Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center.

I’ve decided I may end up sending this communication on Sunday each week, as opposed to Fridays. Rather than rushing to send something as soon as the market closes, it might be better to take a day or so to reflect on the prior week.

After I sent last week’s Market Update, I realized I didn’t go into very much detail as to why the US dollar strengthened relative to other currencies. Probably due to the fact that I was feeling slightly depressed because Cryptos had had yet another lackluster week. Anyway, this is rectified in the relevant sections below.

TL/DR (Too Long/Didn’t Read) Summary: A bad week for most assets; stocks down, crypto down, gold and silver sideways, and US Treasury yields up.

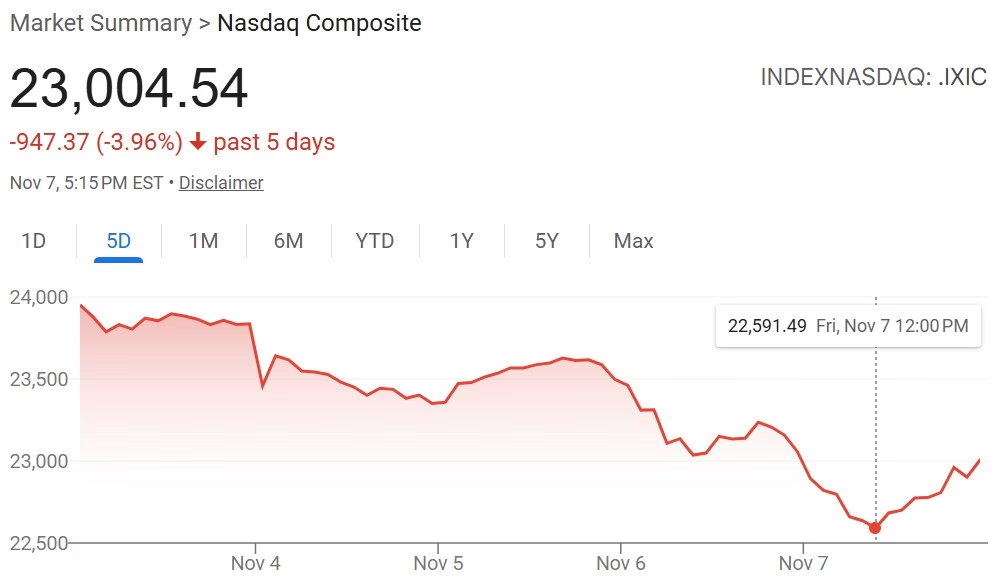

Stocks/Equities: Extremely volatile week. Was looking like a total bloodbath until a surprise rally on Friday afternoon-regardless of which, all indices remain down by 1.5-4%.

Gold/Silver: Sideways action. Looks like consolidation around $4,000/oz for gold, $48/oz for silver.

Cryptocurrency: Kept grinding down Sunday-Tuesday, before Bitcoin seemed to consolidate (for now) just above $100k.

Bonds/US Dollar: Bond yields up. USD strengthened this week.

Stocks:

A sea of red-not a pleasant sight for most of us. Sharp declines from the previous week’s all time highs, then again Tuesday morning, then again Thursday afternoon, only reversing course (for some reason) for the last three hours of US trading on Friday. Mmm. You have to wonder if market manipulation was occurring to prevent further falls. There are ways of doing this-in the wake of the infamous 1987 “Black Monday” market crash (which some recipients of this newsletter will remember well, whilst others weren’t yet born):

Stock Market Crash of 1987 | Federal Reserve History

President Reagan created the Working Group on Financial Markets, informally known as the Plunge Protection Team:

Plunge Protection Team (PPT): Definition and How It Works

I’m not saying there was intervention on Friday; I don’t know. All I’m saying is that it’s a possibility. One thing I am certain of is that markets are a lot less “free” than the financial media would have us believe.

Anyway-to me, it appeared to be the worst week for stocks since the tariffs were formally announced on April 2nd, “Liberation Day”. After which, stocks have performed extremely well. According to Yahoo! Finance, “The S&P 500 and the Dow also closed out the bumpy week in the red as persistent worries about an AI bubble and Big Tech valuations run high”:

So-as has been discussed here since the genesis of Curranomics®, this past week is yet another example of the same problem; the stock market is a house of cards waiting to collapse, because all the growth is concentrated within a handful of tech corporations, who no longer produce anything innovative, and are dependent for much of their income on US taxpayer subsidy, via lucrative Federal Government contracts.

However. You could have said exactly the same thing five years ago, moved your money out of stocks, and missed out on some fantastic year-on-year, double digit portfolio growth. The problem is, when it finally collapses (which it has to, eventually-it always does), it will be swift. And brutal. And nobody knows exactly when that’s going to be. However, I don’t think that time is now.

In conclusion, then-I’m leaving my stocks where they are, at least for the time being. Remember, we were at record highs in every index not even two weeks ago. Also, the US government shutdown ending, the Fed ending its policy of quantitative tightening on December 1st, further expected interest rate cuts, and even the appointment of a new Fed chairman next year, all suggest a continued overall upward trend in stock prices.

nasdaq composite – Google Search

Gold/Silver:

Some volatility this week, but overall a second successive week of consolidation in precious metals:

Gold closed the week almost level at $4,014 (was $4,015 last Friday). It remained above the key $4,000/oz support level.

Silver closed the week at $48.47, down $0.38 or ~0.8% since last Friday. It has yet to regain the key $50/oz support level.

Gold/Silver Ratio: Rose to 82.8 (was 82.2 last Friday)-due to silver falling but gold remaining where it was.

Cryptos:

Last week, I didn’t even mention the fact that the much heralded “Uptober” in Crypto turned out to be a bust. The first “red” October for Bitcoin in seven years:

Bitcoin Returns History,Historical BTC Performance | CoinGlass

November has hardly started with a bang, either. November is historically Bitcoin’s best performing month overall, but this is hugely skewed by its return in November 2013, when the asset (then only valued in the hundreds of dollars), increased in value by a ridiculous 449%. That sure as s**t ain’t happening this year. Monday of this week (11/3) was also a hugely depressing day, as Bitcoin slowly declined from $110k to $105k. It then fell to as low as $99k on Tuesday and again Friday, before recovering slightly (it’s at $103k as of writing, but who knows for how long).

It was following that massively depressing day on Monday that I decided to stop torturing myself by checking my Crypto position every ten minutes or so. What’s the point? There’s a good chance I’ve already missed the moment to sell this cycle-which, if the top IS in, occurred during a matter of hours on October 6th. In itself this is utterly ridiculous-how on earth is any non-insider supposed to identify a selling window, lasting roughly a single day, in a period of four years? In case anyone’s wondering, there are a total of 1,461 days in 4 years.

And unlike in prior crypto cycles, including the ones I recall in 2017 and 2021, the market top (assuming it’s in) has not been accompanied by any euphoria whatsoever. In fact, sentiment is incredibly negative right now-many market participants are predicting a severe bear market throughout 2026. This may well be the case, who knows. I will say though, that as we saw with the widely heralded “Uptober” that never happened, the market has a habit of doing the total opposite of that which is expected of it.

A such, crypto continues to be a source of frustration for me. As long as Bitcoin remains above $100k, I’d say the current four-year-cycle isn’t over, but it can’t seem to decisively reclaim anything above $110k either.

Prices on the week:

Bitcoin’s down $7k at around $103k.

Ethereum’s down $400 at around $3,500.

BTC/ETH ratio: Up to 29.3 (was 28.2 last Friday). If Ethereum’s going to have a decent final push in Q4 2025, we need BTC/ETH to rise first, as Bitcoin rises, then fall, as Ethereum catches up.

Ripple (XRP) down $0.20 at around $2.30.

Solana’s down $24 at around $162.

Bonds/US Dollar:

The US Treasury 10-year bond yield is now at 4.10% (was 4.08% as of last week, so very slightly higher).

The 30-year bond yield increased by 5 basis points (was 4.65%, now 4.70%), so also higher on the week. This means the bonds’ prices have fallen, since bond prices and yields are inversely correlated.

The green values in the screenshot below from Bloomberg show that with the exception of the 30-year-bond, interest rates on all US government debt have fallen in the past twelve months. With the US borrowing more, and having to refinance more debt than ever, this is no doubt being welcomed by the US Treasury department. However, remember-if more and more of our debt is refinanced at the short end of the yield curve, even though it’s less expensive, we’ll be required to “roll it over” more often-meaning we’ll have to continually find buyers for it, as opposed to only having to do so every 10-30 years.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar has strengthened against the Swiss Franc-last week, it cost $1.26 to buy 1CHF. This week, it’s only $1.24. Still seems fairly range bound at the moment; one Swiss has cost between $1.22-$1.27 since June.

The dollar strengthened on the back of Fed Chairman Jerome Powell’s comments that future interest rate cuts weren’t necessarily guaranteed (that isn’t actually what he said, but that was how the markets interpreted it), meaning US government debt, denominated in dollars, would be seen as a more attractive asset than in a lower interest rate environment, and thus increasing its value relative to other currencies.

And finally…a fairly old news story that I wasn’t aware of until this week. If you’re concerned that you’re not where you want to be financially (which probably applies to all of us), celebrity investor and ultimate insider Warren Buffett accumulated 98% of his unimaginable net worth after the age of sixty-five:

In fairness-according to the article from Yahoo! Finance, the Sage of Omaha was already worth $3bn by the time he reached retirement age, and he has already lived longer than most people (he turned 95 this year). However, my point is that it’s never too late to put something (anything) by and let time do the rest.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran