Welcome to this week’s edition of Curranomics® from the Crystal Beach Investor Center. There is some breaking news I’ve just become aware of, although I don’t have time to comment on it this week-which are the rumors that the UK and France, the world’s 6th and 7th largest economies respectively (according to 2024 data produced by the World Bank-link below), are on the verge of requesting loans from the International Monetary Fund (IMF).

https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?most_recent_value_desc=true

It’s only a rumor at the moment, but if it develops, I’ll comment on it next week. On to this week’s market update:

TL/DR (Too Long/Didn’t Read) Summary

Stocks/Equities: Ended basically unchanged this week.

Gold/Silver: Up slightly this week. Gold ($3,463), Silver ($39.88).

Crypto: Down significantly. Worst week for crypto for some time.

Bonds/US Dollar: Bond yields mixed, USD down.

Special Topic: The Federal Reserve (again).

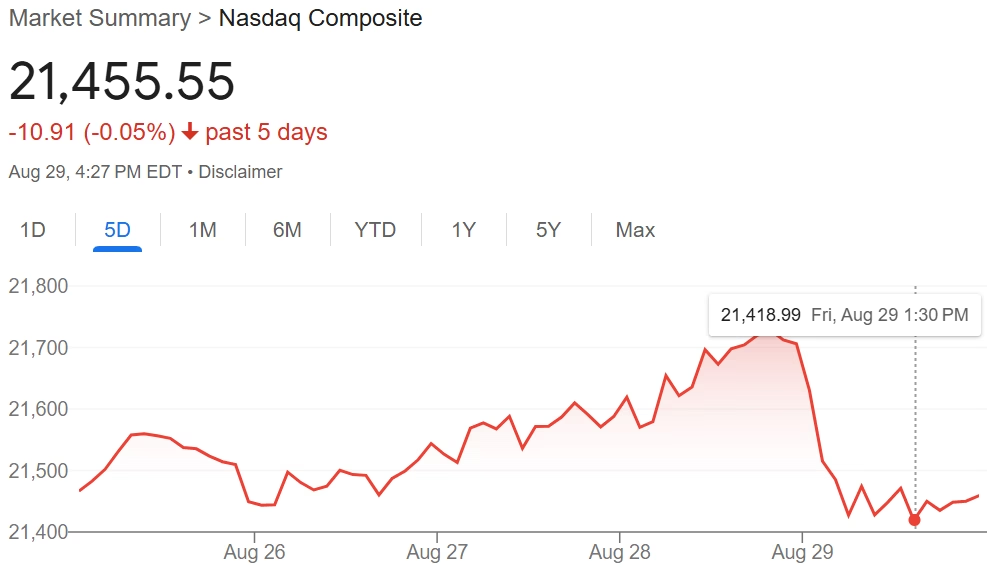

Stocks: One of the main items I’ve been thinking about of late is what the financial markets will do in September. September is normally a bad month for cryptocurrency especially (and since cryptos are so closely correlated with the Nasdaq index in particular, likely technology stocks also), so we should prepare ourselves for bad news. However, as the Fed is expected to cut its fed funds rate next month, this should boost the prices of riskier assets, such as stock and cryptos. In short-I have no idea how things are going to turn out-I can only take positions I think are going to pan out, based on information which is in the public domain, and see what happens. This week, all the major indices are unchanged:

nasdaq composite – Google Search

Gold/Silver:

Good week for gold and silver. Today in particular seems to be a good day; I can only think it’s a reaction to today’s inflation news, which was broadly in line with the Federal Reserve’s expectations:

PCE Inflation Data Passes First Test Of Federal Reserve’s Rate-Cut Shift | Investor’s Business Daily

Meaning the chances of a Fed funds rate cut in September increased slightly (or at least the market has now increased the probability of a cut by a couple of percentage points)-which will weaken the US dollar, and thus increase the prices of commodities which are priced in dollars (such as gold and silver).

Gold currently at $3,463, up $78 or ~2% since last Friday. I remain bullish on gold in the medium-long term. It still hasn’t rebounded from the $3,500 it briefly hit on May 6th (although it didn’t “close” that high-its highest closing price was $3,453-which it hit on Friday June 13th-it’s possible it will close higher than that today-we won’t know for another hour or so).

Silver currently at $39.88, up $0.80 or ~2% since last Friday. SO close to the totemic $40 threshold, which silver hasn’t hit since 2011. Of course, that’s only a nominal value; due to inflation, silver would have to be significantly higher to match the price of $40, fourteen years ago.

Gold/Silver Ratio: Remained below 90. It’s now 86.7 (was 86.6 last Friday).

Cryptos:

As predicted, Ethereum did indeed make a new all time high last weekend, peaking on $4,955 last Sunday, before suddenly crashing, in a matter of nine minutes, to $4,711. A fall of $244, or about 5%, in under a quarter of an hour is significant, but not unheard of, in crypto. The rest of the market fell sharply alongside Ethereum. This article from the ZeroHedge website gives a good summary of what happened:

Long-Dormant Bitcoin Whale Bets Big On Ethereum Upside | ZeroHedge

Bitcoin has risen 100% in under a year (it was trading at around $54,000 last September), which is absolutely phenomenal, although it’s fallen 9% so far in August-despite making an all time high of around $124,000 as recently as August 14th. Ethereum, meanwhile, has seen a massive 14% jump so far in August. It would be extremely helpful to Ethereum’s cause if it could at least breach the $5k threshold in the not too distant future-that way, it’s already overcome that barrier before any September pullback (although the pullback may have started early, and already be in progress).

For now, at least-there seems to be a floor under Bitcoin’s price at the $108,000 mark. It’s fallen to it multiple times since reaching that all time high, and always bounced back. So far…

As with many stocks, there may be a pullback in their values between now and September 17th (the day the Fed announces its decision on interest rates). After that, assuming the Fed follows through with an actual rate cut, I expect higher crypto prices, but for how long? Who knows. I’ve already started thinking about selling at least some Bitcoin and Ethereum later this year, probably around November-but that’s all dependent on the current Crypto bull run continuing as expected.

Per the chart below, September is typically a negative month for Bitcoin-especially in post-halving years (2013, 2017, 2021), with October and November usually in the green (with the exception of November 2021-Bitcoin peaked at $69k around the middle of the month, and fell sharply afterwards).

2025 is also a post-halving year:

https://www.coinglass.com/today

Of course, it is always possible that the market’s already peaked for this cycle, and we’re already on our way down, but I think this is unlikely.

Prices on the week:

Bitcoin’s down $9k at around $108k (currently falling).

Ethereum down $500 (~11%) to ~$4,344.

BTC/ETH ratio: Up to 24.9 (was 24.0 last Friday). I think we remain in a downward trend here-which is bullish for the entire asset class. We’re at the end of the now established 4-year Crypto cycle when this ratio falls to the 12-15 range-which, assuming it does the same thing this time around, will NOT be reached in a straight line.

Ripple (XRP) down to $2.80 (was as low as $3.09 last Friday).

Solana’s level at around $201.

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

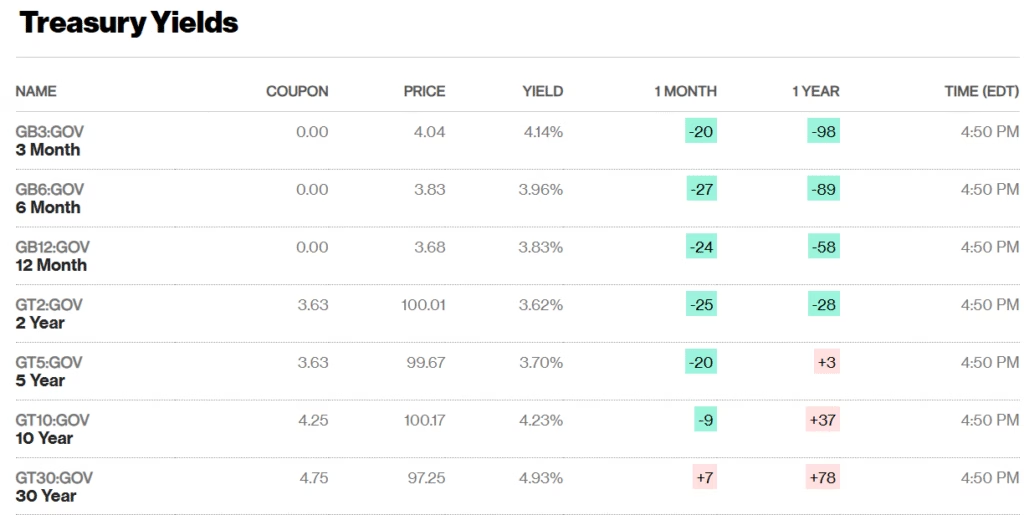

Bonds/US Dollar:

The US Treasury 10-year bond yield is now at 4.23% (was 4.25% last week, so hasn’t moved much). The 30-year bond yield increased by 5 basis points (was 4.88%, now 4.93%), so still uncomfortably close to that totemic 5% threshold for long term US Treasuries. Lower yields mean higher bond prices, as they have an inverse relationship:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Meanwhile, the US Dollar weakened this week against the Swiss Franc-it now costs $1.25 to buy 1CHF (it was only $1.23 last week).

Special Topic: The Federal Reserve (again)

More shenanigans going on at the Fed this week, with President Trump announcing he’d fired one of the members of the board of governors, Lisa Cook, “for cause”-over alleged mortgage fraud:

DOJ set to probe Fed governor Lisa Cook over alleged mortgage fraud after Trump urged her to resign

Trump fires Federal Reserve Gov. Lisa Cook over mortgage fraud allegations

Tellingly, Cook has not yet denied these allegations. I reported the following in the August 1st Market Update:

The Fed is an incredibly opaque institution, a feature which is no doubt deliberate. It’s actually a “system” of twelve regional banks (the nearest location to us is in Dallas), by far the most powerful of which is its branch in New York City (aka the New York Fed). Each of the regional banks reports into the board of governors, which is headed by the chairman (currently Jerome Powell), based in Washington, DC. The President appoints the chairman, but can’t fire them-(except “for cause”, although I don’t think this has ever happened).

What I didn’t know at the time I wrote that summary is that the US President appoints ALL seven governors, one of whom is selected to be the chairman (also by the President-with Senate confirmation):

https://www.stlouisfed.org/in-plain-english/federal-reserve-board-of-governors

I was correct that a Fed chairman (or governor) has never previously been fired-prior to Lisa Cook.

As most of you know by now, I don’t think privately owned central banks should exist in a free market, so I would abolish the Fed tomorrow-meaning Lisa Cook, Jerome Powell, and all the other geniuses would have to find jobs in the real world (good luck with that-I wouldn’t trust the average economist to tie their own shoelaces). Let’s also not forget that central banks are not productive in ANY way. They produce zero goods and services, thus contributing zero value. Nor do they contribute to GDP (GDP is gross domestic product-defined as the total sum of all the goods and services produced within an economy, in a calendar year). And remember, none of their leadership is democratically elected. What central banks DO enable is the funding of projects such as wars, corporate welfare, and so on, which-if they had to funded “honestly” (i.e., via direct taxation), the public would never go along with.

I wonder if what’s going on here is simply more theater. There’s definitely a concerted effort to undermine the Fed-something I’ve never seen before (it always preferred to lurk in the shadows until recently, after all), especially its precious “independence” (which in bankster-ese appears to mean “secrecy”).

Additionally, The Bankster class has been around for centuries, it not longer. The Fed, meanwhile, has only existed since 1913-so is only its latest guise. Maybe the unimaginably wealthy and powerful owners of the central banks have decided the Fed has served its purpose as the financier of endless wars and the destroyer of the US Dollar’s purchasing power, and it can now be sidelined and replaced. But replaced with what? I don’t know; I’m not privy to their conversations. But we do know the recently passed GENIUS act (by the US Congress) paves the way for private banks to issue their own stablecoins (remember, these private banks are the owners of the Fed-so they win, regardless):

Companies plan stablecoins under new law, but experts say hurdles remain | Reuters

So-if the Fed IS somehow sidelined into irrelevance, or abolished altogether, don’t worry-it will simply be replaced in kind by the same gangsters, using the same system, but with different frontmen, and different terminology.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran