Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center. If you prefer, you can read this article at News – Crystal Beach once it’s been published.

This will be the final market update for at least a few weeks.

TL/DR (Too Long/Didn’t Read) Summary: All asset classes performed well. Poor employment data followed by fairly low inflation numbers essentially cemented next week’s Fed funds interest rate cut, which is expected to boost all markets.

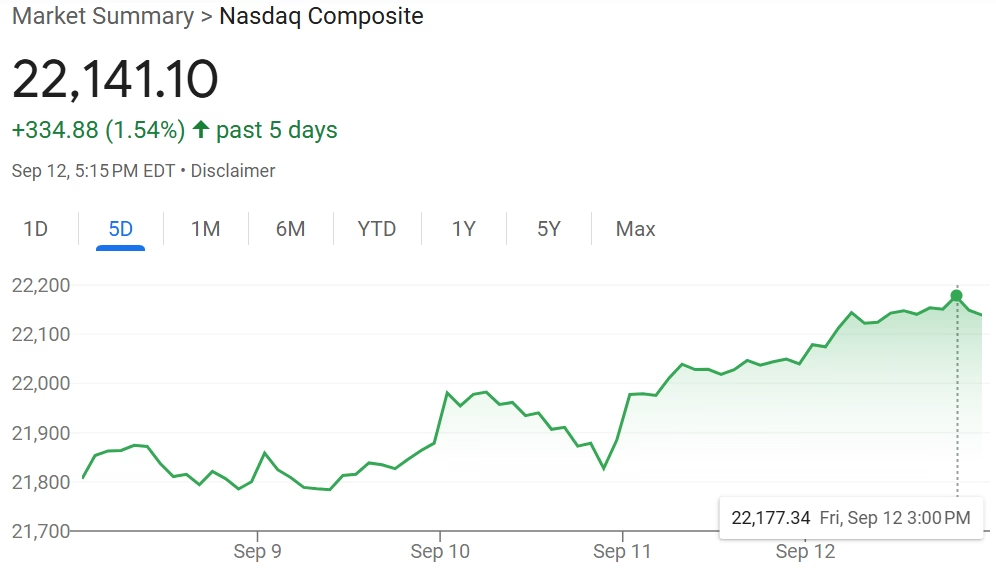

Stocks/Equities: Ended slightly up this week-all major indices remain around all time highs.

Gold/Silver: Up significantly again, for the second consecutive week. Gold ($3,656), Silver ($42.36).

Cryptocurrency: Was quiet until the “cooler” inflation numbers were released on Thursday. Since then has been rising steadily.

Bonds/US Dollar: Bond yields down, USD level-for the second consecutive week.

Special Topic: IMF (International Monetary Fund) Loans

Stocks:

The main items of US news this week were the most recent unemployment data:

US economy added 911,000 fewer jobs than previously reported in largest-ever revision – ABC News

Second, there was official price inflation data:

Wholesale inflation cooled in August as businesses absorb tariff costs — for now | CNN Business

So. Bad jobs data and relatively low inflation. Both of which support the prospect of America’s central bank, the Federal Reserve, lowering interest rates when its FOMC (Fed Open Markets Committee) meets next week. The result of which will be announced on Wednesday, September 17th. One small point I would make here is the deceptiveness of inflation data, generally. Not that you can believe inflation data at the best of times-it’s always massaged to make it look lower than it really is-but when it’s proudly announced by some government suit that “inflation is lower than last month/year”, it doesn’t mean prices are falling-all it means is that they’re (allegedly) rising at a slower rate. Constantly rising prices are already obvious to anyone who’s set foot in a supermarket within the last month. These are deliberately confusing weasel words, in my opinion-typical of mainstream economists.

Also, I wonder if the rate cut’s already been “priced in”. Meaning that as it’s now been talked about for so long, the market’s already reacted to it as though it’s happened-and when the announcement’s made on Wednesday, it will now have almost no effect. However, if the Fed announces a 0.5% rate cut instead of the expected 0.25% cut, then this WILL propel the markets higher.

All the major US indices are up slightly on the week, and remain at or around their nominal all time highs:

nasdaq composite – Google Search

Gold/Silver:

Very good week for gold and silver, continuing the upward trajectory they’ve both been on since the beginning of this year. Although remember, this is more an indication that the currencies they’re priced in (mainly US Dollars) are losing value, rather than gold and silver gaining in value.

Gold closed the week at $3,656, up $56 or ~1.6% since last Friday. Another all time high-gold’s already up 39% so far this year. I remain bullish on gold in the medium-long term.

Silver closed the week at $42.36, up $1.17 or ~3% since last Friday. Closing decisively again above $40 is great news for silver, and very promising for its short term price action. Of course, that’s only a nominal value; due to inflation, silver would have to be significantly higher to match the 2011 price of $40. Still-fingers crossed silver will reach $50/troy oz before too long. Silver’s up 46% so far this year.

Gold/Silver Ratio: Remained below 90. It’s now 86.3 (was 87.4 last Friday).

Cryptos:

Was a static week until yesterday (Thursday) and the supposedly “cooler” inflation data. Since then Crypto’s moved decisively upwards-Solana being the best performer of the biggest coins. Bitcoin and Ethereum are close to recapturing their all time highs, which I expect them to do in October-if not sooner, depending on how they react to next week’s expected Fed funds interest rate cut.

Prices on the week:

Bitcoin’s up $5k at around $116k.

Ethereum up $400 at around $4,700.

BTC/ETH ratio: Down to 24.7 (was 25.8 last Friday). I think we remain in an overall downward trend here-which is bullish for the entire asset class. We’re at the end of the now established 4-year Crypto cycle when this ratio usually falls to the 12-15 range-which, assuming it does the same thing this time around, will NOT be reached in a straight line.

Ripple (XRP) up 11% at around $3.11.

Solana’s up 21% at around $243. Definitely this week’s winning asset.

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

Bonds/US Dollar:

One point I didn’t make clear in last week’s special topic on bonds-is that despite the fact they’re the biggest financial asset class on the planet, I’m not really a big fan of most major types of them. In my opinion, bonds enable theft of future prosperity to cover today’s costs-most of which, if we were required to pay for up front (like wars, big government, etc.), we’d never agree to. To be clear-this opinion applies to national government bonds. On the other hand, I’m a big fan of supporting our local communities-so, for example, a school district issuing a bond to build a new sports stadium, can be a good thing-creating jobs, etc. There’s also significantly more accountability, as it’s much easier for the locally based bond holders to keep a check on the school district’s purse strings. By contrast, when our money is sent “to Ukraine” (for example), we don’t exactly receive an itemized bill, do we?

Anyway.

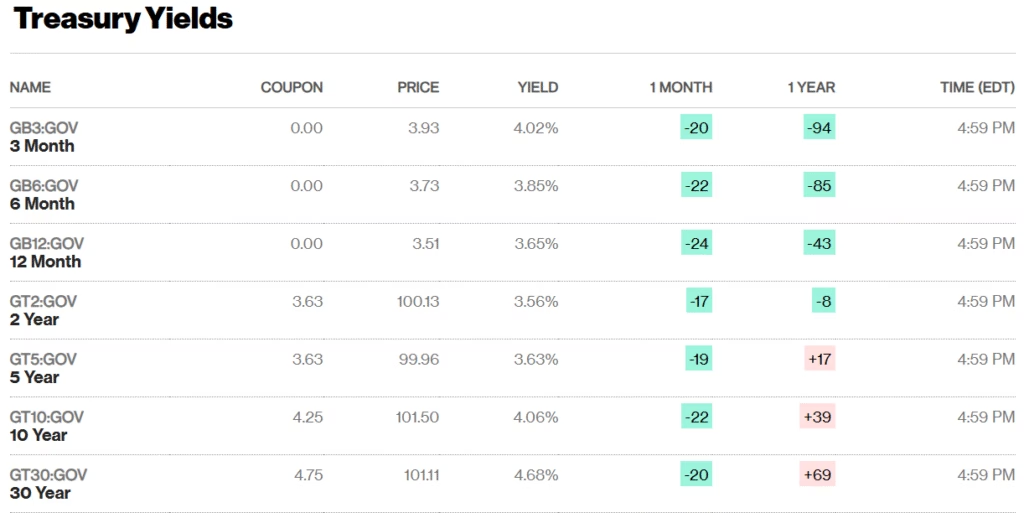

The US Treasury 10-year bond yield is now at 4.06% (was 4.07% last week, so basically unchanged). The 30-year bond yield decreased by 8 basis points (was 4.76%, now 4.68%), so also lower on the week. Likely as a result of pricing in the Fed’s expected rate cut. As I’ve said many times, all this market activity based upon whether or not America’s privately owned central bank is going to cut interest rates, to me, is not a sign of a healthy and productive economy. If all the energy and attention focused on the Fed went into producing quality goods and services that people were willing to pay for in a free market, we’d all be better off.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar remained the same this week against the Swiss Franc-like last week, it still costs $1.25 to buy 1CHF.

Special Topic: IMF Loans

Two weeks ago, I commented that I’d heard a rumor that Britain and France were considering requesting loans from the International Monetary Fund, or IMF. Interestingly, France’s government has apparently since imploded:

France’s government has collapsed again. How did we get here and what’s next? | CNN

The outgoing prime minister had this to say, which I thought was rather good: “You have the power to bring down the government, but you do not have the power to erase reality,” he told lawmakers. “Reality will remain relentless: expenses will continue to rise, and the burden of debt, already unbearable, will grow heavier and more costly.”

He’s certainly right about that.

Anyway, the IMF was created in 1944 as part of the Bretton Woods agreement, and is based in Washington DC, although most countries in the world are members of it. For anyone who doesn’t know who the IMF is and what it does, here’s an explanation from its own website:

The International Monetary Fund (IMF) works to achieve sustainable growth and prosperity for all of its 191 member countries. It does so by supporting economic policies that promote financial stability and monetary cooperation, which are essential to increase productivity, job creation, and economic well-being.

Britain has borrowed from the IMF in the past, in 1976 (my late father and I discussed this dark period of Britain’s history on many occasions). France-I’m unsure about. I mentioned last week that I don’t know why a sovereign country with access to a central bank which can create bank reserves in its own currency would need to go to the IMF for a loan-as the loan would be denominated in an alternative currency (although which one I’m unsure about also)-possibly either US Dollars, or the IMF’s own unit of account-the Special Drawing Right (SDR), described as follows:

What is an SDR? Is it money? Special Drawing Rights (SDRs) are an asset, though not money in the classic sense because they can’t be used to buy things. The value of an SDR is based on a basket of the world’s five leading currencies – the US dollar, euro, yuan, yen and the UK pound. The SDR is an accounting unit for IMF transactions with member countries – and a stable asset in countries’ international reserves.

The official reason given that it’s better for a country to borrow from the IMF is because if they create the currency themselves, this creates price inflation. However-per the IMF, SDRs “can’t be used to buy things”. Which would suggest it’s purely a reserve circuit asset-so it stays in the banking system, and wouldn’t cause retail price inflation. It isn’t very well known, but there are in fact two totally separate circuits of money, which don’t interact with one another. The “reserve” circuit (also known as the wholesale or base money circuit), which the central banks, national governments, and the commercial/high street banks exist within, and the “bank money” circuit (also known as the retail money circuit), within which everyone else exists. The commercial/high street banks are the link between the two-they have the unique ability to create and circulate retail money, of which they are responsible for some 97% (the central bank creates the other 3% or so). Which is an EXTREMELY long way of saying that if SDRs remain in the reserve circuit, they don’t cause retail price inflation.

In addition, the countries who’ve taken significant loans from the IMF, many of them African, seem to have been economically ruined by them. The only countries which have ever developed (i.e., moved from developing to developed status), are Japan, Singapore, South Korea, Taiwan, and since 1978, China. They seem to have developed by decentralizing their banking systems, and creating many thousands of local banks and credit unions, lending money to small businesses and farms, for the purpose of productive investment (i.e., not consumption, or asset purchases). Incidentally, only five nations EVER developing economically is an extremely dismal record for an organization (the IMF) which, since 1944-as stated above, has “work(ed) to achieve sustainable growth and prosperity for all of its 191 member countries”. Mmm.

Anyway-the question of whether or not it’s in a country’s best interests to borrow from the IMF, rather than creating the money itself, is a complex issue, to which I don’t know the answer as yet. Up to now, I don’t think it is; after all, the IMF is simply another branch of the international bankster cartel, whose aim is to further consolidate wealth amongst its owners, not ensure prosperity amongst the citizens of its member countries (as is its stated aim). I’ll plan to report back on this item in a few weeks’ time. Until then, my guess is that if Britain and France DO borrow money from the IMF, the public will pay the price-as usual.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran