Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center.

TL/DR (Too Long/Didn’t Read) Summary: Fairly uneventful week in the end. Most assets are basically where they were seven days ago, except US bond yields, which are up.

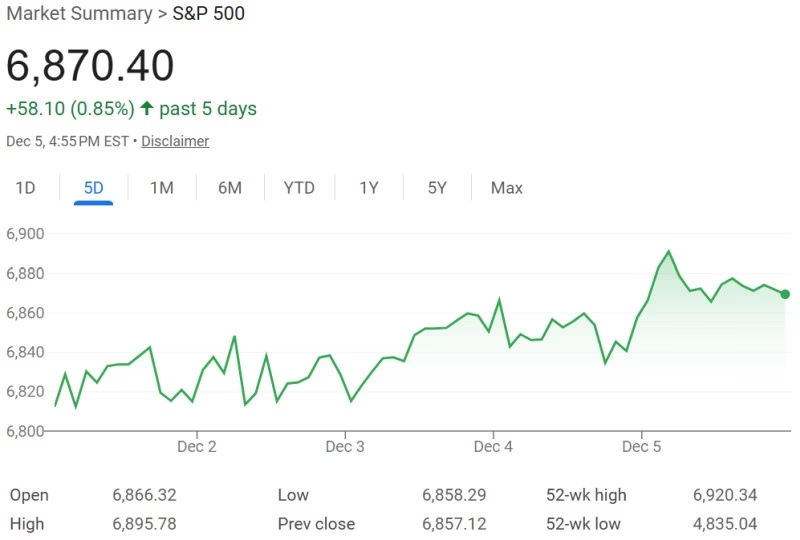

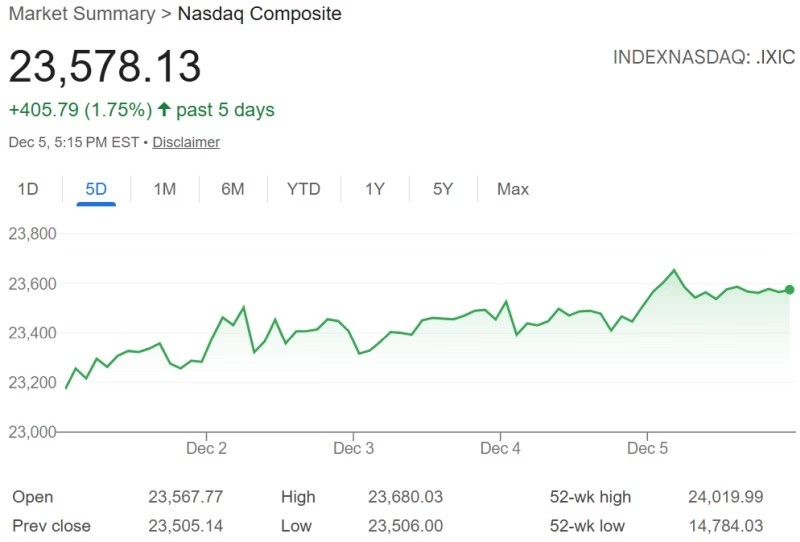

Stocks/Equities: All indices slightly up.

Gold/Silver: Gold basically level, silver up slightly.

Cryptocurrency: A choppy week. Bitcoin lost, then regained $90k. Still impossible to say which way the market’s going to go in the short term.

Bonds/US Dollar: Bond yields up on positive economic news regarding fewer US jobless claims, reversing a multiple weeks-long downward trend. USD very slightly stronger.

Stocks:

Unfortunately, I’ll have to discuss the Federal Reserve and their interest rates-again. However, it IS the single greatest determinant of success or otherwise in the financial markets at present-much to my annoyance.

By now, the interest rate cut next week has already been “priced in”. Meaning that it’s so widely expected, that any gains in the values of “risk” assets (i.e., stocks and cryptocurrencies) have already happened. So-assuming the rate IS cut by 25 basis points (0.25%), there’ll be little, if any, further upside. However, if for some reason the rate remains the same, expect the markets to respond very badly. I can’t see this happening, but then again-I’m not a member of the Fed’s Open Markets Committee (FOMC).

Also, even though the rate was cut at the previous FOMC meeting in October, the markets STILL tanked-as Fed Chairman Jerome Powell deliberately muddied the waters by simultaneously making a statement which was interpreted by the markets as “yes, we’re cutting rates today-but don’t assume we’ll make further cuts anytime soon”. Over the subsequent three weeks, the S&P 500 declined by 5%. The NASDAQ declined by 8%-both indices are yet to regain the highs they made on October 29th. Certainly not the reaction I was expecting.

Having said that, the markets aren’t exactly doing badly-we’re within touching distance of all time highs. Which will probably be helped by President Trump’s imminent announcement of Fed Chairman Powell’s successor:

With Trump being as unpredictable as he is, we don’t know for sure that Kevin Hassett will definitely be named as Powell’s replacement-however, Hassett is apparently the “odds on” favorite. Before his being mentioned in connection to replacing incumbent Chairman Powell, I’d never heard of the guy, either.

Finally, one stock specifically worth mentioning this week is Netflix. Some of us are old enough to remember when it was a “DVD rental by mail” service, prior to it becoming the streaming and original content creation giant it is nowadays. Anyway-it was announced this week that Netflix is purchasing the storied Warner Bros. media brand:

In the first part of this year, Netflix’s stock price performed extremely well, at one point up over 50% (rising from $88 to $134 at the end of June). However, the last six months or so, it’s struggled, and currently sits at around $100:

It was also announced recently that Netflix would be splitting their stock 10-1:

Netflix – Netflix Announces Ten-For-One Stock Split

The relevant press release says the following:

Netflix, Inc. (Nasdaq: NFLX) announced today that its Board of Directors has approved a ten-for-one forward stock split of the Company’s common stock. Each shareholder of record as of the close of trading on Monday, November 10, 2025 (the “record date”) will receive, after the close of trading on Friday, November 14, 2025, nine additional shares for every share held on the record date. Trading is expected to begin on a split-adjusted basis at market open on Monday, November 17, 2025.

The value of the company is unaffected. I suppose the point is to make the shares more affordable to the average investor; an individual price of over $1,000 per share is rather off-putting for most people. Interestingly, even though Netflix went public in 2002, and can therefore hardly be considered a “startup” any longer, it doesn’t pay a dividend on its shares. In my experience, the wealthy, and well established, yet rather unfashionable corporations are the ones which pay the most reliable dividends (oil and tobacco companies, for example).

Why do I mention all of this? Because it may or may not be a buying opportunity; I haven’t decided yet. Netflix is a well known company, which is expanding. Its stock is down 25% the past six months, so RELATIVELY inexpensive. Their directors recently authorized a 10-1 stock split, which makes their shares more affordable. However-they do not pay a dividend. A considerable amount of my portfolio already doesn’t bear interest-specifically cryptos and physical precious metals. So I’ll give this some more thought and keep you all posted.

Here are the week’s indices:

nasdaq composite – Google Search

Gold/Silver:

Gold hardly moved, silver up another couple of bucks. More silver all time highs (although not adjusted for inflation).

Gold closed the week down $23 (~0.5%) at $4,209 (was $4,232 last Friday). It again remained above the key $4,000/oz support level.

Silver closed the week up at $58.50, up $1.92 or ~3% since last Friday. It more than maintained the key $50/oz support level. Surely $60 is only a matter of days away (although I’ve been known to regret making such predictions in the past!).

Gold/Silver Ratio: Fell to 71.9 (was 74.8 last Friday)-due to silver climbing more than gold this week. This is the lowest it’s been in a while-overall, good news for both gold and silver, in my opinion.

Cryptos:

Choppy week in Cryptoworld. Bitcoin suddenly lost, then suddenly regained, $90,000. I’ve decided that all the speculation in the world isn’t productive, as none of us have a clue which way it’s going to go. I’m not selling at the moment, and that’s that.

Prices on the week:

Bitcoin’s up $500 at around $91,500.

Ethereum’s up $150 at around $3,150.

BTC/ETH ratio: Down to 29.0 (was 30.3 last Friday).

Ripple (XRP) down $0.10 at around $2.10.

Solana’s unchanged at around $136.

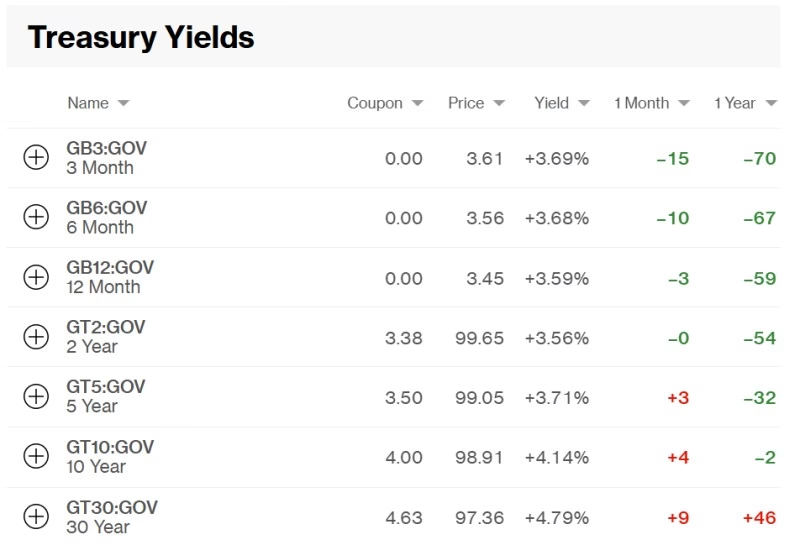

Bonds/US Dollar:

Reversing a several-week-long downward trend, the US Treasury 10-year bond yield is up this week-now at 4.14% (was 4.01% as of last week).

The 30-year bond yield increased by 13 basis points (was 4.66%, now 4.79%), so also higher on the week. This means the bonds’ prices have fallen this week, since bond prices and yields are inversely correlated. Higher yields means reduced demand for “safe” assets like US Treasuries, and more appetite amongst investors for “risk” assets, like stocks.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar has strengthened against the Swiss Franc-last week, it cost $1.25 to buy 1CHF. This week, it’s less expensive at $1.24.

Still seems fairly range bound at the moment; one Swiss has cost between $1.22-$1.27 since June.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know. And keep warm out there.

Good luck and happy investing,

Tom Curran