Welcome to this week’s edition of Curranomics® from a cold and windy Crystal Beach Investor Center.

Yet another crazy week in the world-tariffs, NATO, and Greenland all in the news again-and reluctant as I am to publicize it, the shadowy globalist think tank, the World Economic Forum (WEF), held their annual jamboree in Davos, Switzerland, this past week. I’m no fan of watching billionaires pat each other on the back (which is also why I never watch awards ceremonies), hence why I’ll keep my discussion of Davos to a minimum. Besides, sifting through their speeches and attempting to discern fact from fiction simply isn’t a good use of anyone’s time-not to mention the fact that listening to any of these cretins for more than about thirty seconds makes me feel nauseas.

Battle lines (fake ones, in my opinion) seem to have been drawn between those who are supporting America’s annexation of the Danish territory of Greenland, and others who oppose it. I’ll simply repeat my assertion that the stated reasons for any policy decision are rarely (if ever) the real reasons. As an example, the second Gulf war was never about Saddam Hussein’s (non-existent) weapons of mass destruction, or promoting democracy in the region, or liberating the Iraqi people-all of which were excuses used at the time. Please bear this in mind when listening to the latest rhetoric around Greenland, NATO, Venezuela, tariffs, or anything else.

TL/DR (Too Long/Didn’t Read) Summary: Another great week for metals; stocks didn’t move much; bonds were mixed and cryptos fell.

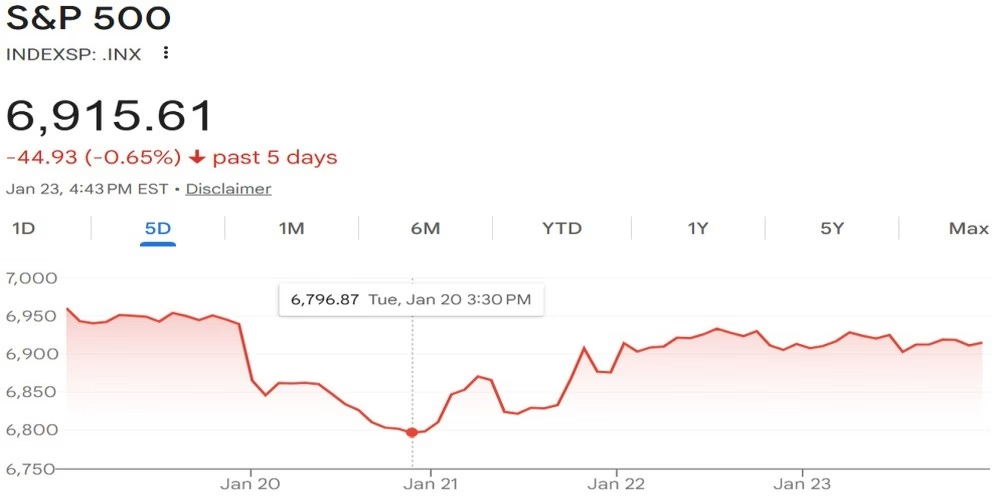

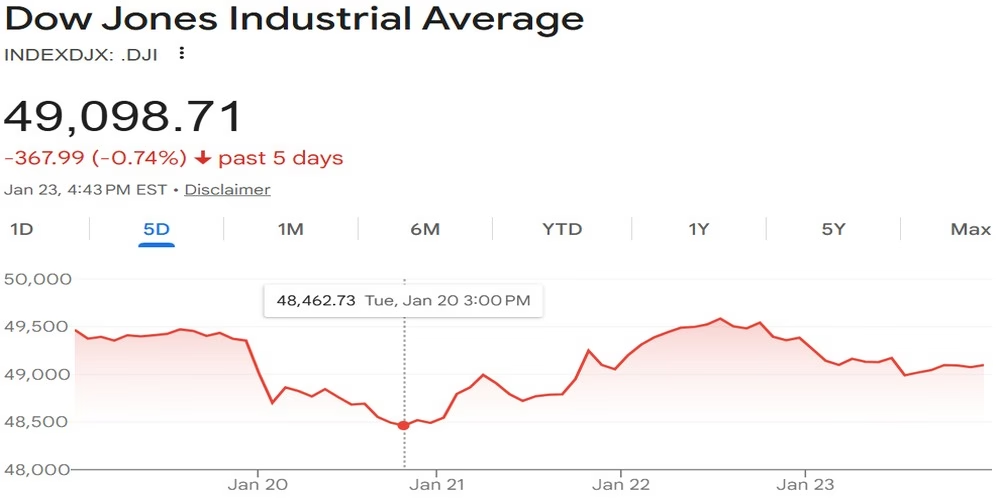

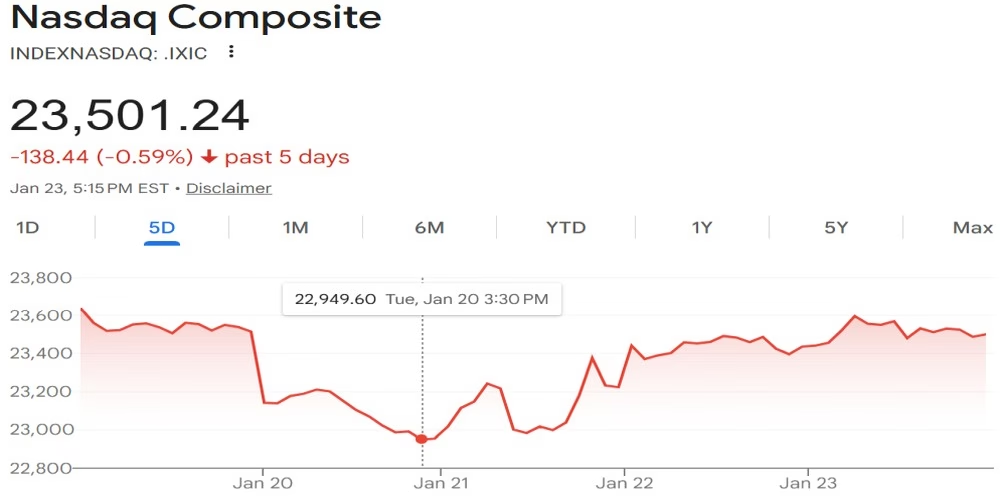

Stocks/Equities: Despite some movement, all three major indices essentially where they were a week ago, still hovering around all time highs.

Gold/Silver: Gold and silver both up strongly this week (again). More new nominal all time highs. Gold hit $5,000, but fell just short of closing above it ($4,997). Silver crossed (and closed above) the totemic $100/oz for the first time ever-huge news.

Cryptocurrency: A terrible week! Although still impossible to say which way the market’s going to go in the short term.

