This week, I heard the term TL/DR for the first time; TL/DR stands for “Too Long, Didn’t Read”. I appreciate my weekly updates can be lengthy, so from now on, I’ll lead with a brief summary of each section:

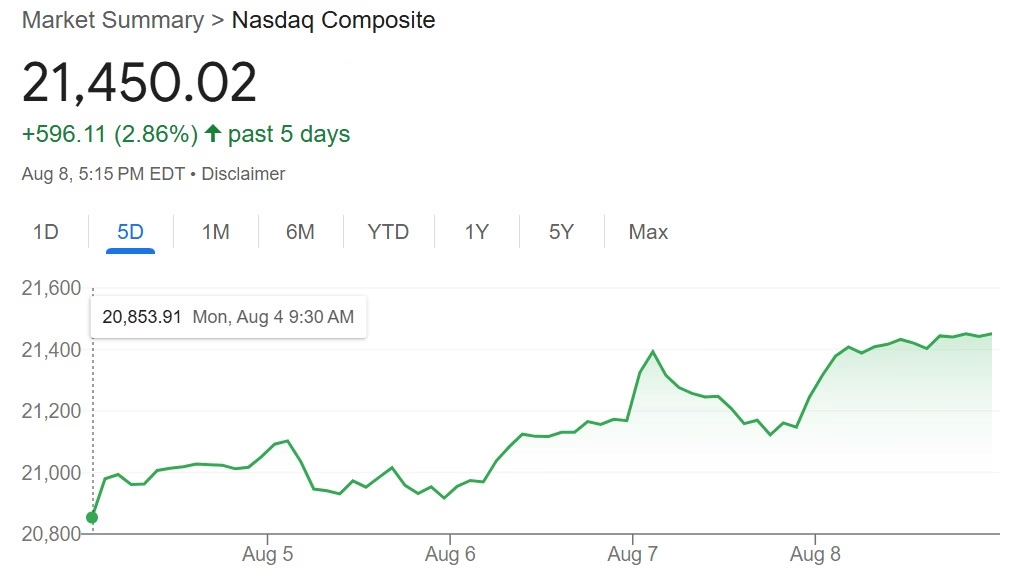

Stocks/Equities: Up. Market mostly bounced back after last Friday’s tumble on poor jobs data, tariff uncertainty, and the Fed refusing to cut rates. With the market now fully expecting an interest rate cut next month, stock prices look to be headed higher in the short term.

Gold/Silver: Up. Gold ($3,400) and silver ($38.50), both up slightly.

Crypto: Up. Ethereum finally breached the totemic $4,000 level yesterday morning (8.53am, US Central Summer Time).

Bonds/US Dollar: Both relatively unchanged this week.

Special Topic: A closer look at the not so “magnificent” Mag. 7. Make sure you read the prospectuses of the mutual funds you’re exposed to.

Stocks: As Monday’s bounce back upwards showed (as though any further proof were needed), bad news no longer matters to the stock market. Stocks are totally disconnected from economic reality. To some extent, the growth is a little bit illusory; priced in dollars, markets are up this year. However, priced in gold, they’re down. Relative to a selection of other major currencies, the dollar’s already fallen in value by 11% this year:

https://www.morganstanley.com/insights/articles/us-dollar-declines#:~:text=Key%20Takeaways,a%2015%2Dyear%20bull%20cycle.

Additionally, almost all the growth is coming from an even smaller number of companies than I’d previously stated (I thought it was 7, it’s actually 3-this is discussed further in the special topic).

So-are assets appreciating? Or is the currency in which they’re measured depreciating? That’s a complex question-although I will say this. I doubt Microsoft is 25% more productive this year than last year-despite the fact it’s laid off in excess of 15,000 employers so far in 2025. So I’ll suggest currency depreciation is having more of an effect than year-on-year improved business performance.

https://www.cnbc.com/2025/07/02/microsoft-laying-off-about-9000-employees-in-latest-round-of-cuts.html

All the three major US stock indices are up this week:

nasdaq composite – Google Search

Gold/Silver:

