Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center.

This will be the last regular edition of Curranomics® for this year-at some point between now and the first week of January, I plan to send out an annual review of this year’s financial assets. I find in the mainstream press that there’s very little discussion about the performance of assets long term-they seem to focus only on the differences from one day to the next-I don’t find this to be especially useful. I grew up listening to talking suits on the likes of BBC News, making throwaway comments such as “and today, the pound is down three tenths of a percent against the dollar”, without any explanation-EVER-of what that actually meant. I can’t be the only person who heard these pronouncements and was mystified by them.

TL/DR (Too Long/Didn’t Read) Summary: Another very up and down week, for the most part-although silver performed very well (again).

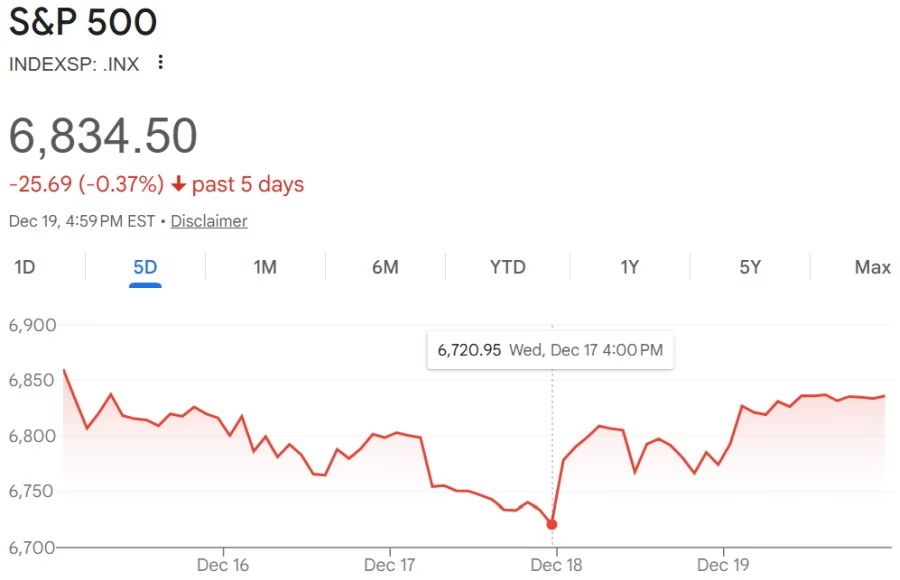

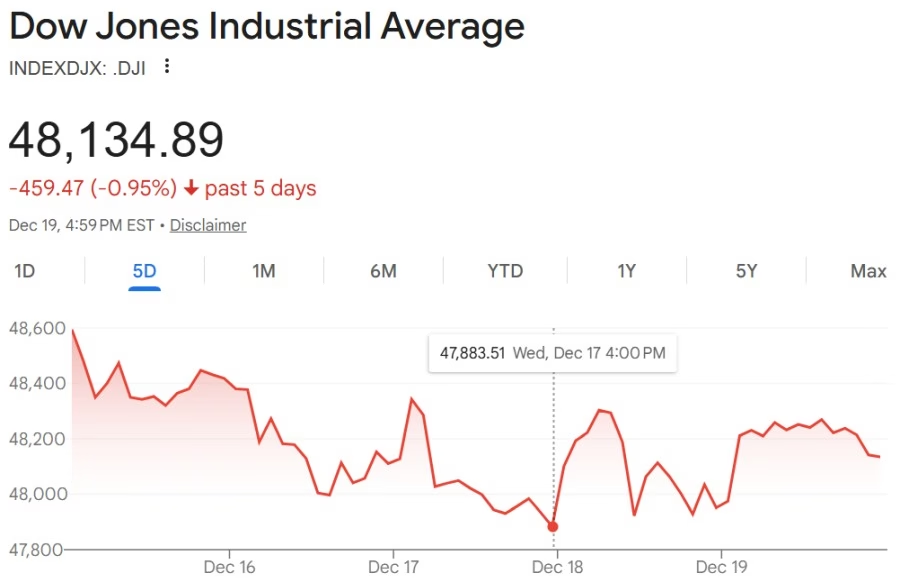

Stocks/Equities: A mixed week. All three major indices fell until close of business Wednesday, before rallying through the remainder of the week.

Gold/Silver: Gold and silver both up this week. Silver keeps making new (non inflation adjusted) all time highs, closing above $65/oz for the first time ever.

Cryptocurrency: A choppy week. Still impossible to say which way the market’s going to go in the short term.

Bonds/US Dollar: Bond yields slightly down. USD slightly stronger.

Stocks:

At close of business on Wednesday it looked as if we were in for a very rough week indeed, but stocks then staged rallies Thursday and Friday. This was seemingly due to lower than expected inflation numbers being released by the US Bureau of Labor Statistics (BLS)-leading to higher expectations of Federal Reserve (Fed) rate cuts in 2026:

Couple of points worth mentioning (all of which have been discussed here previously):

1) The Fed is supposed to have a “dual mandate” of maintaining low inflation and high employment:

The Fed and the Dual Mandate | In Plain English | St. Louis Fed

That’s its stated purpose; not its real purpose (a discussion for another time). Regardless-it’s more likely to cut rates when inflation is already low and unemployment is rising-both of which are occurring right now.

2) Lower interest rates boost the prices of riskier assets like stocks and cryptocurrencies, because if members of the public are able to obtain a decent rate of return from a low risk, FDIC insured, CD (certificate of deposit), money market account, or even a savings account, they don’t need invest their money in anything riskier.

3) Cutting interest rates can fuel inflation (i.e., cause higher prices), which is why the Fed is usually reluctant to lower its cost of borrowing whenever it believes prices are elevated.

4) There’s a famous saying; “there are lies, damned lies, and statistics”. Bear this in mind when reading any figures released by any government. Despite paying for them with our taxes, we have no oversight as to the integrity of them, or the people compiling them. They’re very often revised at a later date, anyway-meaning their usefulness is at best-limited.

5) When inflation is described as “lower” it doesn’t mean prices are falling-something which I think is extremely deceptive. All it means is that prices aren’t rising quite as quickly as they were compared to say, last month, or this time last year. I think we all see that-every time we visit the supermarket, or doing our Christmas shopping, for example.

Anyway, for now it looks as though more Fed interest rate cuts are incoming, and the stock indices, overall, will continue to rise as a result. At least for the time being.

Here are this week’s indices; despite all of them being colored red, none of them have moved that much in the past seven days, and they’re all still very close to the all time highs they all reached only earlier this month:

nasdaq composite – Google Search

Gold/Silver:

Both up this week, especially silver. More silver all time highs (although not adjusted for inflation).

Gold closed the week up $20 (~0.5%) at $4,350 (was $4,330 last Friday). It again remained above the key $4,000/oz support level (moving forward, I may increase gold’s key support level to $4,200/oz).

Silver closed the week up at $67.35, up $5.27 or ~8% since last Friday. Quite an incredible run to see out the year. When it corrects (as it inevitably will-it did so in the second half of October, falling from $54 to $47), afterwards, I do expect it to continue rising again. Surely it will reach $100/oz in 2026.

Gold/Silver Ratio: Fell again to 64.6 (was 69.7 last Friday)-due to silver climbing far more than gold this week. This is the lowest it’s been in a while-overall, good news for both gold and silver, in my opinion. First time it’s been in the 60s since July 2021 (incidentally, gold was around $1,800 and silver $26 at the time-would have been great buying opportunities for both).

Cryptos:

Yet another choppy week in Cryptoworld-although in the end, there’s been very little change from a week ago.

One important recent Crypto story is that Texas has become the first US State to fund its proposed Strategic Bitcoin Reserve:

Texas becomes first state to fund cryptocurrency reserve with $5 million bitcoin purchase

It announced an initial purchase of $5m worth of BTC the week before last, followed by an additional $5m on Wednesday:

Texas Doubles Bitcoin Buy With Second $5 Million, Bringing Holdings To $10 Million

I’m delighted that my adopted home is leading the way here-no doubt other US States, and hopefully the US Federal Government (as well as other countries), will follow suit. However, as usual, such bullish news has not translated into a higher Bitcoin price (at least not yet). I think this may be partly due to the fact that for Texas, $10m isn’t all that much money. As of 2024, if Texas were a country, it would boast the 8th largest economy in the world-ahead of the likes of Canada and Russia:

God Bless the Lone Star State.

Crypto prices on the week:

Bitcoin’s down $300 at around $88,000.

Ethereum’s level at around $3,000.

BTC/ETH ratio: Up to 29.6 (was 29.4 last Friday).

Ripple (XRP) down $0.10 at around $1.90.

Solana’s down $5 at around $125.

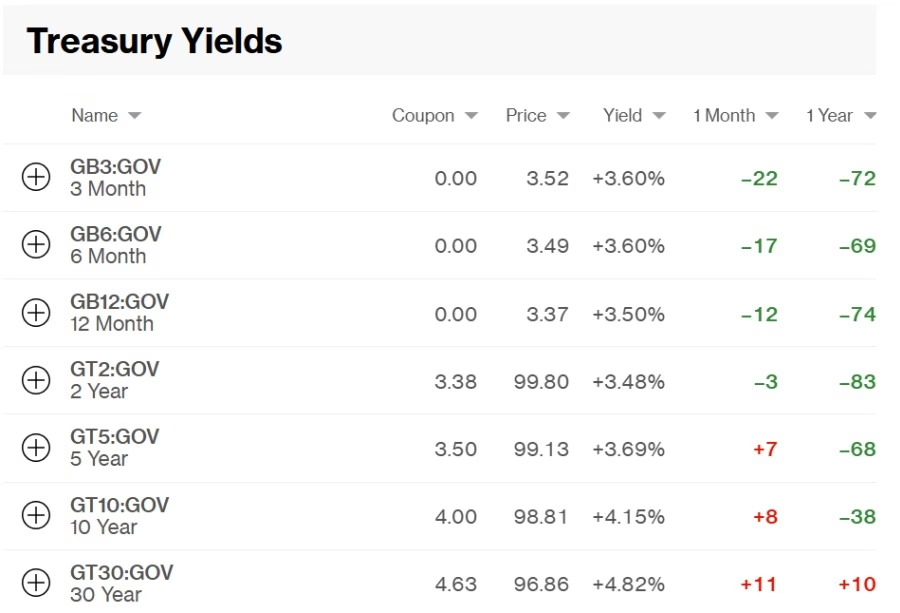

Bonds/US Dollar:

The US Treasury 10-year bond yield fell slightly this week, reversing a two-week-long upward trend. It’s now at 4.15% (was 4.18% as of last week).

The 30-year bond yield fell very slightly by 2 basis points (was 4.84%, now 4.82%), so also lower. This means the bonds’ prices have risen this week, since bond prices and yields are inversely correlated.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar strengthened very slightly against the Swiss Franc. Last week, it cost $1.26 to buy 1CHF. This week, it’s less expensive at $1.25. The exchange rate remains fairly range bound at the moment; one Swiss has cost between $1.22-$1.27 since June.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know. And keep warm out there.

Good luck and happy investing-and Merry Christmas to you all.

Tom Curran