Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center.

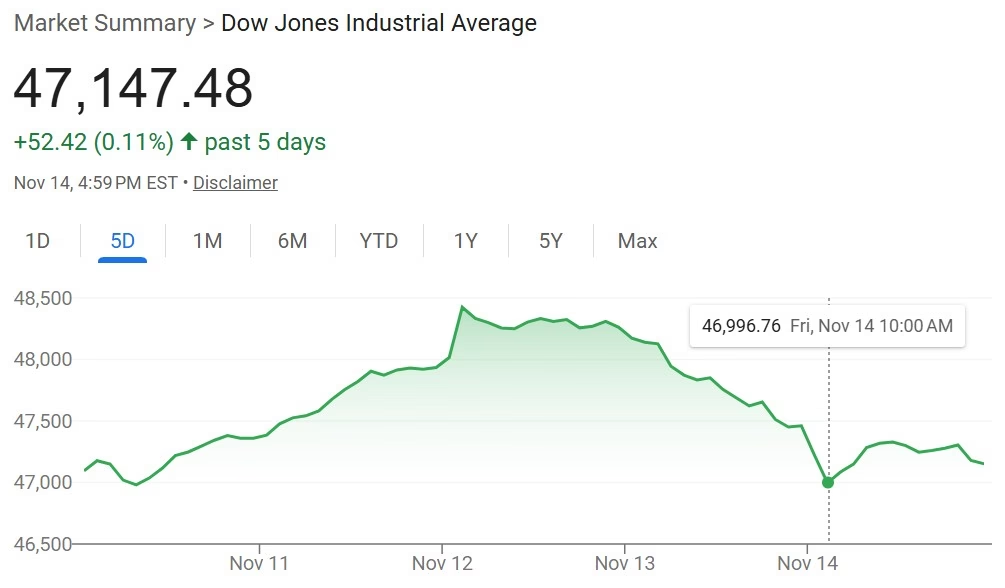

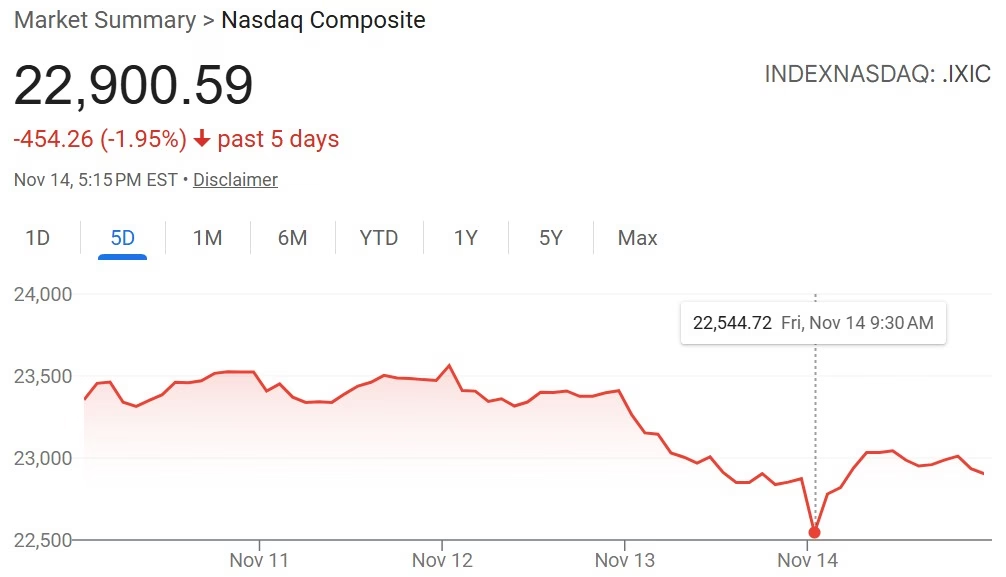

TL/DR (Too Long/Didn’t Read) Summary: The main news this week was the end to the US Federal Government shutdown on Thursday. Despite the fact that it was long awaited, and was expected to “release liquidity into the system”, it ended up being a bad week for risk assets; stocks mixed (Nasdaq finished 2% down), with crypto way down. Gold and silver enjoyed a decent week-the US Dollar weakened, and US Treasury yields finished the week up.

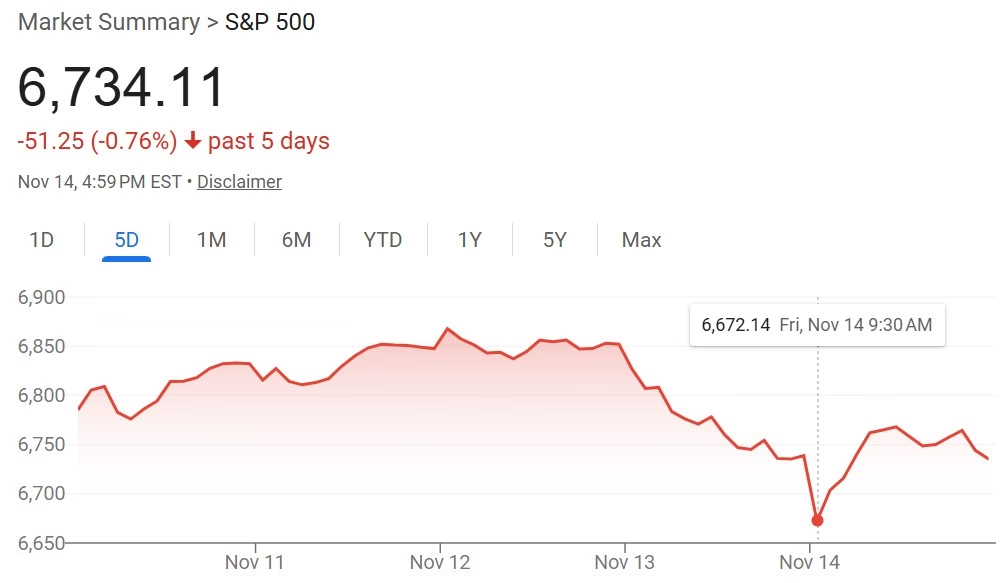

Stocks/Equities: Another volatile week. Was looking like another bloodbath until a rally on Friday-regardless of which, all indices remain level or down.

Gold/Silver: Decent week. Another week of consolidation above $4,000/oz for gold, silver regained $50/oz.

Cryptocurrency: Terrible week. Bitcoin lost the key $100k threshold.

Bonds/US Dollar: Bond yields up. USD weakened.

Stocks:

In keeping with the recent trend of “good” news seemingly tanking the financial markets and having completely the opposite effect to that expected, after the US Federal Government reopened on Thursday, stocks experienced sharp declines.

I also realize I’ve been throwing the word “Federal” around a lot lately. This may be an unfamiliar term for my non-American subscribers, so I’ll discuss it briefly. Per the US Constitution, each of the fifty US States is treated as a sovereign entity, with their own powers to enact and enforce most laws. The vast majority of political activity is supposed to take place at the local and State level (which is something I like very much about America; I’m a big believer in decentralized decision making). The Federal Government, on the other hand, is based in Washington DC, and comprises (amongst other things), Congress and the Executive branch, of which the President is the Chief Executive. It is THIS area of the US government which has been shutdown for the past six weeks (the longest in history, apparently).

Longest shutdown in history • Government shutdown 2025

Other examples of countries which have Federal structures of government include Canada, Switzerland, and Germany.

Incidentally, the funding issue has only been kicked down the road until January 30th 2026:

So in under three months’ time, we may be doing this all over again.

Alright; on with the market update. The reason given for the sharp decline in stock prices was that as a result of the shutdown, crucial data which the Federal Reserve relies on to make its decisions, makes an interest rate cut in December less likely:

Fading chance of December interest rate cut sends stocks tumbling

Mmm. Really? Apparently that’s all it takes nowadays to send stock prices soaring or tumbling-a change in the expectation of what the Fed may or may not do. This is not a sign of a healthy economy. Besides, it sounds like an excuse to me; almost as if the price drives the narrative, rather than the other way around.

Anyway-I’m leaving my stocks where they are, at least for the time being. Remember, we were at record highs in every index not even three weeks ago. Or-was that the peak before a significant correction?

Additionally, I mentioned last week a list of upcoming events which you would expect to be bullish for stock prices-however, with the markets being as unpredictable as they are, who knows? Here are this week’s indices:

nasdaq composite – Google Search

Gold/Silver:

Pretty volatile this week. Gold and silver were doing really well until Thursday morning, when they started falling right as the US government shutdown ended. Why? I don’t know. But the drop on Thursday, followed by a slight rebound on Friday, mirrored the performance of the major stock indices.

Gold closed the week up 2% at $4,095 (was $4,014 last Friday). It again remained above the key $4,000/oz support level.

Silver closed the week at $50.72, up $1.85 or ~4% since last Friday. It regained the key $50/oz support level.

Gold/Silver Ratio: Fell to 80.7 (was 82.8 last Friday)-due to silver rising more than gold this week.

Cryptos:

Another hugely depressing week in Cryptoworld. Bitcoin is now trading at around $94,000. Yikes. Despite a brief rally to $105,000 as recently as Wednesday, since the US Federal Government reopened, it’s been downhill all the way.

Despite the fact that the crypto market trades 24/7/365, it does “close”-at midnight UK time (so 6pm my time) daily, and weekly on a Sunday-so about 4 hours from the time I’m writing this. Closing the week significantly below $100k is NOT good news, and indicates the four year cycle is probably over-really before it ever got started. If it closes below $100k again next Sunday, November 23rd, then based on the past three cycles, this is all but confirmation that the peak occurred, very briefly, on October 6th.

However.