The big news this week in precious metals was the Trump administration’s imposition of a 39% tariff on imports from Switzerland-including gold, which is one of the largest Swiss exports. This is one of the highest tariffs announced so far-although with all the uncertainty around tariffs, we’ll see how long it lasts. In the short term, however, it does indicate higher gold prices:

https://www.theguardian.com/business/2025/aug/08/gold-futures-soar-to-record-high-after-reports-of-us-tariffs-on-swiss-bars

Gold closed on $3,412, up $36 or ~1% since last Friday. I remain bullish on gold in the medium-long term. It still hasn’t rebounded from the $3,500 it briefly hit on May 6th (although didn’t “close” that high-its highest closing price was $3,453-which it hit on Friday June 13th).

Silver closed on $38.53, up $1.32 or 3.5% since last Friday.

Gold/Silver Ratio: Fell below 90 again. It’s now 88.6 (was 91 last Friday).

Cryptos:

Another very volatile (i.e., perfectly normal) week in Crypto world. Last Saturday, Bitcoin fell to just under $112,000, before rising to $117,000, which is where it currently sits. Ethereum was similarly wild-it breached the key resistance level of $4,000 yesterday, and currently sits at $4,160. Hopefully the bull market will continue, although significant declines (such as the one we saw this week) will no doubt continue to occur along the way.

Prices on the week:

Bitcoin’s up $4,000 to around $117k.

Ethereum up $660 (19%) to ~$4,160.

BTC/ETH ratio: Down to 28.1 (was 32.6 last Friday). I think we remain in a downward trend here. We’re typically at the end of the now established 4-year Crypto cycle when this ratio falls to the 12-15 range-which, assuming it does the same thing this time around, will NOT be reached in a straight line.

Ripple (XRP) up to $3.27 (was as low as $2.94 last Friday).

Solana’s up to $180 (was as low as $162 last Friday).

PLEASE NOTE: Cryptos are the only assets covered in this newsletter which trade during the weekend. They’re also very volatile. And there’s usually a delay between the time I collect the data and send the newsletter. As such, the market may have moved substantially from the above numbers by the time you read this.

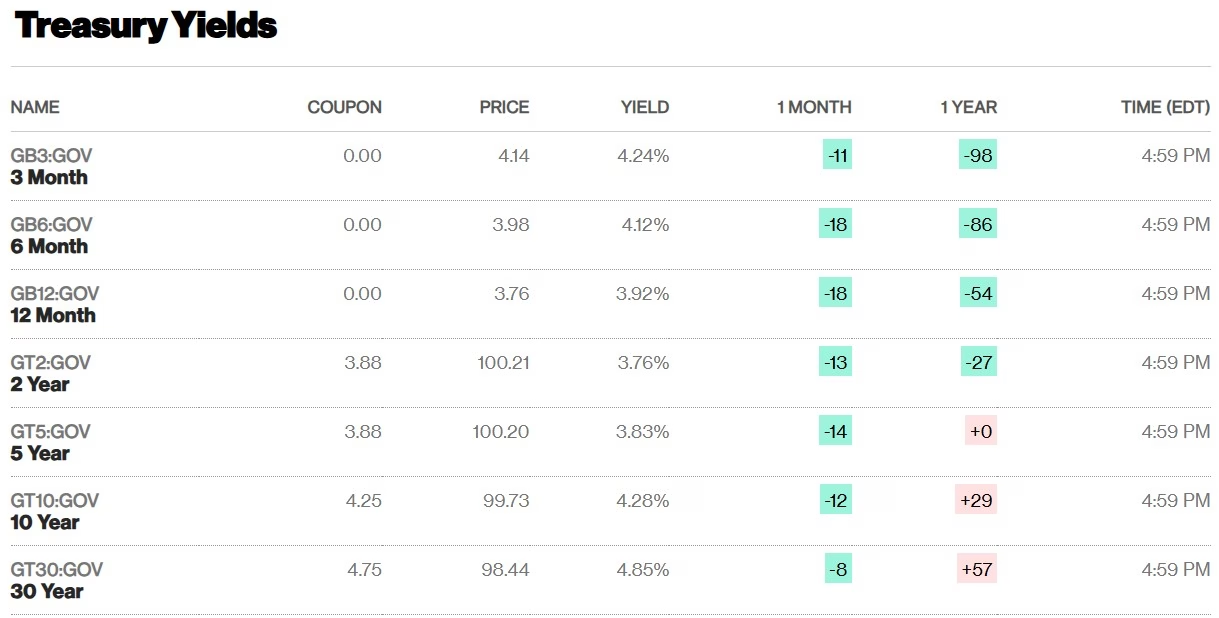

Bonds/US Dollar:

The US Treasury 10-year T-Bill is now at 4.28% (was 4.39% a fortnight ago, so has improved significantly). The 30-year bond remained basically the same (was 4.82%, now 4.85%), so still uncomfortably close to that totemic 5% threshold for long term US Treasuries. Lower yields mean higher bond prices, as they have an inverse relationship.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

As with last week, it still costs $1.24 to buy a Swiss Franc.

I’ve been asked the question why each week I compare the US Dollar to the Swiss Franc, rather than, say-the Euro, which is the dollar’s biggest competitor on the world stage. It’s because the Swiss Franc was the last currency on the planet to depeg from gold, which it did by a referendum in 1999, making it a wholly fiat currency (if anyone’s interested, I’ve attached a transcript of a speech made by a member of the Swiss National Bank (the SNB is Switzerland’s Central Bank), discussing this matter further-it describes aspects of the Swiss political system quite well, I think).

So, although not used as widely as the Euro, in my opinion, the Swiss Franc is a better currency with which to compare the dollar-since it’s the hardest remaining fiat currency out there.

Special Topic: Make sure you read the prospectuses of the mutual funds you’re exposed to

I’ve been hearing questions from some readers that despite being exposed to the “right” stocks, their portfolios aren’t moving upwards as rapidly as expected. I did a little bit of research into this and discovered something interesting.

I’ve mentioned the Magnificent (or Mag.) 7 group of stocks before. The website www.slickcharts.com defines the group as follows: The most dominant and influential technology companies in the U.S. stock market: Apple, Microsoft, Alphabet (Google), Amazon, Meta Platforms (Facebook), Nvidia, and Tesla. These companies are known for their large market capitalizations, strong revenue growth, and outsized influence on market indices like the S&P 500 and Nasdaq.

Magnificent Seven Stocks

However-on closer inspection, only 3 of the constituents of the Mag. 7 are having a good year; Microsoft, Meta (Facebook), and Nvidia, all of whom have enjoyed approximately 25% growth in their stock prices so far (it seems to be generally accepted that an increase of 7-10%, excluding dividends, in a 12 month period is considered to be a “good” return). Conversely, Google’s only up 6% (this is a worse performance than the overall S&P 500, which is up almost 9% this year)-whilst Apple, Amazon, and Tesla, are all either level or down. Tesla’s down significantly-which can be partly explained by its CEO Elon Musk, and his DOGE antics:

tesla stock price – Google Search

And because of the “weighting” of the index (i.e., the largest constituent corporations have the biggest effect on its performance), if the big companies are stagnant or falling, it has a disproportionate overall impact.

So-check what the constituent stocks are in your mutual fund, and what proportion they’re in (expressed as a percentage). Amazon and Apple have been two of the best performing stocks for many years; however, this doesn’t necessarily mean they’ll produce double digit returns every year.

Finally-after I sent last week’s market update, I remembered I’d neglected to mention tariffs, which alongside the Fed leaving interest rates unchanged and the abysmal jobs data reported by the US Bureau of Labor Statistics, had conspired by last Friday to push stocks and cryptos down, and metals and treasury bond yields up. Last Friday, August 1st, was described as “Liberation Day 2.0”, in reference to “Liberation Day” on April 2nd, the day upon which the tariffs were initially announced by President Trump. Liberation Day 2.0 was apparently necessitated by all the delays, pauses, and other shenanigans we’ve seen around actually implementing the tariffs. In my defense, it’s an extremely confusing situation, which is almost impossible to keep track of.

Alright. Until next time, I’ll talk atcha. If anyone has any comments or questions, please let me know.

Good luck and happy investing,

Tom Curran