Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center. A happy new year to you all. As promised, this is going to be a look back on the performance of our various asset classes during the past year; almost a “double edition” of Curranomics® if you like. I’ll plan to release the next regular market update sometime around Sunday January 11th, following the first uninterrupted work week of 2026.

TL/DR (Too Long/Didn’t Read) Summary: A volatile year for assets. Tariffs in particular continue to spook the financial markets whenever mentioned.

Stocks/Equities: Did well, but the overall performance was skewed by a handful of corporations which accounted for almost all the growth (the so called “Mag. 7”). The less said about (my team) Manchester United FC’s share price this year, the better!

Gold/Silver: Incredible performances-the best year in precious metals since 1979. Still not entirely sure why, as I know of no new retail buyers in the precious metals space (the official explanation alone of “higher industrial demand” doesn’t cut it for me. Solar panels have already been pushed for decades).

Cryptocurrency: Very high expectations, followed by a very disappointing performance. For the first time in Bitcoin history (i.e., since 2009), Q4 in its post-halving year was a total bust.

Bonds/US Dollar: Bond prices haven’t moved much in 2025, but they are up-however, the longer term bear market continues. The US Dollar has weakened (as have all fiat currencies).

Special Topic: Predictions for 2026

Stocks:

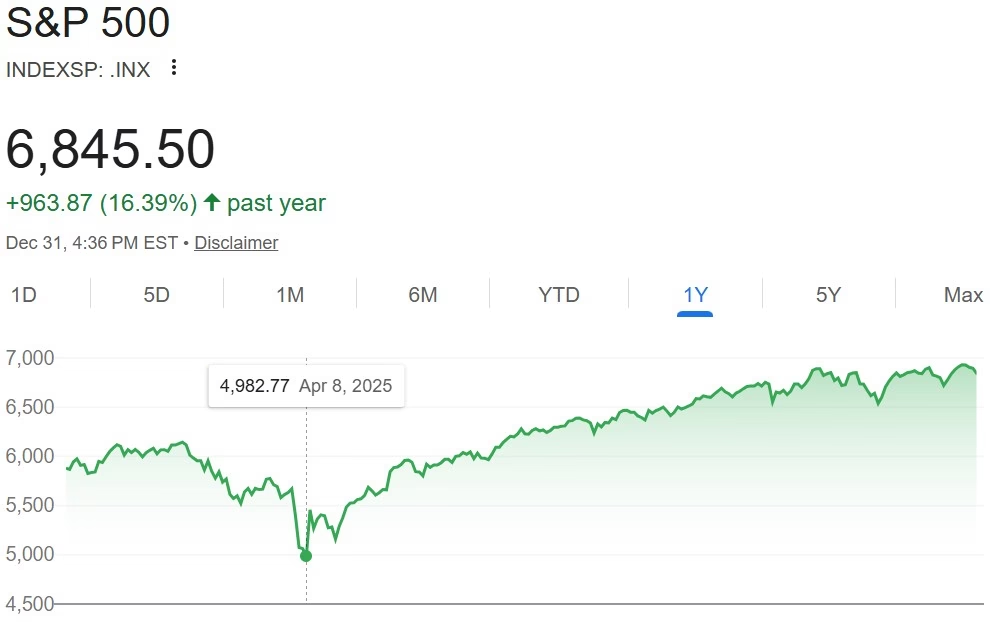

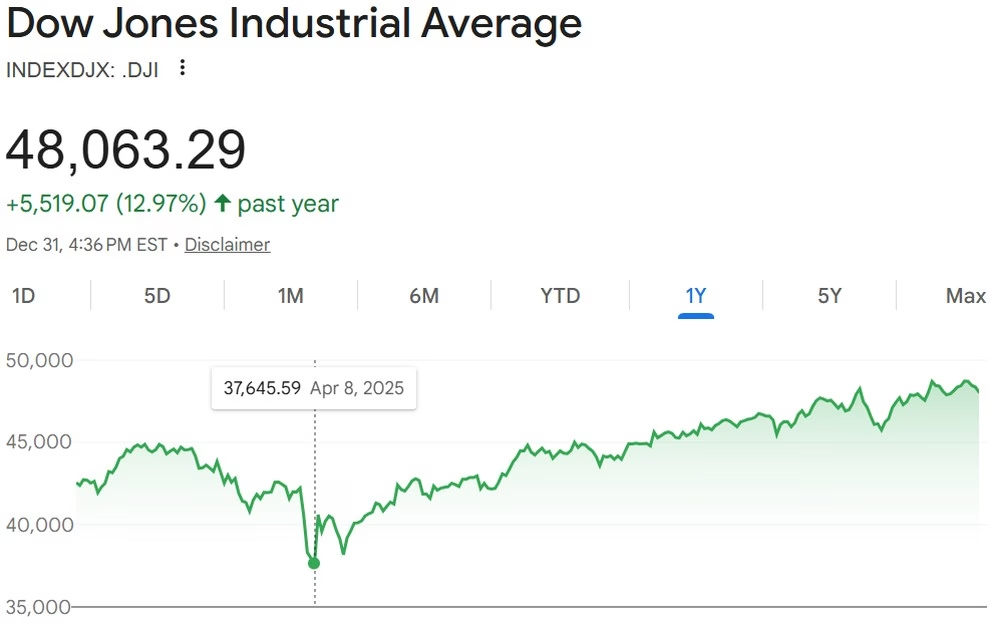

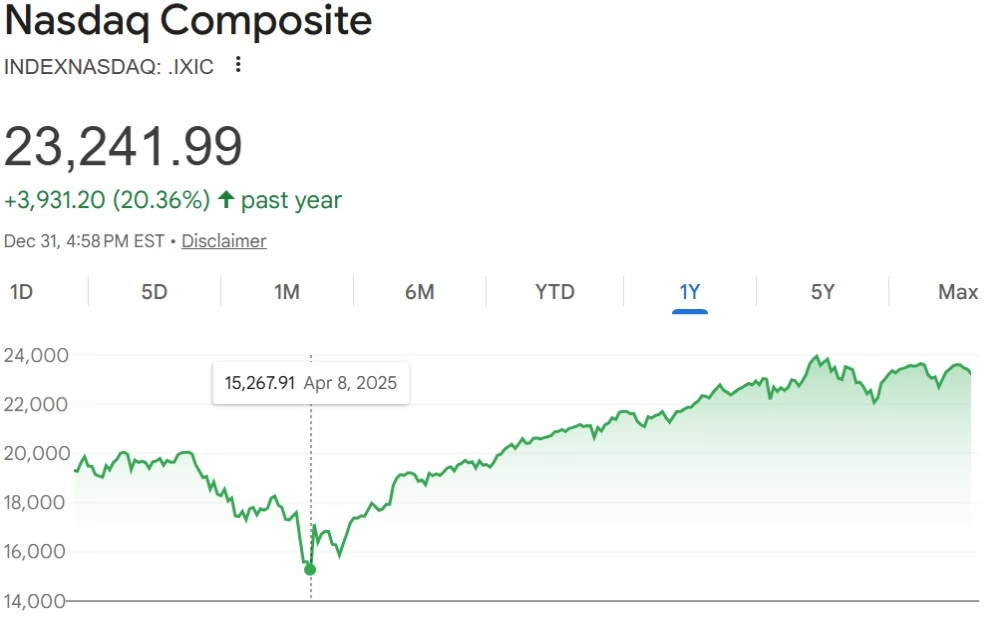

Here are this year’s indices. They’ve all performed well, returning between 13-20%. The major wobble occurred in the aftermath of “Liberation Day”, April 2nd; the day upon which President Trump formally announced his tariff policy. All three indices bottomed on April 8th, and were turbulent until April 21st-since which, it’s been an upward trajectory:

nasdaq composite – Google Search

However-as I keep saying, the performance is skewed by a handful of companies enjoying all the growth. By the end of this year, the often referred to “Magnificent 7” group of tech. companies (Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla) “accounted for roughly 34% of the S&P 500’s total market capitalization and was responsible for a staggering 54% of the index’s price gains over the last 12 months”.

The Great Divergence: How the ‘Magnificent Seven’ Redefined Market Dominance in 2025

This concentration of growth within so few companies is hardly a sign of a healthy stock market. Especially companies who receive a plethora of US Federal taxpayer subsidy, don’t produce anything especially new or innovative, and exist primarily to collect and sell our private data. However, there was even a significant difference in the performance of the individual constituents of the Mag. 7; Alphabet (66% up), Nvidia (36% up), and Tesla (21% up), accounted for almost all the growth of these seven corporations! The other 4 members performed at or below the performance of the overall S&P 500 index (i.e., ~17%).

how much stock market growth were the magnificent 7 responsible for in 2025 – Google Search

So-are we now going to be talking about the Mag. 3 next year? The Mag. 1 in 2027? Who knows. These tech. giants are way overvalued-we all know it, but this is hardly new information. When the correction in their stock prices inevitably occurs, it will be swift and brutal-but for reasons explained in the special topic section, I simply don’t see it happening anytime soon. As ever, I’m not an insider, and as such, could be totally wrong-if any readers have other thoughts on this, please let me know.

Gold/Silver:

I didn’t expect this year to be as spectacular as it has for metals. I started buying gold and silver in 2020, in the expectation that they would at least retain their value, in real terms, against the fiat currencies in which they’re priced. I’ve been blown away by the performance of both gold and silver this year-especially silver, which has been one of the least loved assets of the past (almost) five decades. In fact, both metals had their best year since 1979-interestingly another period characterized by high inflation, and geopolitical uncertainty:

when was the last time gold and silver performed as well as in 2025 – Google Search

I’m very pleased by the price action in metals, but I have to say, I’m a little suspicious of it. It isn’t as though the public is rushing out to buy silver, as far as I know (I don’t know any new metals buyers-if you do, or are one, please let me know). So what’s causing silver’s meteoric rise, after almost five decades of being totally ignored by institutions, and the public, alike? I can only think that it’s being manipulated, and artificially pumped, for reasons which aren’t yet clear. However, I’m more than happy to ride the rollercoaster, provided it continues up. As we saw from gold’s slow and painful decline from $873 in 1980 to $250 by 2000, it can, and will, fall-like any other asset price. In addition, such large daily swings in the prices of gold and silver are definitely new to me-I’ve never experienced such volatility in what is traditionally a very slow moving market.

Gold closed the year up $1,705 (65%) at $4,330 (was $2,625 one year ago). Making all time high after all time high, it peaked on $4,534 on Boxing Day (December 26th for my American readers). I suspect $4,000 is a new floor for gold’s price moving forward-at least during 2026. I’d hope we can reach a minimum of $5,000 this year.

Silver closed the year at $72.30, up a whopping $43.38 or 150% this past year. Quite incredible. Also making all time high after all time high, it similarly peaked on $79.32 a few days ago, although it did exceed $80 on interday trading). Surely it will reach $100/oz in 2026.

Gold/Silver Ratio: Fell to 60 (started the year at 91, and peaked at 105 on April 21st-unsurprisingly, the same day stocks bottomed). 60 is the lowest it’s been in a while-overall, good news for both gold and silver, in my opinion. My guess is that we’ll reach somewhere around 50 in 2026, although it would have to fall lower than that to tempt me into swapping any of my silver for gold.

Cryptos:

Definitely the most disappointing asset class this year. In my admittedly short investing career, I’ve never seen an asset carrying such high expectations, only to fail as spectacularly as Crypto did in 2025. In my opinion, speculation as to why isn’t helpful-especially as it won’t help us make an educated guess as to what will happen in the Crypto space in 2026. For now, I’m going to stick to my positions, invest mainly in BTC and ETH, wait for the market to recover, and be better about taking smaller profits “on the way up”. How long the market will take to recover is anybody’s guess; and the answer to which partly depends on whether or not you think the traditional 4-year-cycle is still valid. I could go either way on this-if it is, we’re already down 30% from BTC’s all time high of $126k from October 6th. If not, we’ll make new all time highs at some point within the next year. Either way, I remain bullish on BTC and ETH for 2026.

Crypto prices on the year:

Bitcoin’s down $9,500 at around $87,500.

Ethereum’s down $450 at around $3,000.

BTC/ETH ratio: Up to 29.2 (was 28.1 on 1/1/25).

Ripple (XRP) down $0.56 at around $1.84.

Solana’s down $84 at around $124.

Bonds/US Dollar:

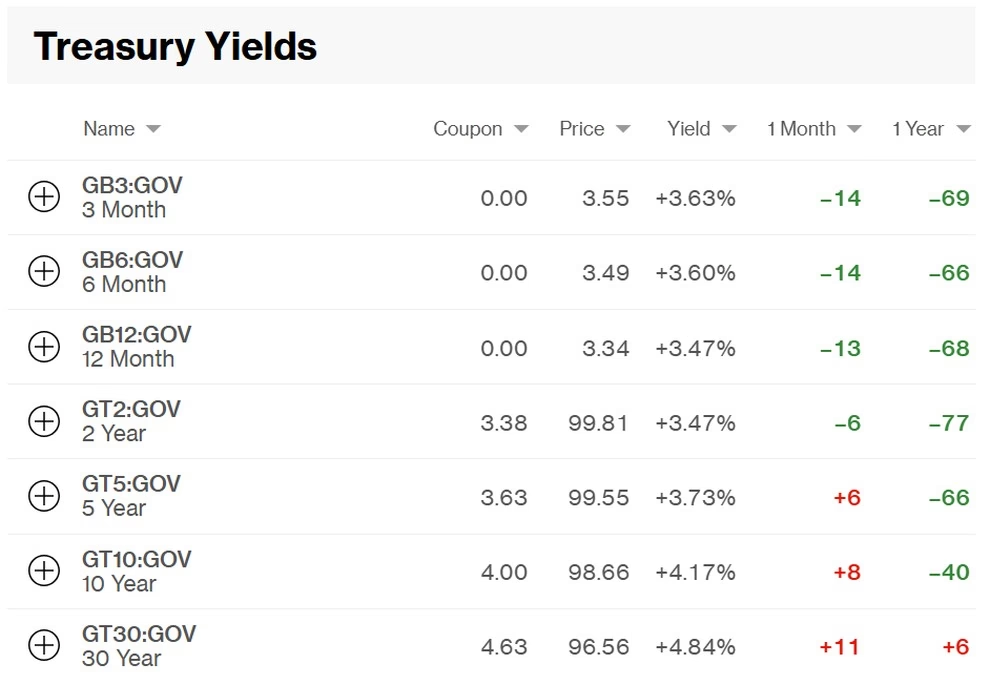

There was speculation earlier this year (I was party to some of it) around America being unable to refinance its gigantic, $37trn debt mountain, much of which matured in 2025. In the end, it would appear that she did so with relative ease-I certainly heard very little about it in the latter half of the year. The lesson here being, don’t become distracted by baseless rumors about the backbone of the entire global financial system collapsing by the morning. Overall US Government bonds performed well this year:

When yields fall, bond prices rise. Since all US Treasury yields have fallen this year (with the exception of the longest dated bond, 30 years, which has risen only 6 basis points), the values of most bonds have risen:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar weakened significantly against the Swiss Franc this year. January 1st 2025, it cost $1.10 to buy 1CHF. Now, it’s 15% more expensive at $1.26. The Fed has already advertised that quantitative tightening ended on December 1st:

So-with looser monetary policy (i.e., lower interest rates, and an expansion in the size of the Fed’s balance sheet), the US Dollar is likely to continue weakening during 2026, which alone is bullish for assets priced in USD-so do remember that; it isn’t really the value of your assets increasing-it’s the value of your Dollars (or Pounds, or Euros, or Swiss Francs) falling.

Special Topic: Predictions for 2026

I’ve learned through bitter experience that financial market predictions are a mug’s game. If you remember, earlier this year, I was convinced Bitcoin was going to reach somewhere around the $200k mark by November. Equally, I had no idea that gold and silver were going to explode in value. I also mentioned that I thought President Trump may have been chosen to oversee the transition to a new global monetary paradigm (similar to the shifts from the British pound to the US dollar as part of the 1944 Bretton Woods agreement, or the effective end of the same system when the gold standard was abandoned by President Nixon in 1971). Even though it hasn’t happened yet, it wouldn’t surprise me if some similarly significant shift occurred before Trump leaves office. He has another three years, which is an eternity in politics. The transition may have something to do with both his tariffs, and the pumps we’ve seen in gold and silver prices this year.

Anyway-all we can do, as outsiders, is try to sift through the information we’re constantly bombarded with, try to draw the most rational conclusions we can, and allocate our hard earned money accordingly.

We are due for a serious market correction. The most recent one lasted from December 2021-August 2022, during which time the S&P 500 fell by around 25%. However, to make the most of that opportunity, you’d have to know when to sell, and then buy back in. Who knows that information with any certainty? I don’t. On balance, most of us are probably as well off leaving our portfolios where they are, and letting time do the rest.

In short, I’m bullish on most asset classes for next year. America remains very dominant in global bonds and stocks, as well as being home to the world’s reserve currency-and America has a big 2026 planned. She turns 250-years-old, President Trump turns 80-years-old (on June 14th), and she’s hosting the vast majority of the FIFA World Cup. With all that attention being focused on her, I don’t think those running the show are going to want the party spoiled by negative headlines about financial crises.

I also checked the most comparable year-1976-which was the year in which America’s bicentennial was celebrated. This is what Google responded when I asked if 1976 was a good year for the American stock market:

was 1976 a good year for the american stock market? – Google Search

Yes, 1976 was a good year for the American stock market in nominal terms, with significant gains for major indices. The Dow Jones Industrial Average and the S&P 500 both posted strong double-digit returns, though this rally was part of a recovery from a deep recession and preceded a downturn in the following years.

So, even though the context is different (1976 was an election year, whereas 2026 is a midterm year, for example), the last time America celebrated a similar occasion, stocks performed well.

In addition, it looks as though “looser” monetary policy is on the cards for the world’s central banks-led by the US’s Federal Reserve-especially if President Trump replaces current Chairman Jerome Powell with one of his yes-men (although do expect more fake theater around this appointment). Lower interest rates, more money printing, and weaker currencies are all bullish for asset prices-except for government bonds, which may continue to fall, as they have done now for almost six years. The one exception to this appears to be the Bank of Japan, which in a reverse of decades long policy, is raising its base rate.

From my own personal financial standpoint, once cryptos have recovered, I’d like to sell some of them, and purchase something that actually bears interest. Tobacco and oil stocks have historically paid good quarterly dividends. Not the most fashionable of industries, but then again, I’ve never been described as “fashionable”.

Disclaimer: I could be wrong about any, or all, of the above! However, seeing where we are in a year’s time in comparison to what I think may happen will be interesting.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know. And keep warm out there.

Good luck and happy investing-and a prosperous 2026 to you all.

Tom Curran