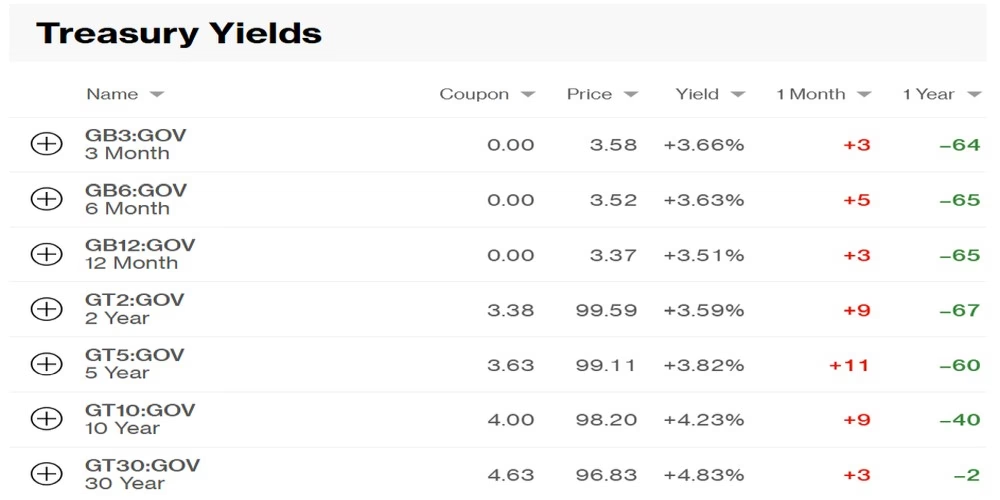

Bonds/US Dollar: A mixed week, although in general, bond yields keep creeping up, especially at the long end of the yield curve. Towards the end of the week, the USD weakened significantly against the Swiss Franc, probably due to European threats to dump dollar denominated assets in response to the US’s continued pursuit of Greenland, and the continued threat of additional tariffs. All very theatrical, in my opinion, and is simply there to provide a convenient narrative for unfolding events.

Stocks:

Even though the weekly charts are red, the reality is they’ve hardly moved this week (again). I think it’s important to remember that the major US indices remain right around their all time highs; so we’re probably about to see some major thresholds crossed-which are:

S&P 500: 7,000

Dow Jones: 50,000

Nasdaq 24,000

Here are all three indices on the week:

nasdaq composite – Google Search

Gold/Silver:

Both up significantly this week, and closed on new (nominal) all time highs-again-although the precious metals market is becoming increasingly volatile. Towards the end of last year, gold peaked around $4,550/oz, and silver at $84/oz. Silver, however, has been as low as ~$73/oz since making that high. The more (manufactured) geopolitical tension there is, the higher metals prices rise. The continued devaluation of fiat currencies, in particular the US Dollar, helps also.

Gold closed the week up $389 (~8%) at $4,997 (was $4,608 at the previous Friday’s close). Almost certain to reach $5,000/oz next week.

Silver closed the week at $103.87, up ~$10 or ~11% since the previous Friday’s close. Surely it can’t keep going up like this forever?

Gold/Silver Ratio: Fell to 48.1 (was 50.7 the previous Friday)-due to silver climbing more than gold this week. This is the lowest it’s been in a while-overall, good news for both gold and silver, in my opinion. If/when it falls into the low 30s as it last did in 2011, I’ll consider swapping some gold for silver. If I can find a coin shop which will do so at a reasonable rate, that is; as ever, turning paper profits into real profits proves to be more complex than it initially appears.

Cryptos:

All of last week’s gains erased! What a surprise. My comments last week about Bitcoin having difficulty in regaining $100k again were proved correct, although I wasn’t expecting it to fall below $90k in the process. I’m not sure why; Bitcoin often does what’s least expected of it, after all.

In my experience, it’s times like these that the Crypto market is trying to bore us all to death; either encouraging us to sell before it spikes, or buy before it collapses. I keep reminding myself that patience is required in the short tern.

As discussed last year, I’ve decided that all the speculation in the world isn’t productive, as none of us have a clue which way it’s going to go. I’m not selling at the moment, and that’s that.

Prices on the week:

Bitcoin’s down $8,700 at around $86,500.

Ethereum’s down $500 at around $2,800.

BTC/ETH ratio: Up to 30.9 (was 28.5 last Sunday).

Ripple (XRP) down $0.20 at around $1.85.

Solana’s up $24 at around $118.

Bonds/US Dollar:

The US Treasury 10-year bond yield is very slightly up this week-now at 4.23% (was 4.22% as of last week).

The 30-year bond yield fell by 1 basis point (was 4.84%, now 4.83%).

The long term bear market in government debt (from 2020 onwards) continues.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar weakened significantly against the Swiss Franc. Last week, it cost $1.25 to buy 1CHF. This week, it’s more expensive at $1.29. The exchange rate has finally broken out of the range it had been in for seven months; one Swiss had cost between $1.22-$1.27 since June 2025. Good job I bought some Euros the previous week.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know. And keep warm out there.

Good luck and happy investing,

Tom Curran

E: thomasjxcurran@gmail.com