Welcome to this week’s edition of Curranomics. I’ve been away for a few weeks, but now I’m back; I couldn’t possibly leave the storied Crystal Beach Investor Center unattended for too long.

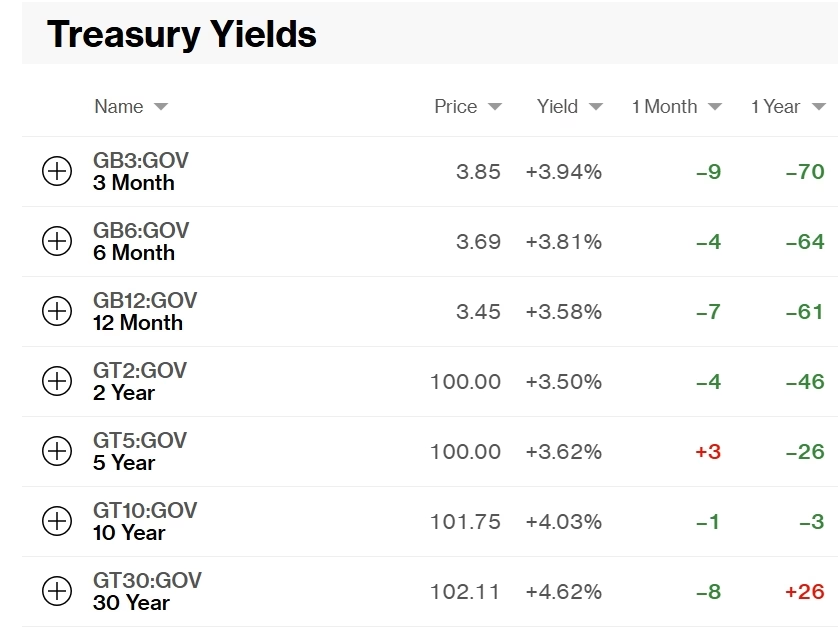

TL/DR (Too Long/Didn’t Read) Summary: Was a mostly uneventful week until today when a mere mention of the word “tariffs” was enough to roil the markets. Riskier assets (stocks, cryptocurrencies) are down sharply, safe haven assets (precious metals, US Treasuries) are up.

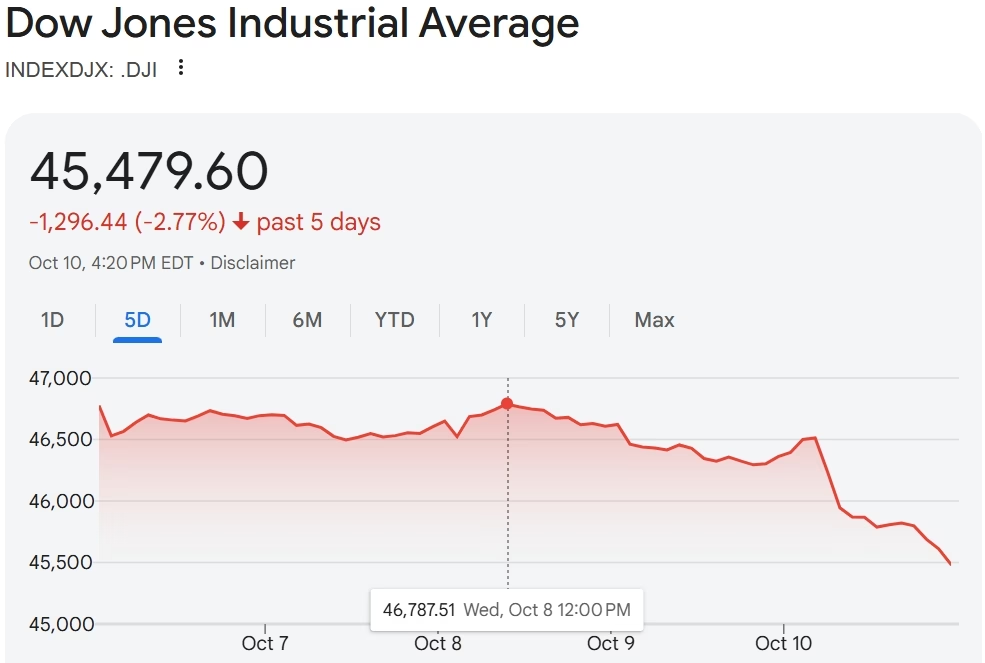

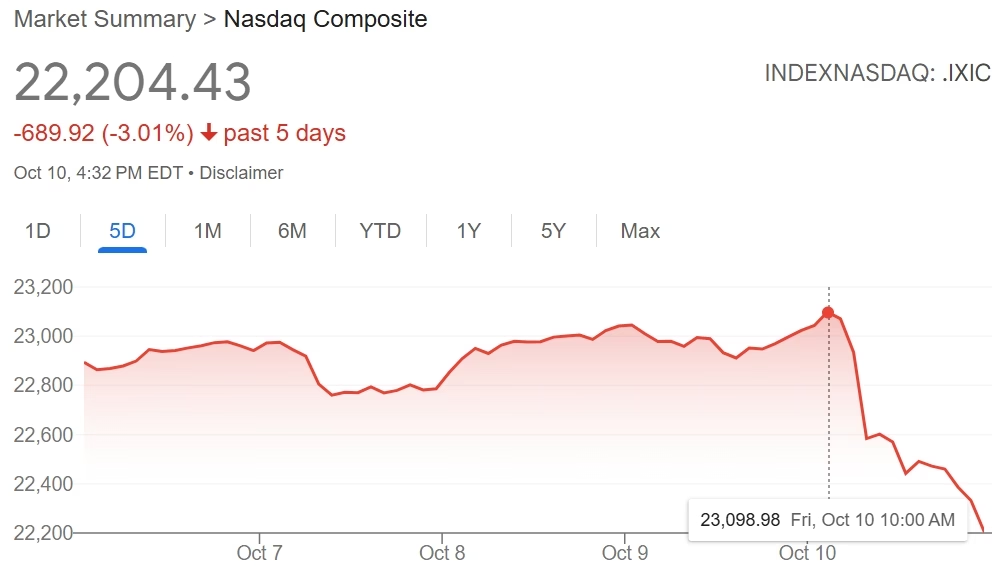

Stocks/Equities: Ended down this week-however, all major indices remain around all time highs.

Gold/Silver: Gold hit $4,000/oz for the first time ever this week. Hurrah! Likewise, silver finally breached the magic $50 level. Double Hurrah!

Cryptocurrency: A terrible week. Bitcoin hit a new all time high of over $126k on Monday, before falling for the rest of the week, especially today. Currently sits at around $114k.

Bonds/US Dollar: Bond yields down and prices up, USD level.

Stocks:

Stocks were having a decent week until this morning:

I thought we’d agreed not to mention tariffs ever again on Curranomics? Oh, well. I guess this publication hasn’t reached as far as the White House…yet.

Actually, I think it’s a timely reminder of how fragile today’s stocks are-when all it takes is one word from a powerful figure to send the markets tumbling. Remember how terrified the investing world was the last time tariffs were dominating the news cycle-back in April? I know I was-I sold some of my stocks during a bounce in what I thought was becoming a bear market, only to buy them back again shortly afterwards (and I’m very glad I did so).

I’ve said time and again that I think the all time highs we’re seeing in stocks aren’t based on anything solid; they’re artificially inflated because of all the currency which was printed during Covid having to go somewhere; the growth of just four companies (Meta, Microsoft, Nvidia, and Netflix) is carrying thousands of others; none of them have produced a new or innovative product or service in ages; and the endless speculation on whether or not the Federal Reserve is cutting interest rates is a massive waste of time and energy which could be better spent elsewhere.

However, I’m not panicking. The Fed IS expected to make small cuts to its funds rate at the end of October and the beginning of December, the final two FOMC (Fed Open Market Committee) meetings of 2025, and with 2026 being a midterm election year in the US, there’s no doubt Trump and Vance (who’s probably the President in waiting) will want voters feeling good about their stock portfolios. Sure, the party can’t last forever. But I don’t think today’s activity means it’s over, regardless of how brutal it’s been.

So, in summary-all the major US indices are down significantly on the week. However, they remain only slightly below their nominal all time highs-which, for the Nasdaq was reached as recently as this morning (no, really), the S&P yesterday, and the Dow Jones, all the way back on October 3rd (i.e., last Friday):

nasdaq composite – Google Search

Gold/Silver:

A historic week for gold and silver, continuing the upward trajectory they’ve both been on since the beginning of this year. Although remember, this is more an indication that the currencies they’re priced in (mainly US Dollars) are losing value, rather than gold and silver gaining in value-after all the metals themselves haven’t suddenly become any more useful or valuable (or scarce, as far as I know).

Gold crossed $4k per ounce for the first time on Tuesday, and silver $50 per ounce yesterday (it actually briefly exceeded $51, before falling to close Thursday on $49.19). Note that unlike gold at $4k, silver HAS reached $50 before-once, on intraday trading on Thursday January 18th 1980, it reached $50.35:

When Did Silver Hit $50 an Ounce? A Brief History – Accounting Insights

However, today is the first day silver’s ever CLOSED above $50. For everyone who’s been a long term investor in precious metals this is huge news-especially for those poor sods who bought at the last market peak in 2011 and have been sitting on losses ever since. I had to laugh when I read an article dated Wednesday October 8th, when silver was already north of $49, in which some “silver market gurus” (named Morgan and Butler, but who they are isn’t important, as you’ll see) were quoted as follows:

When will silver hit US$50? Both Morgan and Butler agree the market may not see US$50 this year, and that’s probably a good thing.

Before we get there, silver market guru Morgan thinks we’re likely to see a “big shake off” in the price, potentially this October. Butler sees silver crossing the US$50 level, or the Rubicon as Morgan put it, perhaps early next year.

Silver’s New Price Era: What Happens at US$50 and Beyond? | INN

Mmm…when will silver hit US$50? Er-how about within 20 hours of this article being published, geniuses? Wow, didn’t see that one coming. Silver’s literally pennies short of a major milestone, and has enjoyed significant upwards momentum all year. Yeah, I agree; no idea when it’s going to happen.

Call me psychic, but I DID see that one coming-this year. And I’m no “silver market guru” or anything. Just goes to show you, be very careful of anyone who’s portrayed in the media as a “guru” or “expert” on anything. Do your own research, and make your own decisions.

Gold closed the week at $4,031, up $78 or ~2% since last Friday.

Silver closed the week at $50.14, up $1.88 or ~4% since last Friday.

Gold/Silver Ratio: Remains just above 80. It’s now 80.4 (was 81.9 last Friday).

Cryptos:

A typically volatile week in Cryptoworld. Having hit a new all time high on Monday of just over $126k, as I write this, Bitcoin’s now trading significantly lower at $114k-and it doesn’t look as if it’s done falling yet. Take a look at the below 1 hour Bitcoin price chart from Coinbase (America’s largest Cryptocurrency exchange-which I know sounds like an advert for it, but it isn’t-they simply happen to have the most up to date graphs):

I’m writing this sentence at 4.36pm, CST. Which means that 11 minutes ago, Bitcoin was over seven grand lower than it is now. That’s one hell of a flash crash. I’ve seen many of these before (they’re inevitable if you’re going to be a Crypto investor), but that doesn’t mean I’m no longer shocked by them. I don’t know what caused this one, but overall I do remain confident in a good end to the year for the Crypto sector-as crazy as that probably sounds on a day like today.

Prices on the week:

Bitcoin’s down $9k at around $114k.

Ethereum down $700 at around $3,800.

BTC/ETH ratio: Up to 29.6 (was 26.7 last Friday). I think we remain in an overall downward trend here-which is bullish for the entire asset class. We’re at the end of the now established 4-year Crypto cycle when this ratio usually falls to the 12-15 range-which, assuming it does the same thing this time around, will NOT be reached in a straight line.

Ripple (XRP) down 18% at around $2.50.

Solana’s down 14% at around $200.

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

Bonds/US Dollar:

The US Treasury 10-year bond yield is now at 4.03% (was 4.06% as of the last Market Update, so a little lower). The 30-year bond yield decreased by 6 basis points (was 4.68%, now 4.62%), so also lower on the month. This means the bonds’ prices have risen, since bond prices and yields are inversely correlated. Likely as a result of tariff induced market turmoil in riskier assets.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar remained the same this week against the Swiss Franc-like last week, it still costs $1.25 to buy 1CHF. Seems fairly range bound at the moment; one Swiss has cost between $1.22-$1.27 since June.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran