By Thomas Curran

As mentioned last week, the “big beautiful bill” (BBB) was approved by Congress, adding $5trn to the US debt ceiling. The US is already $37trn in debt (and rising rapidly). The suffixes million, billion, and trillion all sound very similar, and at some point, such figures start to become somewhat meaningless. To help us attempt to get our heads around it, If I compare the numbers to periods of time, we come up with the following:

1,000,000 seconds ago was 12 days ago

1,000,000,000 seconds ago was 1993

1,000,000,000,000 seconds ago was 29,685 BC

So. A timeframe of a million seconds is comprehendible. A billion is within the lifetimes of some (but not all) recipients of this newsletter. A trillion is simply unfathomable. And sadly, that’s kinda where we are.

Tariffs are back in the news again (hooray…not). Quick reminder on tariffs; tariffs are an import tax on goods from a foreign country. The tariff is paid by the importer of the good, to the government which is imposing the tariff. The importer pays the tariff, but it can be offset in some way-likely to whomever the importer sells the good to-i.e., the consumer of the good.

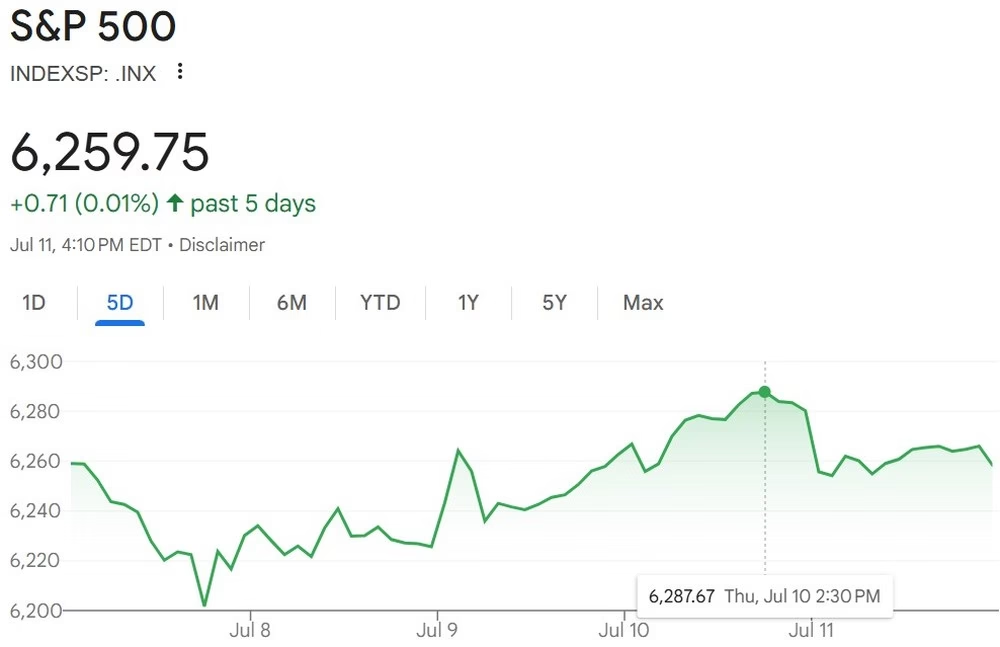

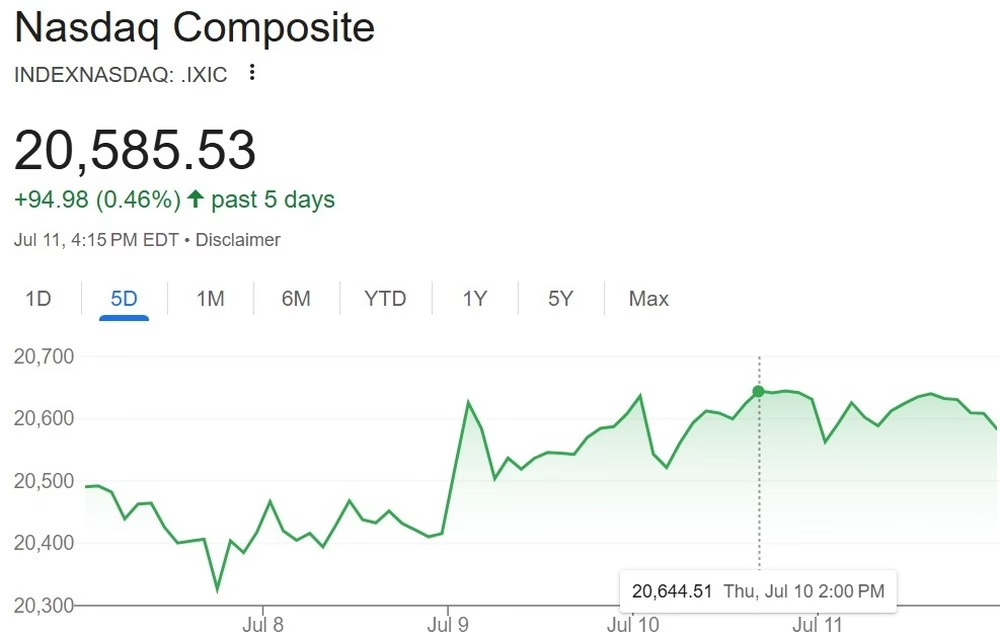

Alright; stocks. Most hardly moved this week, although all three major US indices are still right around their record highs:

Gold/Silver:

Gold hasn’t moved, silver had a great week.

Gold: Up <1% to $3,370. Closed last week on $3,342. I remain bullish on gold in the medium-long term. It still hasn’t rebounded from the $3,500 it briefly hit on May 6th (although didn’t “close” that high-its highest closing price was $3,453-which it hit on Friday June 13th). Silver: Up >4% to $38.66, nearly all of the growth ($1.47) coming today alone. Closed last week on $37.01.

Gold/Silver Ratio: Fell from 90.3 to 88.1, due to silver significantly outperforming gold this week. Still remains very high compared to the historic range of 50-80.

Remember, a high ratio indicates silver is better value for money than gold. A falling ratio is likely bullish for both gold AND silver prices.

Cryptos:

Crypto investing is a cruel mistress. All the positive news from the 2025 Bitcoin conference in Las Vegas only made the price fall. However, it’s days like yesterday and Wednesday that make it all worthwhile-especially as they happen so rarely. I commented some weeks ago that following Bitcoin’s sudden rise to the rather interesting all time high (ATH) figure of $111,999 (before falling sharply again to below $100k only last month), we should expect new all time highs in due course-well, this week, they arrived.

Wednesday: Trundling along sub $110k, before suddenly hitting around $112k (i.e., the previous ATH).

Thursday (yesterday): Exceeding its ATH to $114,000, followed by another jump to $116,500.

Today: Currently (Friday morning 5.30am CST) trading around $118k, has been as high as around $119k.

So often in Cryptoworld, you go to bed on a gain, only to wake up the following morning to find out it’s been erased (and then some). Today was one of those very rare occasions in which this week’s nascent rally not only sustained, but strengthened. I’ve been saying for some time that based on the previous two four-year-long Crypto cycles I’ve been involved with (2017 and 2021), we should expect most of the gains in the final quarter of 2025. I really hope that’s still the case. We’ll see.

Bitcoin’s rally this week dragged the alt-coins up with it:

Ethereum up $400 (15%) to ~$3,000.

BTC/ETH ratio: Down to 39.3 (was 42.3 last Friday and in excess of 44 the week prior to that). I maintain that we’re overall in a downward trend here, in which Ethereum will appreciate at a faster rate than Bitcoin through the rest of the year.

Ripple (XRP) Up to $2.80 (was as low as $2.28 last Friday).

Solana’s Up to $165 (was as low as $152 last Friday).

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

Bonds/US Dollar:

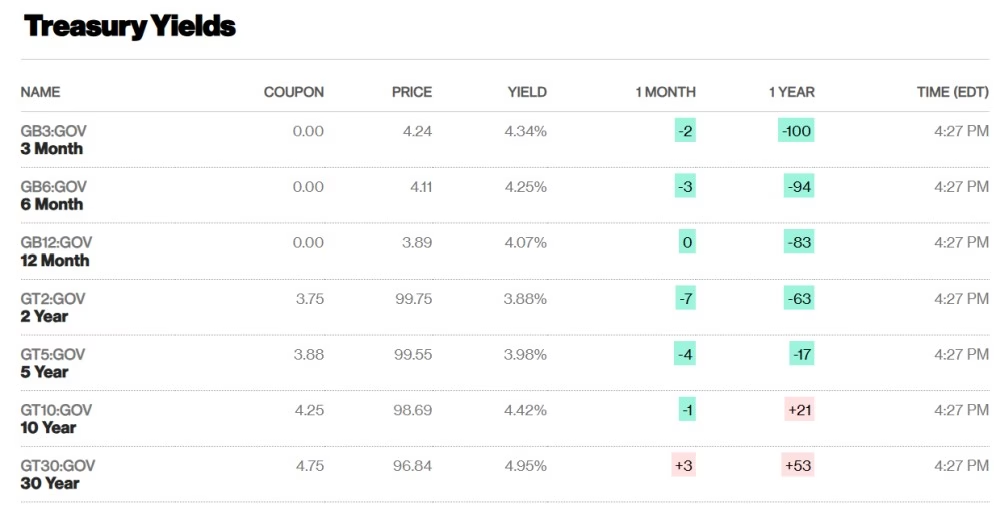

The bond yield curve steepened this week. What does that mean? Well, the yields on long term bonds increased, while short term remained more or less the same. Likely due to the passage of the aforementioned “big beautiful bill” (BBB), adding more indebtedness to the already overburdened American taxpayer. Since a bond is an IOU, my guess is that investors are worried that by the time they’re due to receive their principal back in 10-30 years’ time, the purchasing power of their investment will be greatly reduced (which it will), and that the yield they receive in the meantime won’t compensate them for it.

The 10-year increased from 4.35% to 4.42%, as did the 30-year, to 4.95% (it closed at 4.86% last week). 5% is a totemic threshold for long term US Treasuries. Higher yields mean lower bond prices, as they have an inverse relationship.

The Federal Reserve’s (the central bank of the US) next decision on interest rates will be after their meeting at the end of July. They’re unlikely to raise rates, but it isn’t yet known if they’ll maintain or lower them. We’ll have to wait and see.

Meanwhile, the US Dollar strengthened against the Swiss Franc-it now costs only $1.25 to buy 1CHF (it was as much as $1.27 on Tuesday last week):

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom

July 11, 2025