Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center. It may be a little bit shorter than usual this week, as I’m frankly worn out from all the bad news! Also, the financial markets in America are closed next Thursday in observance of the annual Thanksgiving holiday, so I may or may not send out an update next week-I haven’t decided yet.

TL/DR (Too Long/Didn’t Read) Summary: Last week was one of the most difficult weeks in my nascent investing career. In fact, as I write this, I’m still wiping away the tears. We seem to be in one of those periods in history in which even “good” news spooks the financial markets (such as Nvidia’s better than expected earnings report-discussed below).

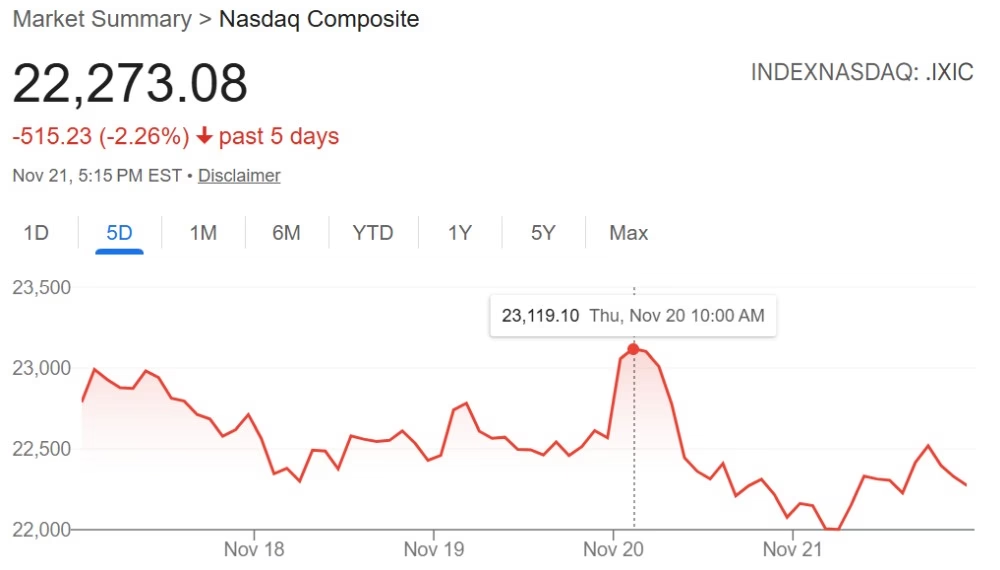

Stocks/Equities: Another volatile/bad week. The “AI bubble” keeps being mentioned. Speculation goes back and forth over whether or not the Fed will cut interest rates next month. All three major indices are down around 2%.

Gold/Silver: Another week of consolidation above $4,000/oz for gold, whilst silver maintained $50/oz.

Cryptocurrency: Worst week in ages. Bitcoin fell as low as under $81k on Friday, taking the rest of the crypto market with it. Sentiment hasn’t felt this bad since the depths of the FTX crisis in 2022 (discussed below).

Bonds/US Dollar: Bond yields down. USD stronger.

Stocks:

The two major stories in stocks this week were firstly, Nvidia (the silicon chip manufacturer) announcing its quarterly results, which were better than expected.

Nvidia reports strong quarterly earnings, topping Wall Street forecasts

Nvidia is currently the world’s largest company by market capitalization, and has been one of the best performing stocks this year:

Companies ranked by Market Cap – CompaniesMarketCap.com

Most of us are invested in it one way or another, probably indirectly via an index-linked mutual fund. For these reasons, its performance has an outsized impact on the overall market. However, despite its impressive performance, it only had a very limited effect on the market overall. The announcement was made Wednesday after the market closed, and you can see from the graphs below, market open on Thursday morning saw a brief jump in prices before they very quickly slumped (by lunchtime), before recovering slightly on Friday following dovish comments from a Federal Reserve member (covered below).

Second, more back and forth from the Fed regarding interest rates. The odds of a cut in December increased on Friday, following comments from one of its governors:

The 2 Fed comments that are boosting odds of a December rate cut

Was the release of these comments to the media timed to rescue what could have been a much worse week than would otherwise have been the case? I don’t know, but it wouldn’t surprise me.

At this point, I’m completely fed up with the unaccountable, unelected suits at the Fed, pontificating in bankster-ese, about whether or not they’re going to cut rates by a measly 25 basis points, and it being turned into price action by Wall Street. I don’t think the Fed should exist to begin with, so to see so much time, energy, and attention focused on it really annoys me. So unproductive.

Additionally, the latest unemployment data was released this week, delayed due to the US Federal Government shutdown. More jobs than expected were added, but the unemployment rate climbed to 4.4%-the highest in 4 years:

Jobs report September 2025: 119,000 added, jobless rate 4.4%

Higher unemployment means a rate cut is now more likely than it was last week. But nobody knows what’s going to happen, despite all the flip-flopping. So we still have no idea what they’re going to announce on Wednesday December 10th. Alright-here are this week’s indices:

nasdaq composite – Google Search

Gold/Silver:

Not much movement in the end this week.

Gold closed basically level at $4,078 (was $4,095 last Friday). It again remained above the key $4,000/oz support level.

Silver closed at $50.19, down $0.53 or ~1% since last Friday. It maintained the key $50/oz support level.

Gold/Silver Ratio: Rose to 81.3 (was 80.7 last Friday)-due to silver falling more than gold this week.

Cryptos:

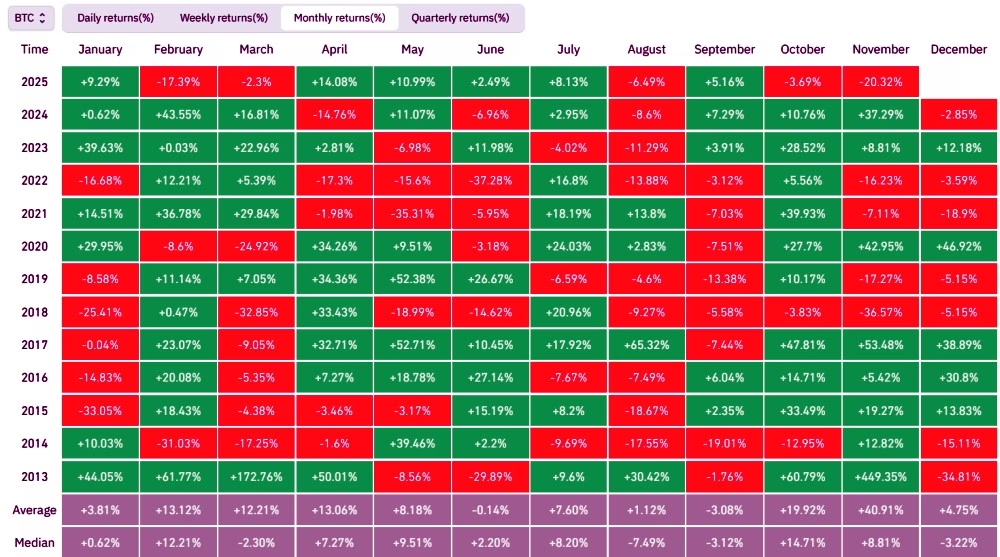

Yet another hugely depressing week in Cryptoworld. Bitcoin is now trading at around $87,000, although it fell below $81k as recently as Friday, since which time, it’s been grinding upwards. I’m now in that phase of the market in which it’s too cheap to sell, too expensive to buy. I’m going to have to wait for price action in either direction before I do anything with my Crypto portfolio. I think the most depressing aspect of the market right now, and definitely a lesson learned for me, is that it was SUPPOSED to be peaking right now. Remember “Uptober”? Me neither. So-whenever there’s a consensus amongst the masses, stoked by the media-financial markets have a tendency to do the exact opposite. Looking at the monthly chart of Bitcoin:

Bitcoin Returns History,Historical BTC Performance | CoinGlass

This month is shaping up to be the second worst November in Bitcoin’s history. Sentiment is as negative as I can remember-the last time things were this bad was in 2022 when the FTX exchange spectacularly collapsed in a massive fraud (its CEO Sam Bankman-Fried allegedly went to prison for a long time over it):

FTX Crypto Exchange Collapse: Causes, Consequences, and Lessons

By this time next week, Bitcoin could very easily be at $70k, or above $100k again-or exactly where it is. It’s SO unpredictable. Having said that, at this point, it’s likely going to require significant upward momentum for it to regain $100k, a very significant psychological barrier, and which will probably now act as resistance rather than support.

Prices on the week:

Bitcoin’s down another $7k at around $87k.

Ethereum’s down $300 at around $2,800.

BTC/ETH ratio: Up to 31.0 (was 30.3 last Friday).

Ripple (XRP) down $0.10 at around $2.10.

Solana’s down $5 at around $133.

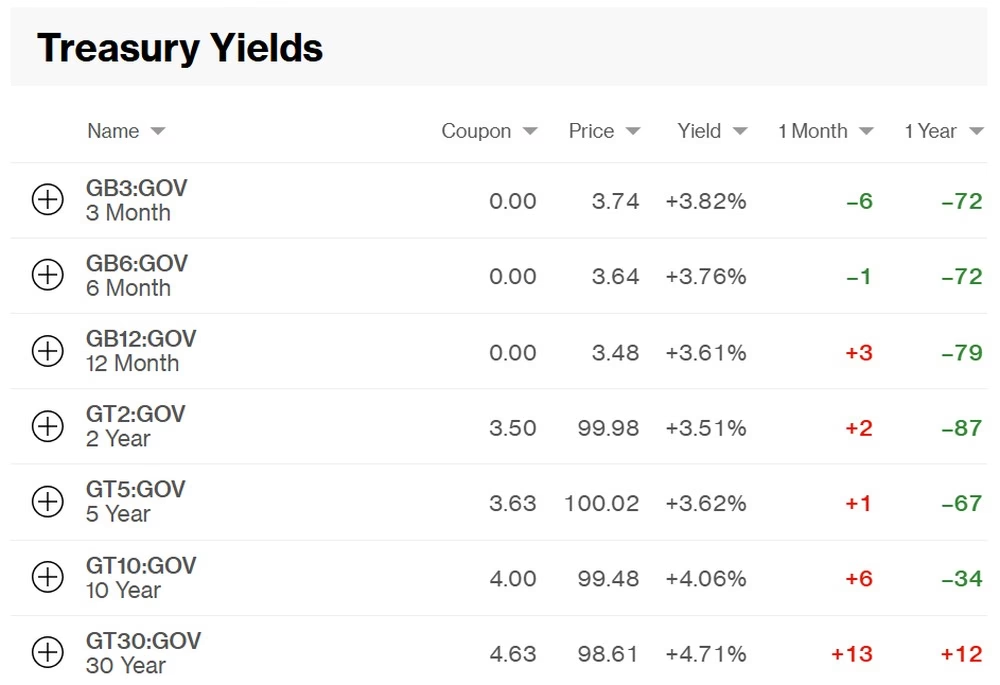

Bonds/US Dollar:

The US Treasury 10-year bond yield is now at 4.06% (was 4.15% as of last week).

The 30-year bond yield decreased by 4 basis points (was 4.75%, now 4.71%), so also lower on the week. This means the bonds’ prices have risen this week, since bond prices and yields are inversely correlated. Prices probably increased due to uncertainty in risk assets, with investors preferring “safe haven” assets (like US Government debt)-although gold didn’t go up this week, so as I keep saying-who knows what’s going on right now?

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar has strengthened against the Swiss Franc-last week, it cost $1.26 to buy 1CHF. This week, it’s less expensive at $1.24.

Still seems fairly range bound at the moment; one Swiss has cost between $1.22-$1.27 since June.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran