 18, 2025