Crypto remains a very unpredictable asset class. It bores many individual investors into selling right before it increases, and buying right before it drops. It also has a habit of doing the total opposite of that which is expected of it-and right now, I’m hearing nothing but bad news. Investors who bought recently for the first time are capitulating and selling at a loss. So, as ever, I have no idea what’s going to happen in the short term, but as I remain bullish in the long term, I’m not selling. In fact, if we fall much further, I’ll buy some more. I also have to remember to take some more profits on the way up next time.

Also, if the top IS in, we didn’t experience any euphoria this time whatsoever-meaning the bear market should be significantly less severe-maybe a 50% fall as opposed to a 70-80% drop experienced in prior cycles. And we’re already 30% down from the peak (again, assuming October 6th WAS the peak).

Prices on the week:

Bitcoin’s down $9k at around $94k.

Ethereum’s down $400 at around $3,100.

BTC/ETH ratio: Up to 30.3 (was 29.3 last Friday). If Ethereum’s going to have a decent final push in Q4 2025 (for which we are running out of time), we need BTC/ETH to rise first, as Bitcoin rises, then fall, as Ethereum catches up.

Ripple (XRP) down $0.10 at around $2.20.

Solana’s down $24 at around $138.

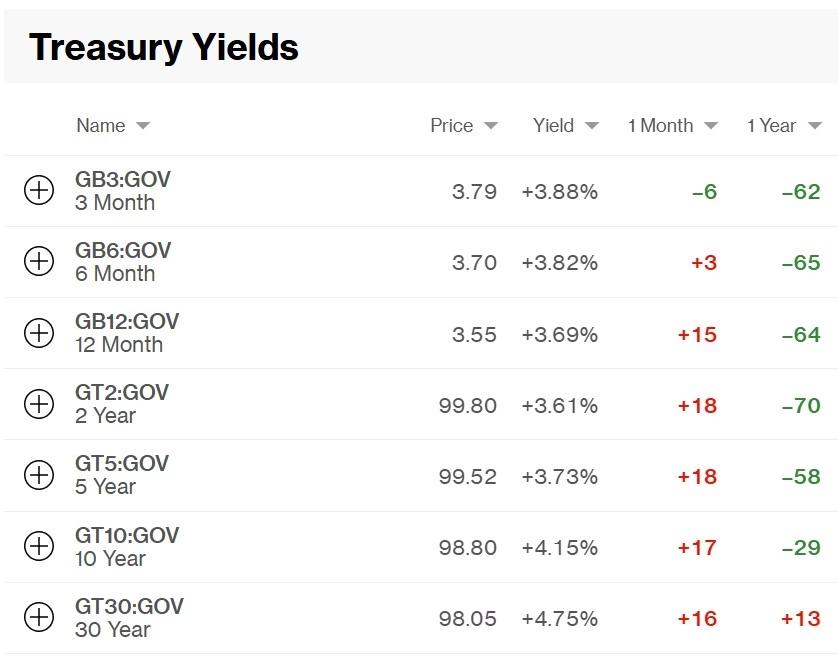

Bonds/US Dollar:

The US Treasury 10-year bond yield is now at 4.15% (was 4.10% as of last week).

The 30-year bond yield increased by 5 basis points (was 4.70%, now 4.75%), so also higher on the week. This means the bonds’ prices have fallen this week, since bond prices and yields are inversely correlated.

The green values in the screenshot below from Bloomberg show that with the exception of the 30-year-bond, interest rates on all US government debt have fallen in the past twelve months-and that with the exception of the 3-month-bond, all interest rates have risen in the past month. With the US borrowing more, and having to refinance more debt than ever, this is no doubt being welcomed by the US Treasury department. However, remember-if more and more of our debt is refinanced at the short end of the yield curve, even though it’s less expensive, we’ll be required to “roll it over” more often-meaning we’ll have to continually find buyers for it, as opposed to only having to do so every 10-30 years.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar has again weakened against the Swiss Franc-last week, it cost $1.24 to buy 1CHF. This week, it’s more expensive at $1.26. Still seems fairly range bound at the moment; one Swiss has cost between $1.22-$1.27 since June.

The dollar weakened on the back of expected and actual negative news around job losses:

Dollar Falls as ADP Report Shows US Job Losses

And finally…there was discussion this week around the idea of fifty-year-long mortgages:

Trump Proposes 50-Year Mortgages: What Are the Pros and Cons?

I know there are some real estate agents on this distribution list, so I’d be curious to hear what they think about this proposal. My own initial reaction is that this is not a good idea for the average borrower. Why would anyone put themselves in debt for fifty years? The additional interest paid during the term of a fifty year loan compared to the same amount of money borrowed over fifteen, or even thirty years, is absolutely astronomical-especially when you remember the fact that the money borrowed to buy a house is created from nothing by the bank in the first place-it doesn’t exist until you sign the promissory note.

I’m a big believer in both private property rights and individual home ownership-I simply don’t see how this helps either of them.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran