By Bruce Cline, Gulf Coast Home Loans

If you’ve lived or owned property on the Bolivar Peninsula long enough, you already know the market out here can change direction quicker than a pelican diving for a morning mullet. And while we’re not seeing a rush of investors at the moment, a few early signs suggest 2026 could look a whole lot different, especially for folks interested in buying coastal rentals using DSCR loans.

This isn’t a report on what’s happening today. It’s more of a look at the clues, the conversations, and the numbers that are starting to point us toward what might be headed our way. We’re nowhere close to another “golf-cart migration” like we saw a few years back, but the signs are definitely showing up—and I’ve been watching them like a seagull hovering over an unattended bag of chips.

What the Forecasts Suggest for 2026

Rates Could Ease Up

Most major housing economists, including Fannie Mae’s forecasts, are leaning toward mortgage rates sliding into the low 6’s or even the upper 5’s sometime in 2026. It’s not a guarantee, but it’s the first bit of encouraging rate talk we’ve had in a while.

Rental Demand Still Looks Steady

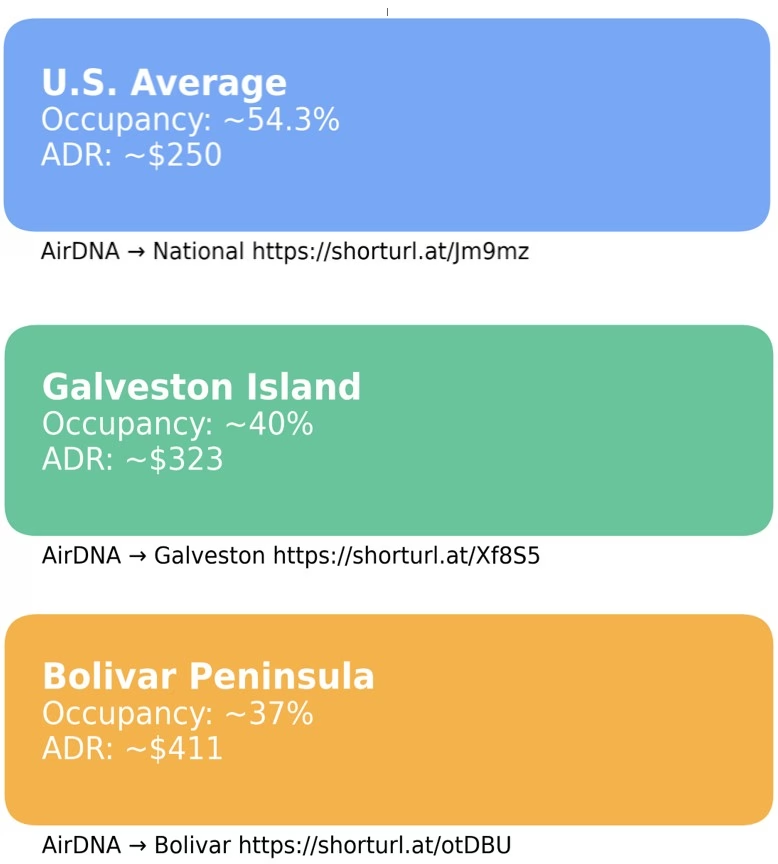

Bolivar’s short-term rental numbers have held up pretty well

- Occupancy: around 37%

- Average Daily Rate (ADR): about $411

These aren’t sky-high numbers, but they represent a stable base for a moderately priced coastal market—especially compared to the larger, pricier destinations across Texas.

Inventory Should Improve

Across many Gulf Coast markets, listings are lasting a little longer, which usually leads to more negotiation room, more options for buyers, and less pressure to rush into the wrong property.

Home Prices Expected to Grow Gradually

Most 2026 projections fall in the 1–3% appreciation range. No big spikes, but no major dips either—a steady, healthy pace that tends to benefit investors focused on long-term rental performance rather than quick flips.

A Quick Reality Check on National Short Term Rental Trends

On the national level, short-term rentals are still growing—just not exploding like they were in 2021. Airbtics projects demand cooling from 15.8% (2021) to around 5.5% (2026). That’s still growth, just not the rocket-fueled growth we saw during the post-pandemic travel surge.

It’s important to remember that the national slowdown is mostly coming from major metro destinations that overbuilt STR supply. Markets like Nashville, Scottsdale, Austin, and Orlando added thousands of new rentals at once—far more than the demand could support.

Bolivar Peninsula / Crystal Beach is not that. We’re:

- smaller

- more affordable

- less saturated

- still under the radar

- not fighting city-wide Airbnb restrictions

In other words, what hurts the big cities doesn’t necessarily apply here.

Short-term rental data for the Bolivar market shows an annualized occupancy of about 37% and an ADR around $411. Keep in mind, though, this market is highly seasonal — occupancy can climb much higher in peak months and drop significantly in the off-season, so building a realistic model with both cycles in mind is essential.

I contacted Janice Grossheim from Bolivar Escapes to get a real, local perspective on what rental demand might look like in 2026.

When I asked her what she expected for the coming rental season, she didn’t hesitate:

“We have seen a noticeable increase in demand over the past year. Given the significant increase in marketing and development efforts from local businesses across the peninsula, I anticipate the 2026 rental season will show substantial improvement compared to the last couple of years.”

I also asked if interest from out-of-state renters was picking up. She confirmed:

“Yes, we are definitely seeing increased interest from out-of-state visitors, and this trend applies to both renters and potential buyers.”

Finally, I asked her which homes are performing best and are likely to continue doing well next year:

“Properties that consistently perform best are larger homes that can accommodate 12 or more guests, especially those with amenities like hot tubs or private pools. Location is key; beachfront properties or homes with excellent beach views are always in high demand. Additionally, having attractive, interactive amenities, such as a tiki bar, cornhole, or other lawn games, is a great advertisement that drives bookings. Being ‘Pet Friendly’ is always a plus.”

These local insights line up with what we’re seeing in early data and buyer activity. While nothing is guaranteed, the ingredients for a stronger 2026 rental season are beginning to show—steady demand, growing visibility, and continued interest from both Texas and out-of-state travelers.

Next month, we’ll wrap up this two-part series by shifting from what’s likely to happen in 2026 to what you can actually do to prepare for it. With interest rates expected to ease, inventory improving, and rental demand showing early signs of strengthening, December’s article will focus on turning all of this into a practical plan for buyers, homeowners, and investors.

We’ll cover:

• How to position yourself for the best buying window in 2026

• Simple ways to evaluate cash flow on a beach rental

• What matters most when choosing a DSCR-friendly property

• Key market signals to watch as spring approaches

If you’re considering buying, refinancing, or investing on the Bolivar Peninsula, the final part of this series will give you a clear, usable roadmap heading into the new year.

If you want something to dig into before then, you’re welcome to check out the new 25-question mortgage FAQ I’ve added to my website — it’s a quick, helpful guide for buyers, homeowners, and investors at every stage.

About The Author

Bayside Bruce Cline is the only independent, locally based mortgage broker in Crystal Beach, TX, serving the Bolivar Peninsula and greater Galveston County. As founder of Gulf Coast Home Loans powered by NEXA Lending, Bruce shops more than 250 wholesale lenders to find the right loan program for each borrower — including VA, FHA, Conventional, Non-QM, DSCR, HELOC, and Reverse Mortgage options.

Learn more at GulfCoastHomeLoans.com.

Most Frequently Asked Mortgage Questions at MORTGAGE FAQ