For starters — did you know you can purchase a home with a reverse mortgage?

That’s right. Reverse mortgage programs have evolved far beyond what most people remember. Today’s version is one of the safest, most flexible, and most carefully regulated mortgage programs in America — fully backed and insured by the FHA.

Whether you already own a home and want to unlock your equity, or you’re ready to buy your dream place by the water without a monthly mortgage payment, a reverse mortgage might be one of the smartest tools available for homeowners age 62 and over.

What Exactly Is a Reverse Mortgage?

A Reverse Mortgage (officially called a Home Equity Conversion Mortgage, or HECM) allows homeowners aged 62 and above to convert part of their home’s equity into tax-free funds — without selling or taking on a monthly mortgage payment.

The program is FHA-insured, meaning it’s federally backed and designed with multiple consumer protections. Just like any “forward” mortgage, borrowers remain on the title, continue living in the home, and simply keep up with property taxes, homeowners’ insurance, and basic maintenance.

What’s New: Reverse for Purchase

Here’s the part many people don’t know — you can use a reverse mortgage to buy a new home. It’s called a HECM for Purchase, and it’s an incredible option for retirees looking to right-size, relocate closer to family, or buy their dream home by the bay.

Here’s how it works:

- You make a down payment (usually 40–60%, depending on age and rates, often coming from the equity from the departing residence).

- The reverse mortgage covers the rest — with no required monthly mortgage payment.

- You own the home, live in it as your primary residence, and never make principal or interest payments for as long as you live there.

Imagine selling your current home, buying your next primary home in Crystal Beach, and keeping a large portion of your sale proceeds invested or available for travel, medical needs, or simply peace of mind. That’s the power of a HECM for Purchase.

FHA-Backed and Built for Safety

The modern HECM program was completely restructured after 2008. These aren’t the “Wild West” loans of the past — they’re designed to protect homeowners and their heirs. Here are some of the safeguards that make today’s HECM one of the most consumer-friendly products on the market:

✅ FHA Insurance protects both the borrower and lender.

✅ Mandatory HUD Counseling ensures borrowers fully understand the program before moving forward.

✅ Non-Recourse Feature guarantees that neither you nor your heirs will ever owe more than the home’s value.

✅ Flexible Payout Options — receive funds as a lump sum, monthly income, or line of credit.

Myth-Busting: Common Reverse Mortgage Misconceptions

Let’s clear up some of the biggest myths:

Myth 1: “The bank owns my home.”

False. You keep the title. The bank simply holds a lien, just like any other mortgage.

Myth 2: “My kids will lose their inheritance.”

False. Your heirs can sell or refinance the home to pay off the loan — and they’ll never owe more than the home’s current value, thanks to FHA insurance.

Myth 3: “It’s only for people in financial trouble.”

False. Many financially savvy retirees use HECMs to strategically manage wealth, delay Social Security, or preserve investment portfolios.

Myth 4: “If I move out, I lose everything.”

Not true. If you eventually sell or move into assisted living, the loan is repaid from the sale — and any remaining equity still belongs to you or your estate.

Who Qualifies?

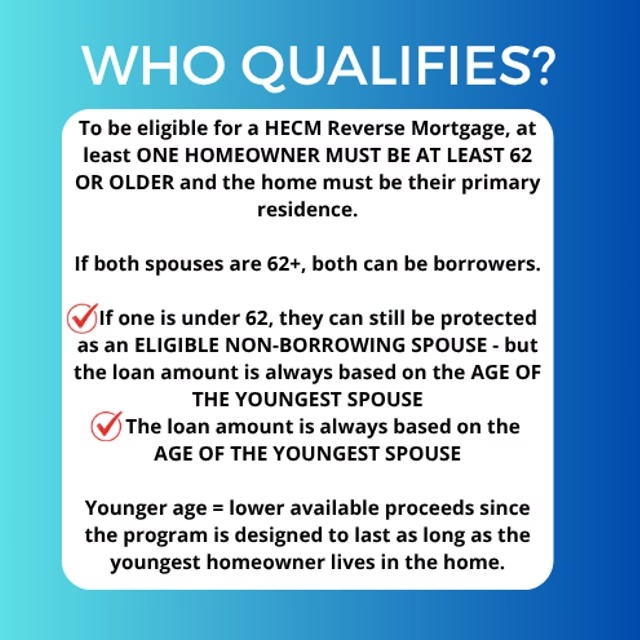

To be eligible for a HECM Reverse Mortgage, at least one homeowner must be 62 or older and the home must be their primary residence.

If both spouses are 62+, they can both be borrowers.

If one is under 62, they can still be protected as an eligible non-borrowing spouse — but the loan amount is always based on the age of the youngest spouse.

Younger age = lower available proceeds, since the program is designed to last as long as the youngest homeowner lives in the home.

Strategy Corner: Turning Home Equity into Coastal Freedom

Here’s a strategy most homeowners have never heard of — but it’s one of the smartest ways to leverage a reverse mortgage.

If your beach home or investment property is here on the Bolivar Peninsula, but your primary residence is somewhere else, you can use a reverse mortgage on your primary home to unlock tax-free funds. Those proceeds can then be used to purchase, remodel, or invest in your coastal property — all without taking on a new monthly payment.

Example:

Let’s say a couple in League City, both age 68, own their home free and clear.

They take out a HECM line of credit and access roughly $300,000 in available funds.

They use $200,000 to buy a smaller bay house in Crystal Beach (40 – 60% down payment).

The remaining $100,000 stays in their reverse line of credit — which actually grows over time for future needs.

They now own two homes, have no monthly mortgage payments, and maintain complete control of their finances.

Later, if they decide to make the beach their permanent home, they can sell the original property, pay off the reverse mortgage, and even use a HECM for Purchase on their new Crystal Beach home to start fresh — again, with no monthly mortgage payments.

It’s a powerful, FHA-insured way to build flexibility and financial peace of mind in retirement.

The Bottom Line

Reverse Mortgages today are not the risky loans of yesteryear. They’re FHA-insured, transparent, and built to empower homeowners with flexibility, security, and choice. For many along the Gulf Coast, they’re helping turn the dream of living out retirement by the water into a safe, sustainable reality.

If you’d like to see whether a HECM or Reverse Purchase could work for you or your loved ones, reach out to me anytime. My partnership with NEXA Lending provides a dedicated division whose sole purpose is Reverse Mortgage. I’m happy to walk you through the numbers, answer every question, and help you explore your options.

About the Author

Bayside Bruce Cline is the only independent, locally based mortgage broker in Crystal Beach, TX, serving the Bolivar Peninsula and greater Galveston County. As founder of Gulf Coast Home Loans powered by NEXA Lending, Bruce shops more than 250 wholesale lenders to match each borrower with the right program — from VA, FHA, and conventional loans to non-QM, DSCR, HELOC, and reverse mortgages. Learn more at GulfCoastHomeLoans.com.